Pound Sterling Under Fresh Pressure as Reeves Ducks the Big Questions

- Written by: Gary Howes

Above: File image of Chancellor Rachel Reeves speaking in parliament. Still from Parliament.tv.

The UK Chancellor spoke in Parliament but gave no indication she would change course, signalling bonds and the pound will remain under pressure.

The British Pound and UK bonds came under renewed pressure on Tuesday after Rachel Reeves skirted any commitment to reining in fears over the sustainability of UK debt dynamics.

Reeves gave a statement about her recent visit to China and said the government would continue to stick to the UK's debt rules, which means she will eventually have to announce a raft of spending cuts or tax rises.

The UK ten-year gilt yield - a benchmark for government borrowing costs - has risen from Monday's lows to 4.872%, leaving it on course to close at its highest level since 2008.

"She did not deliver a knockout blow, and the bond vigilantes have not been put to bed," says Kathleen Brooks, research director at XTB. "The pound is once again moving lower, which could be an ominous sign that investors are getting ready to sell UK debt once more if we get some weak economic data later this week."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

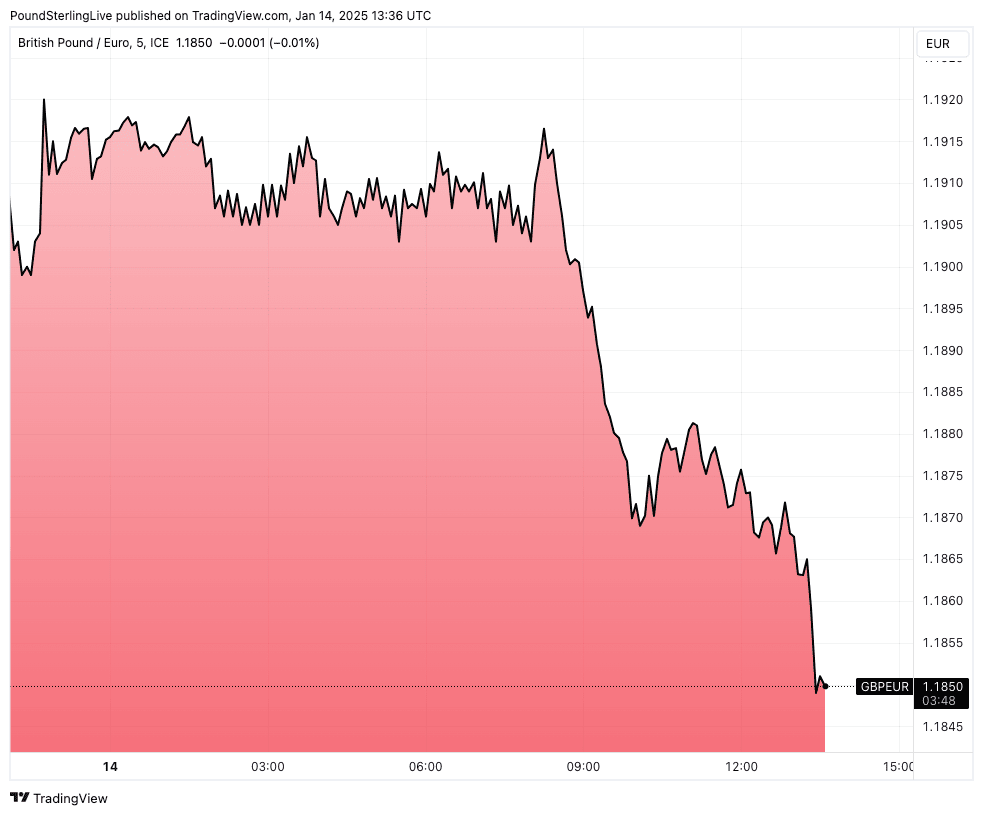

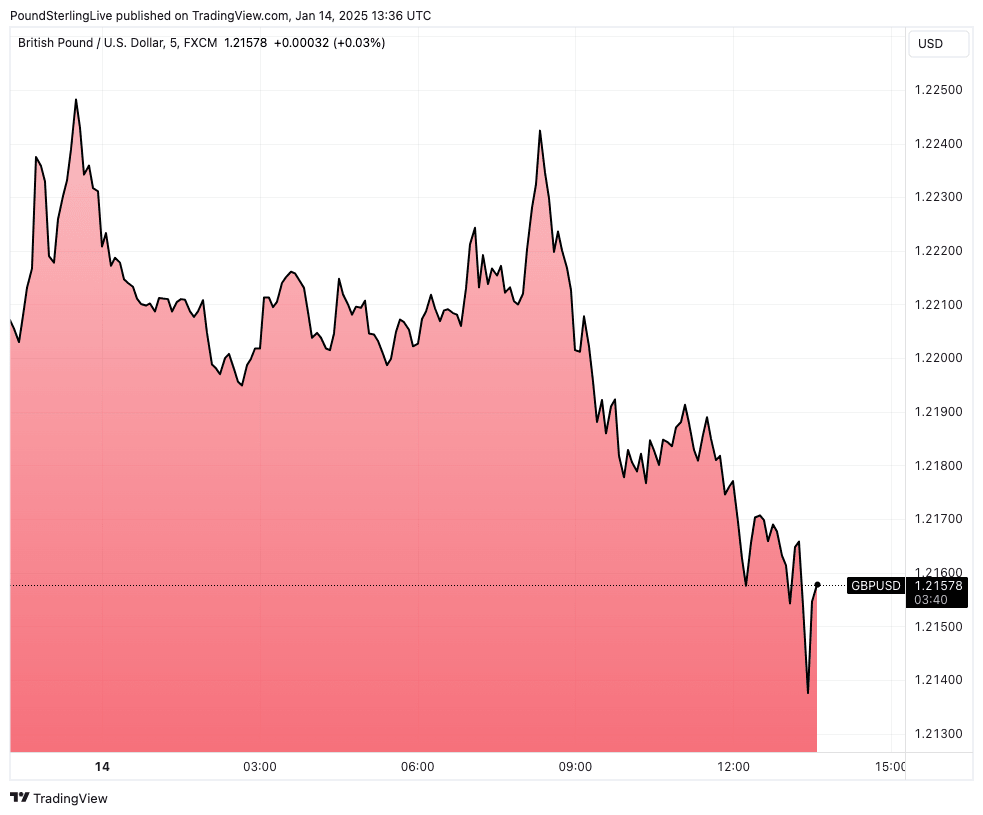

The Pound to Euro exchange rate has fallen for four days in succession and is at 1.1851, the lowest level since September 09. The Pound to Dollar exchange rate remains under substantial pressure at nine-month lows at 1.2151.

Gilt yields rise when the underlying value of the gilt - or bond - falls, and speaks of ongoing pressures in the UK debt market, where investors demand greater compensation for lending to the government.

The Pound typically rises alongside climbing yields, but it tends to go in the opposite direction when market confidence deteriorates, as was famously the case when Liz Truss attempted to pass her budget in 2022.

Reeves is facing the same dynamics, albeit at a slower burn. Yet the consequences for UK businesses and home owners will be as consequential: at the start of 2025 they are facing surging borrowing costs that will squeeze their pockets.

Until the market gets more clarity about how the UK's fiscal footing will be put on a sustainable path, consumers, businesses, UK bonds and the Pound can remain under pressure.

Above: GBP/EUR has come under renewed pressure amidst a lack of clarify from Reeves.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Chancellor had been conspicuous by her absence in recent days, with the only official communications from her Treasury department coming via official statements and an appearance by her deputy, Darren Jones.

He said the government won't change the course of its spending and taxation plans, despite falling economic growth and a rout of UK bonds and the Pound.

Investors wanted to hear on Tuesday whether the Chancellor has, in fact, been pondering the issue and will respond to growing funding costs by delivering new policies to restore confidence in the UK.

"The sooner she bites the bullet on spending, the sooner Britain can break free from this self-inflicted fiscal trap," says Darwin Friend, the head of research at the Taxpayers' Alliance.

Although it is now oversold in the short term, the Pound has so far shown little interest in rebounding, confirming markets have not seen any indication that the government intends to make the necessary changes to boost confidence in the UK's debt dynamics.

Reeves will come under pressure to cut spending and/or raise taxes in 2025, with most economists predicting a combination of the two as she now has no room to meet her fiscal rules, the most important being that debt must start falling as a percentage of GDP by 2029.

Above: GBP/USD hit oversold conditions (see RSI in lower panel), and has scope to enter a relief bounce.

However, tax hikes were announced in October and survey after survey has indicated the decision has severely dented business confidence and led to a retrenchment in growth and employment.

"Business sentiment took a sharp turn for the worse in the latter months of the year, as business leaders digested the full implications of the government’s early policy decisions. Business was dismayed by the tax increases announced in the Autumn budget, and also concerned by the aggregate impact of proposed employment law reforms," says Dr. Roger Barker, Director of Policy at the Institute of Directors.

UK 10-year gilt yields, the benchmark government that investors typically watch, have risen to 17-year highs on fears that the economy is in stagflation, where rising inflation meets weakening growth.

"Sterling has been in focus this week as the clear underperformer in G10 FX, with the bear steepening and underperformance in UK gilts alongside the currency sell-off characteristic of an acute rise in UK fiscal risk premia," says Kamakshya Trivedi, an analyst at Goldman Sachs.

No One Really Believes Her

Above: Conservative MP Mel Stride questions Reeves in Parliament on Jan. 14.

Reeves and the Treasury department maintain that they government's main mission is to get the economy growing again, and that the fiscal rules will be respected. In doing so she repeats the pro-business soundbites she delivered in the lead-up to the election.

The feedback from businesses and the incoming data is that she delivered the exact opposite.

"No one really believes the promise as Reeves is seen to have lied in opposition about tax plans," says Simon French, Chief Economist & Head of Research at Panmure Liberum.

With her credibility in question, Reeves might find any statements that promise to deliver growth as a way out of the recent market troubles to be ineffective.

Solid policy commitments are needed, with the most effective likely to be a commitment to cut the UK's benefits bills significantly. There have been reports of such a desire, but nothing official, and Reeves knows her left-wing Labour Party colleagues would balk at such a commitment.

Instead, Prime Minister Keir Starmer has indicated the preference would be to fight a war on waste in the UK's departments, pressing them to find cost savings.

Markets don't think this is enough and there is a risk Reeves attempts to adopt a strategy of lying low and hoping the market settles on its own volition.

"With the market’s not-too-distant memory of previous fiscal risk episodes, the clear risk to Sterling from here is an escalation in the loop of sell-offs in UK assets and a more strenuous fiscal position," says Trivedi.

We Won't Chase the GBP Selloff

However, Goldman Sachs FX analysts are not inclined to chase the Pound lower at this stage: "while the recent GBP weakening is likely primarily a UK-specific story, we think it can also partly be explained by the broader risk-off price action in FX markets this week, and as such an eventual recovery in risk appetite should lend some support to the Pound."

Trivedi adds that market dynamics are likely to improve, with both the macroeconomic and bond supply pictures pointing to an eventual compression in fiscal risk premium in Gilts, "which we think would also imply some pricing-out of fiscal risks in the currency."

Goldman Sachs thinks the UK data pulse can improve in the coming weeks, in part helped by a rise in government spending.

If analysts at the bank are correct, GBP weakness could soon fade, although it warns a number of risks remain. These include the dollar rally continuing as Donald Trump takes power and the Bank of England cutting interest rates faster and further than expected this year.