Pound to Dollar Rate Steadies as Bond Market Settles

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling is settling as the UK bond market rout eases.

The Pound to Dollar exchange rate (GBP/USD) traded as low as 1.2237 earlier on Thursday before steadily recovering to 1.2313 by late London trade, reflecting something of an improvement in bond markets.

"The sell off was driven by increasing worries about the government’s high borrowing needs, the cost of supporting the national debt and increasing risks of stagflation," says John Meyer, an analyst at SP Angel. "Increasing interest rates risk Chancellor’s headroom against the current budget rules that in turn might see additional borrowing or further budget adjustments."

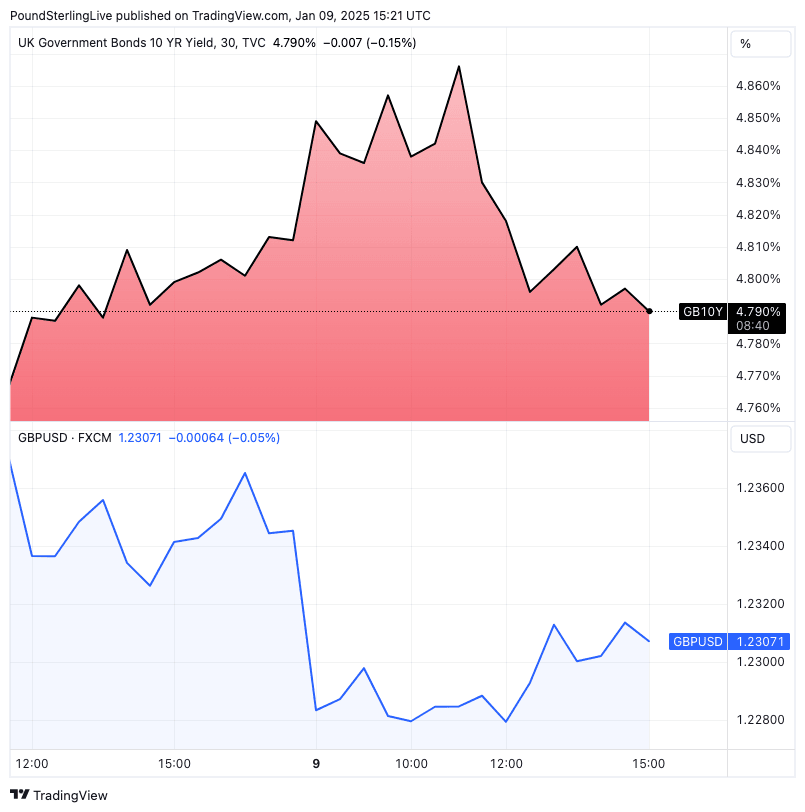

The benchmark bond everyone is watching is the ten-year gilt, where the yield gapped higher at today's open before steading at 4.796%, which puts it below yesterday's close.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

To be sure, these are still multi-decade highs, and it will put the UK economy under pressure, but there is a semblance of order returning to the market.

This can help stabilise the Pound, and dip-buyers might even emerge.

Perhaps it was Darren Jones, Chancellor Rachel Reeves' deputy, who helped. He was called to Parliament by Conservative MP Mel Stride to give a statement on the selloff in UK asset markets. He told lawmakers that the bond market is functioning in an orderly way and said, "there should be no doubt of the government's commitment to economic stability and sound public finances. This is why meeting the fiscal rules is non-negotiable."

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The line coming from the UK Treasury is that the government would cut spending if needed in order to stabilise the financial outlook.

Economists and market participants say this is the only credible route forward, as raising taxes would surely damage economic growth.

"Pretty clear now, if it wasn't already, that markets have lost confidence in the government's ability to control the fiscal backdrop. Participants will surely want to see a concrete commitment from HMT to further spending cuts/revenue-raising measures in order to restore confidence," says Michael Brown, Senior Research Strategist at Pepperstone.

Above: As the UK ten-year gilt yield steadies, so GBP/USD bottoms.

The slowdown in growth that has followed Labour's budget means the government's tax revenues are likely to disappoint, which means financing debt becomes more challenging. Borrowers want to be sure they will be repaid, and any doubts can lead to bond sales, which pushes up a bond's yield.

As yields rise, the cost of debt increases, and a negative feedback loop emerges.

"We're moving into a period of economic crisis," says Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee.

Although the Pound has stabilised, it remains at risk of further decline.

Analyst Kit Juckes at Société Générale says it would be no surprise if some FX traders swapped EUR/USD shorts for GBP/USD ones on any GBP bounce here because there is no longer a compelling reason to hope for significant GBP out-performance against the EUR," says Juckes.

The Pound outperformed the Euro in 2024 thanks to UK growth outstripping that of the Eurozone. This compelled traders to lay pro-USD bets against the EUR, seeing EUR/USD weakness as likely to outpace GBP/USD weakness.

If this changes, and GBP/USD becomes the preferred vehicle for selling, then we will see GBP start to underperform a whole host of other currencies.

GBP could go from the second-best performing G10 in 2024 to a bottom dweller in 2025.

A risk for Sterling would involve the government stubbornly steering the current course.

When markets rejected Liz Truss' proposed budget in 2022, it was binned. But, this time around, the budget has been implemented, and economic data is now telling the market that it's no good for growth.

Reeves might take periods of calm in the bond markets as a validation of her decision. This means no real changes are implemented and a steady cycle of decline awaits both the economy and Pound Sterling.