Investors Told to Prepare for Market Correction

- Written by: Sam Coventry

-

Image © Adobe Images

Markets face correction risks amid inflation and rate pressures says a leading wealth manager.

U.S. stocks are poised for a challenging year as market vulnerabilities come to the forefront, says Nigel Green CEO of deVere Group; "rising bond yields and potential disappointments in economic data or earnings are key threats that could derail the rally."

deVere, one of the world’s largest independent financial advisory and asset management organisations, says investors should adjust exposure to account for near-term volatility while staying positioned for longer-term opportunities.

"The complacency among investors regarding inflation and interest rates is alarming," says Green, who forecasts that "US interest rates could rise above 5%, a level not sufficiently priced into the market."

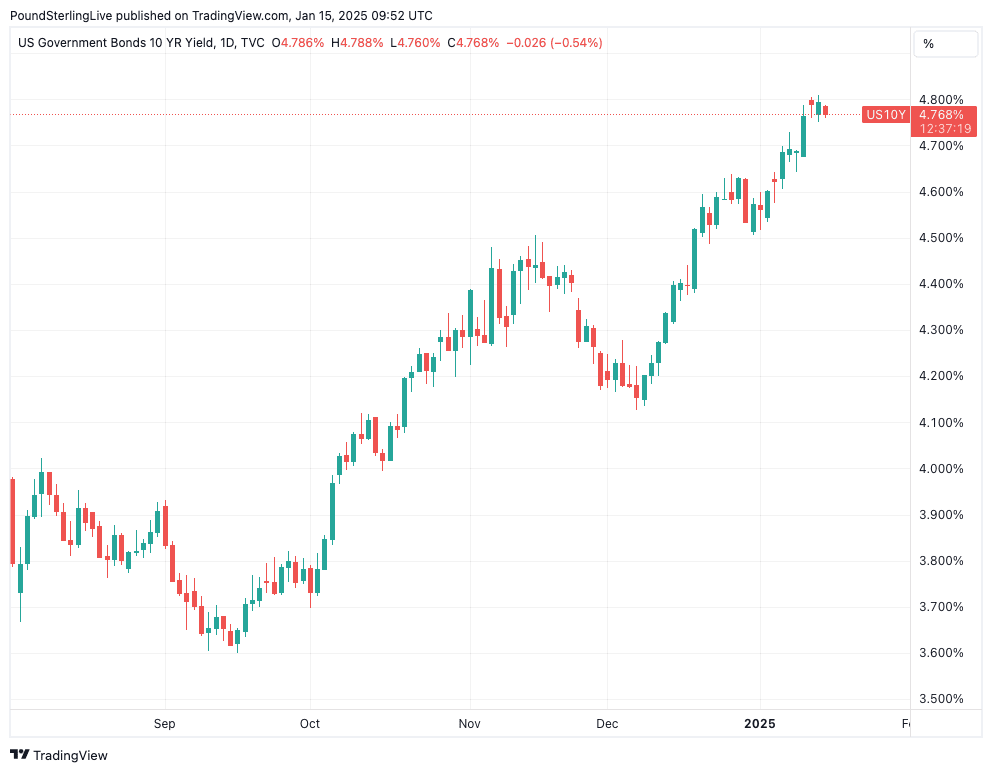

The U.S. ten-year bond yield, a key measure of U.S. financing costs, this week peaked at 4.80% and markets are wary of the 5.0% level being breached before the month is out.

Above: The yield on U.S. ten-year government Treasuries offer attractive returns.

This speaks of tightening financial conditions for businesses and consumers while also raising the attractiveness of government sovereign bonds relative to equities.

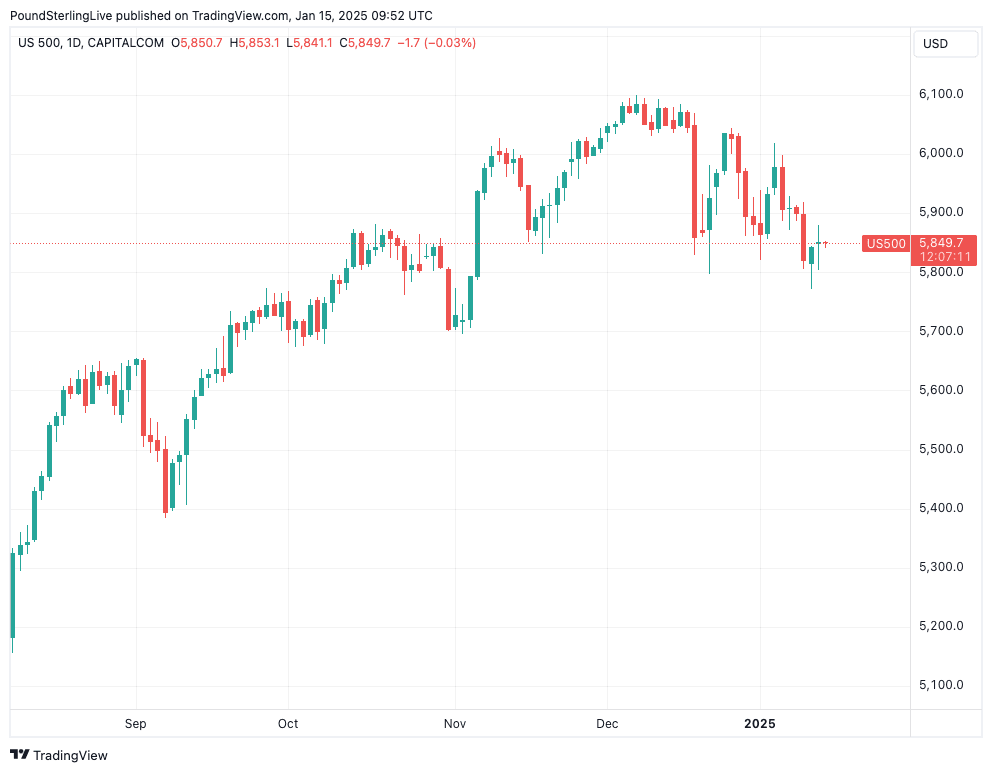

The U.S. equity market rally of the past two years ranks in the 93rd percentile over the past century, leaving markets "increasingly susceptible to corrections."

"The market’s current assumptions about inflation and rates are dangerously optimistic," says Green.

Above: The U.S. benchmark S&P 500 has retreated from record highs.

He explains that inflationary pressures persist, driven by supply-side constraints and wage growth, which risks further rate hikes at the Federal Reserve.

"As a result, bond yields can be expected to climb higher, with 10-year Treasury yields likely to breach the 5% threshold,” says Green. "Investors must prepare for this dual threat of higher rates and slower growth."

Corporate earnings will be important, as the robust earnings growth seen over the past two years has been a key driver of market performance.

"However, the sustainability of this trend is now in question. As central banks maintain their hawkish stance to combat inflation, the risk of an economic slowdown increases," says Green.

He explains that disappointments in economic data or earnings could act as a catalyst for market corrections.

deVere says investors must adopt a more cautious approach and be ready for increased volatility, while also staying exposed to the benefits of longer-term structural trends.

"While the long-term outlook for equities remains positive, driven by technological innovation and structural shifts in the global economy, the path forward will not be without turbulence. The market needs to digest the extraordinary gains of recent years, and this digestion period could manifest as a correction," says Green.