Yields Down, Pound Sterling Up on Inflation Relief

- Written by: Gary Howes

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

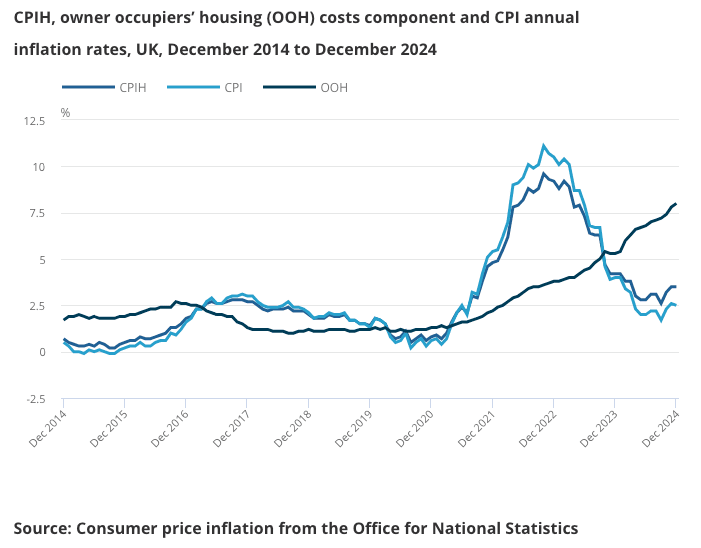

The British Pound has risen after UK inflation undershot expectations, however all signs point to an acceleration in inflation from January onwards.

Usually, weaker than expected inflation would be expected to result in a decline in the value of the Pound, but in early 2025 the opposite is proving true.

The Pound to Euro exchange rate has bounced from 1.1835 to 1.1868 from after the ONS reported UK CPI inflation rose 2.5% in the 12 months to December 2024, down from 2.6% in November, undershooting a consensus estimate for a rise to 2.7%.

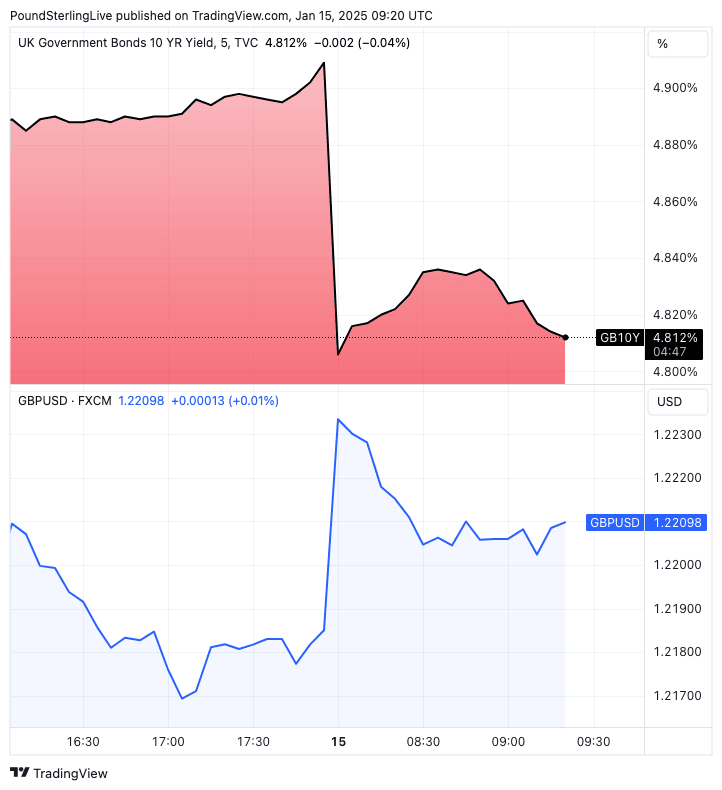

The Pound to Dollar exchange rate rose to 1.2240 from 1.2184 in a move that mirrored an easing in UK bond yields, with the ten-year UK gilt yield dipping to 4.813% from 4.90%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Inflation rose 0.3% month-on-month in December, which was below estimates for a 0.4% gain. Core inflation rose 3.2% y/y in December, down from 3.5% and below the estimate of 3.4%.

Importantly, service inflation, closely watched by the Bank of England, fell from 5.0% to 4.4%.

These data open the door to an interest rate cut at the Bank of England next month and will, therefore, mechanically weigh on UK bond yields.

Above: Yields down, Pound up.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The inflation undershoot is a welcome development in the context of the sharp rise in UK bond yields we have witnessed in earliy 2025, which reflects deteriorating confidence in the UK's financial outlook.

There was a significant risk that bond yields would blow the roof off in the event of an above-consensus reading.

The Pound has traded lower in response to rising bond yields during 2025 as a previous positive correlation between the two inverts.

'Yields up-pound down' is the market reaction that occurs when market concerns arise that the UK's debt dynamics are deteriorating, as was the case following Liz Truss's mini budget and Chancellor Rachel Reeves's budget, which appears to have killed off economic growth.

It therefore stands that 'yields down-pound up' would be the reaction to today's softer inflation data.

"Underlying price pressures still appear a bit more favourable than we had thought. That strengthens the case for a 25bps interest rate cut in February and lends some support to our view that rates will fall further and faster than markets expect," says Ruth Gregory, Deputy Chief UK Economist at Capital Economics.

Above: Bigger picture, the disinflation process in the UK has stalled well above the Bank of England's 2.0% target.

Inflation Will Rise from Here

However, the data could be too good to be true and all signs point to inflation rising steadily from here in the coming months, limiting the scope for the market to price for further Bank of England rate cuts aggressively.

Firstly, there are technical considerations. Base effects from last January's sharp fall in inflation mean this January will see a commensurate spike.

December's data collection anomaly also flatters the underlying picture. Robert Wood, Chief U.K. Economist at Pantheon Macroeconomics, says December's inflation undershoot is "a temporary reprieve", and the reason the data flattered was because of an early ONS price collection date on December 10.

This means the ONS measured airfares left well before school holidays, returning on Christmas and NY Eve. "That cut 14bp from headline inflation and will rebound," says Wood.

Secondly, there is the likelihood that firms will pass on Rachel Reeves's tax hikes to customers via higher prices.

The inflation data comes on the day the British Retail Consortium releases a survey revealing two-thirds of chief financial officers warned they would pass on costs from the increase to employer national insurance contributions.

More than half said they would reduce staff hours, including overtime, while 46% said they would reduce store headcount.

Research from the British Chambers of Commerce (BCC) meanwhile shows UK firms are having to make "difficult decisions" to manage the upcoming rises in national insurance contributions and the minimum wage.

Its latest survey shows most firms expect to raise their prices in the next three months, while business confidence has dipped to 2022 levels. Labour cost pressures have grown significantly and are particularly acute in the hospitality sector.

"We need quick government action to ease the cost pressures companies are facing and create new opportunities for investment. Ministers should focus on accelerating business rates reform, giving infrastructure projects the green light and boosting exports," says Stuart Morrison, Research Manager at the BCC.

Fears of rising inflation in the coming months will therefore limit Pound Sterling's recovery potential.