Investors Urged to Act as UK Faces IMF bailout 2.0

- Written by: Sam Coventry

-

Image © Adobe Images

The UK’s economic turmoil has taken a perilous turn, says Nigel Green, CEO of deVere Group, with markets bracing for what could rival the 1976 IMF bailout crisis.

Green, who heads one of the world's largest independent financial advisory organisations, says investors must act decisively before they’re caught in the economic crossfire.

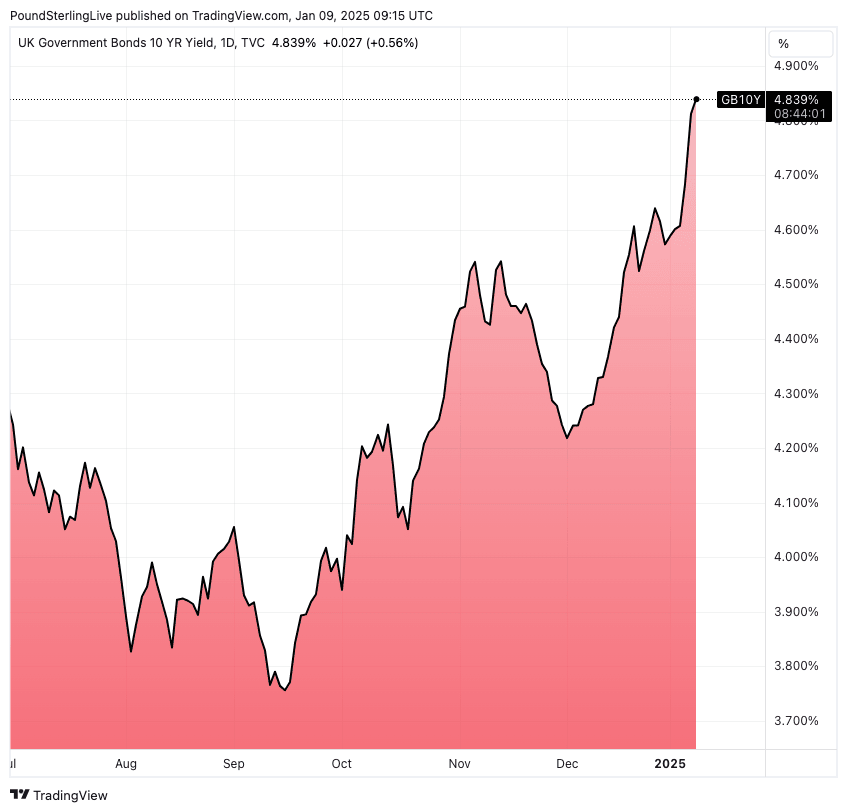

The call comes as UK 10-year sovereign bond yields rise to their highest levels since the start of the millennium.

Thursday sees the yield hit 4.839%, a figure last seen in 2001. Crucially, the Pound has fallen against all major currencies.

Above: The UK ten-year gilt yield hit its highest level since 2001.

Typically, the Pound tracks yields higher, but it is a sign of market stress when they part company.

"UK stocks also tumbled, underscoring a toxic mix of rising debt costs and collapsing market confidence," says Green.

Former Bank of England rate-setter Martin Weale said on Thursday he sees shades of the 1976 crisis when Britain was forced to beg the IMF for a $3.9BN bailout.

Back then, ballooning deficits and plunging market confidence pushed the UK into economic humiliation.

"Today, under Reeves’ leadership, twin deficits and skyrocketing borrowing costs are eerily reminiscent of that national nightmare," says Green.

He explains that promises of funding massive spending via growing the economy have clearly failed to convince markets.

"Investors can't afford to sit back and wait for her to deliver on empty rhetoric," says Green.

Following the market moves, the Treasury was forced to offer a rare intervention, saying Reeves would set out plans to grow the economy in the coming days and weeks.

However, memories are fresh that Reeves stated this as her ambition in the run up to the general election, only to deliver a business-crushing budget in October.

What's more, to restore credibility, economists say Reeves will need to raise taxes again and cut spending. A combination of both is likely.

"Reeves’ fragile £9.9 billion fiscal buffer could be obliterated well before her official fiscal update on March 26. The Chancellor's inability to reassure markets is fanning fears of an economic implosion, with austerity looming as the only option to restore credibility—a brutal throwback to 1976,” says Green.

This, says the deVere CEO, is starting to look like a perfect storm for investors.

"The parallels with the Liz Truss mini-budget debacle of 2022 are obvious, but the risks now are even graver. The toxic combination of a falling pound and rising borrowing costs is historically rare, and it’s a clear signal that the markets have lost faith in this government’s ability to manage the UK’s debt," says Green.

Back in 1976, Britain’s IMF bailout came with strings attached: harsh austerity measures that left deep scars on the economy. With Labour’s reckless fiscal promises unravelling, it’s hard to see how Reeves can steer the UK away from a similar fate. Twin deficits are back, and the markets are watching closely.

"For investors, the writing is on the wall. The UK’s financial instability demands decisive action. Diversification into safe-haven assets, exploring international markets, and hedging against a weak pound are not just prudent strategies—they are essential," says Green, adding that:

"Investors who wait for Reeves to get her act together are gambling with their portfolios. The time to act is now. History seems to be repeating itself, and those who ignore the lessons of the past do so at their peril."