Pound to Euro Rate Slumps to 1.19 as Ten-year Gilt Yield Hits Millennium Highs

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling is under fresh pressure against the Euro as a UK debt crisis evolves.

The Pound to Euro exchange rate is down a further half per cent on Thursday, falling to 1.1920, the lowest point since the start of November.

The declines come amidst a widespread fire-sale of the British Pound as foreign exchange markets react to a significant selloff in UK government debt.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

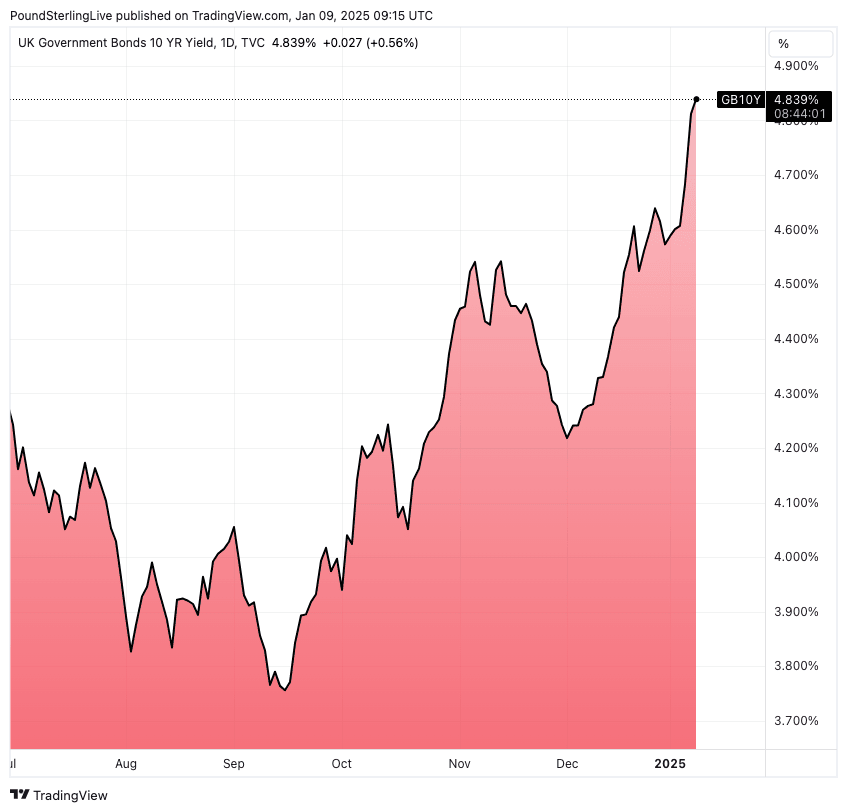

The benchmark UK ten-year government bond was sold again on Thursday, driving up its yield (which is effectively the interest rate the government pays to borrow money on a ten-year fixed term).

At 4.839%, the yield is the highest it's been since the turn of the millennium. This means the government must find billions more to simply repay its debt.

In 2022, Prime Minister Liz Truss crashed the bond market by proposing a set of spending and tax changes that investors thought would put the country's economy and finances in jeopardy. However, the proposals were never enacted, and the economy never collapsed. Coincidentally, Truss has sent Prime Minister Keir Starmer a cease-and-desist instruction to stop claiming she crashed the economy.

Above: The cost of borrowing is at its highest since the turn of the century.

The opposite is true now: it's because the economy is collapsing that the bond market is reacting in the way it is.

Economists say the big tax-borrow-and-spend budget is causing the slowdown she succeeded in passing in October.

Many businesses are shutting doors in early 2025 due to the multi-billion-pound tax raid which will hit in April, while surveys show a rapid slowdown in hiring and collapsing business confidence.

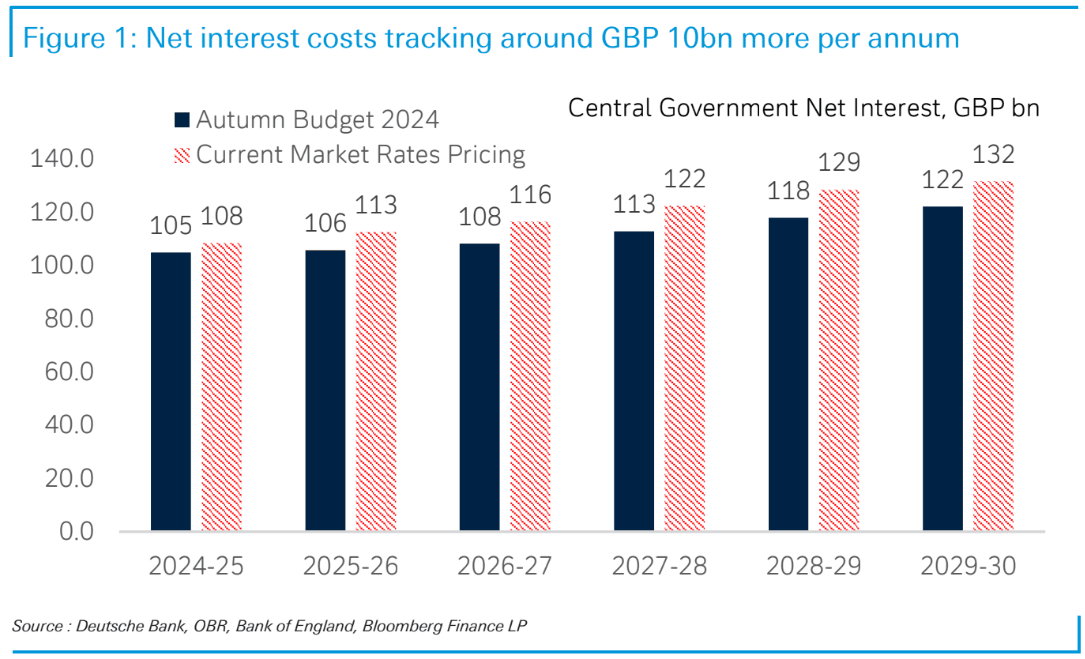

Economists warn the UK's debt dynamics have deteriorated by more than £10BN since the budget, meaning the government will have to enact tax hikes or spending cuts to meet its fiscal rules.

"How much bigger is the UK's debt burden? Based on current market expectations, we expect central government net interest costs to track around GBP 10BN more per annum between 2025/26 and 2029/30 (relative to the Autumn Budget projections)," says economist Sanjay Raja at Deutsche Bank.

The prospect of higher taxes threatens to drive UK economic growth further into the ground, creating a perpetuating doom loop for the economy.

"There's more to the story too. On 26 March, when the OBR presents its updated economic outlook, a raft of economic changes look inevitable," says Raja.

Deutsche Bank thinks GDP growth will likely be revised lower from its optimistic 2% projection for the current calendar year.

Inflation will be revised higher, adding to debt costs, as a significant portion of UK debt is priced on the Retail Price Index, which is a measure of inflation.

The OBR's unemployment projections will also likely rise further, in line with a string of economic surveys showing businesses will shed jobs in reaction to Rachel Reeve's business tax raid.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"What does this mean for the fiscal outlook? Spending cuts, more borrowing, and likely a little more taxation to close the emerging fiscal hole," says Raja.

Holding UK bonds and the Pound, under such circumstances, looks increasingly unattractive.

The Pound was able to rapidly rebound to the Truss episode as the plans were quickly scrapped. The problem facing Reeves is her plans have been put in motion, and the real-world impact of said plans is only starting to be felt.

Although the British Pound has not fallen by as much as it did under the Truss episode, foreign exchange analysts warn that it is hard to see the currency snapping back to register the outperformance that it registered in 2023 and 2024.

The 2024 highs in Pound-Euro - located at 1.2150, might therefore be firmly behind us. At the very least, it would take months to reclaim such levels.

"A repricing of UK growth prospects helped sterling in 2024 but the upward revision to the UK's outlook has stopped. This argues for EUR/GBP to be range-bound (even dull) despite a sharp move as gilt yields spiked. GBP isn't a currency which goes nowhere. So, if EUR/GBP can’t go down, it seems it has to go up," explains Juckes.

(EUR/GBP = GBP/EUR down!).