Deutsche Bank Turns Seller of the Pound

- Written by: Gary Howes

Image © Deutsche Bank

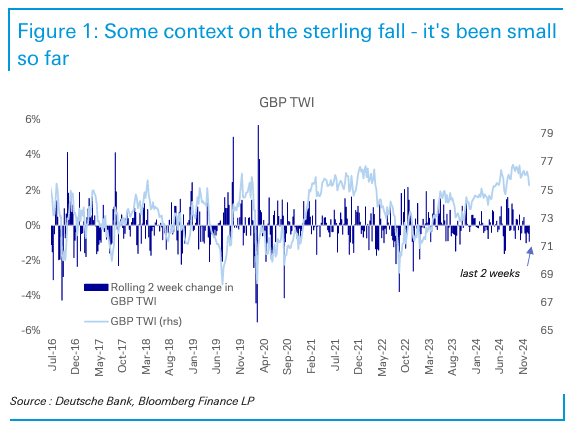

Strategists at Deutsche Bank have turned sellers of the Pound, suggesting the 2025 decline is still relatively small.

"This time it's not a fade: Selling GBP," says Shreyas Gopal, Strategist at Deutsche Bank.

The call comes at the end of a week that saw the British Pound come under sustained selling pressure amidst a fall in UK sovereign bond values, which resulted from a deterioration in investor sentiment towards the UK's debt dynamics.

However, a number of analysts we follow point out that the selloff is not disorderly and the pound can rebound. Signs of early dip buying activity emerged on Thursday as the rise in the ten-year UK bond yield eased from multi-decade highs as the bond selloff eased.

"As the crescendo of gloom-laden news reaches a peak, we have seen some tentative buying of the pound," says Chris Beauchamp, Chief Market Analyst at IG.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Deutsche Bank strategists had been bullish of Sterling over recent months, and the last time Sterling fell this sharply was in the immediate aftermath of the UK budget in early November. At the time, the strategy desk recommended fading the move.

However, "this time is different," says Gopal.

He explains the pound's fall is actually relatively small in the context of the multi-month advance heading into 2025.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

It is now losing its recent sources of support: "the current account deficit is likely no longer improving, and volatility-adjusted yield pickup is at risk of worsening further."

According to Deutsche Bank analysts, fundamental shifts that could work against the pound going forward include:

The loss of volatility-adjusted carry attractiveness. This is where capital flows into countries with high interest rates, which the UK boasts. But for it to work, volatility must be low. "Recent volatility is damaging," says Gopal.

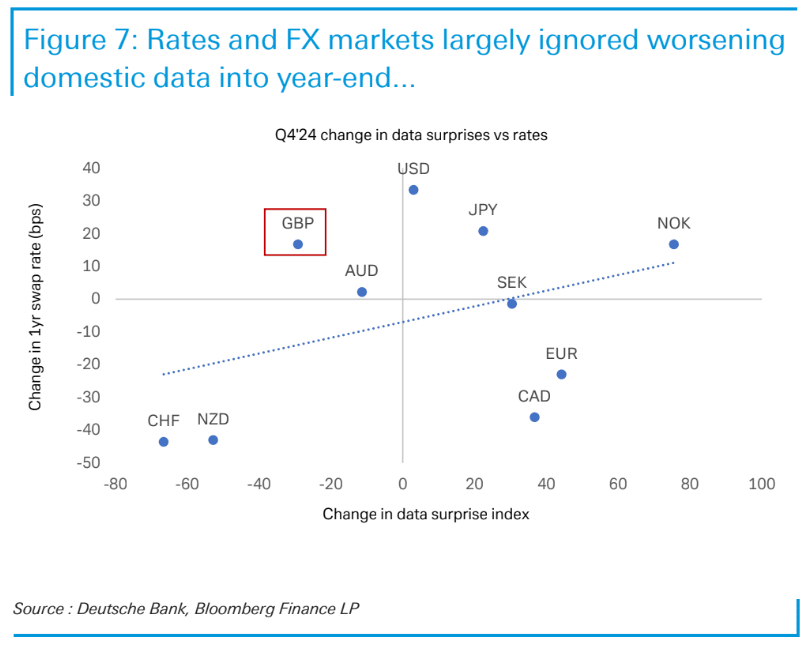

The UK, meanwhile, is printing "demonstrably weaker-than-expected UK economic data." The first half of 2024 saw the opposite, whereby the UK was growing faster than all its G7 peers.

Deutsche Bank thinks economic deterioration means there is growing potential for more rate cuts at the Bank of England this year than the approximately 50 basis points currently priced into money markets.

The improvements in the current account deficit seen over recent years is also likely to fade as energy prices rise again. "A wider current account deficit going forward increases the need for sterling to weaken in an environment where UK yield rises are limited by the need for monetary policy easing," says Gopal.

"Having taken profit on our GBP longs at the highs in mid-December, we now recommend selling the pound," says Gopal.

Deutsche Bank strategists like selling GBP against a basket of other major currencies (EUR, USD, JPY, and CHF).