Dollar Rate Setback by Soft U.S. Core Inflation Print

- Written by: Gary Howes

Image © Adobe Images

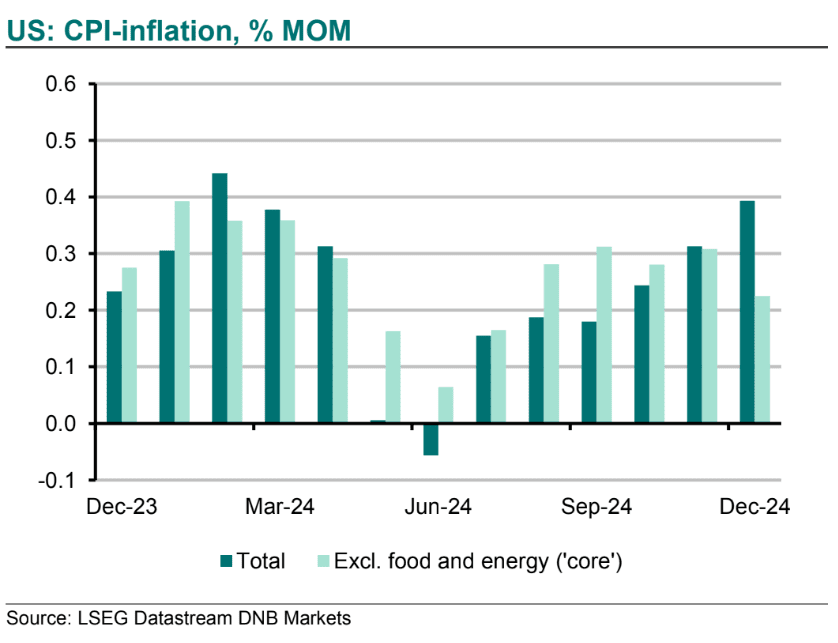

Dollar bulls needed a consensus-beating inflation print to maintain their stampede but received news of an unexpected cooling in core inflation.

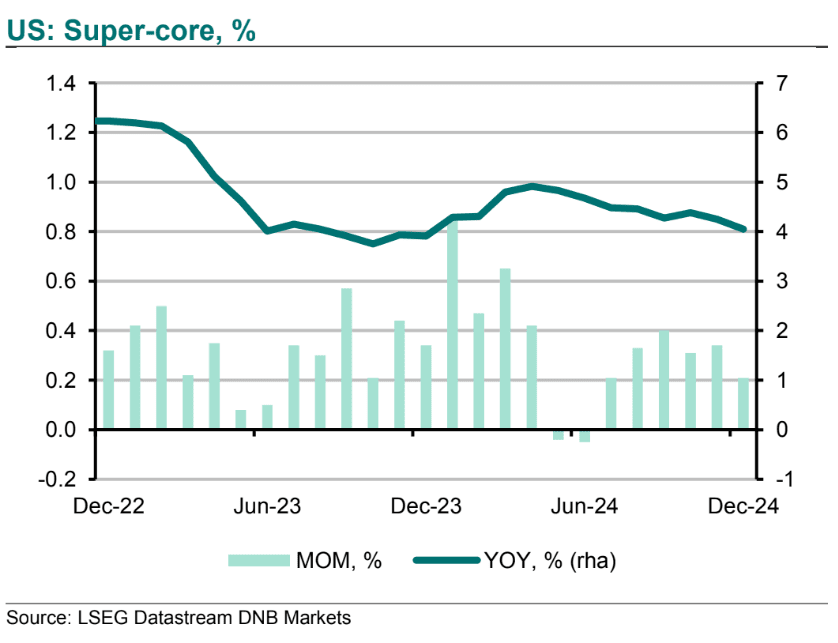

The Dollar dropped after it was reported U.S. core CPI fell to 3.2% year-on-year from 3.3% (expected: 3.3%), marking the first drop since July. U.S. super-core inflation, which is core inflation minus rents, remains elevated but is still trending lower.

Headline CPI inflation rose to 2.9% year-on-year in December from 2.7%, which met expectations and helped bolster expectations for a June interest rate cut.

U.S. bond yields retreated, stocks rose and money market pricing showed traders raised bets for the next Federal Reserve interest rate cut falling in June, with a second likely in H2.

The Pound to Dollar (GBP/USD) exchange rate rallied and is 0.70% higher on the day at 1.2296, while the Euro to Dollar rate is trading 0.30% higher at 1.0336.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The fact that the inflation number excluding food and energy was actually lower than expectation will be well received by the market. The market had priced out expectations of any rate cuts up to October, an impressive swing over the last couple of months. If this number is followed by similarly stable prints, we would expect the US dollar to soften and both the market and the Fed to adopt a less hawkish tone," says Kambiz Kazemi, Chief Investment Officer at Validus Risk Management.

The slowdown in core inflation has driven market bets for a June rate cut higher. Image courtesy of DNB Markets.

The data comes amidst signals that the Dollar is overbought and trading well above fundamental drivers. This overvaluation has been driven by a series of above-consensus U.S. economic data prints, which now leaves the bar for further upside set particularly high.

This leaves the Dollar vulnerable to data releases that meet or undershoot expectations.

Above: Super-core inflation, which the Fed watches closely, continues to trend lower.

The dollar index - a measure of USD strength against a basket of currencies - is now 25% above the average level of the past 25 years and at a level seen only briefly since the 1980s.

Kit Juckes, FX analyst at Société Générale, says dollar overvaluation appears to reflect the market front-running incoming President Donald Trump's policies. He says the risk is that what he delivers fails to meet expectations.

That said, there is also limited scope for U.S. interest rates to fall materially, given the strength of the U.S. economy, which suggests a rout of the Greenback is also unlikely.

"Further dollar strength looks unjustified but a significant fall would need a significant catalyst," says Juckes.

"Today's report, while very much welcomed, doesn’t change the game plan for the Fed. The labour market and growth remain on solid footing, so they can comfortably wait for continued inflation progress and more insight into the future directions of fiscal and trade policy. Expect that message from Powell later this month," says Ali Jaffery, an economist at CIBC Capital Markets.