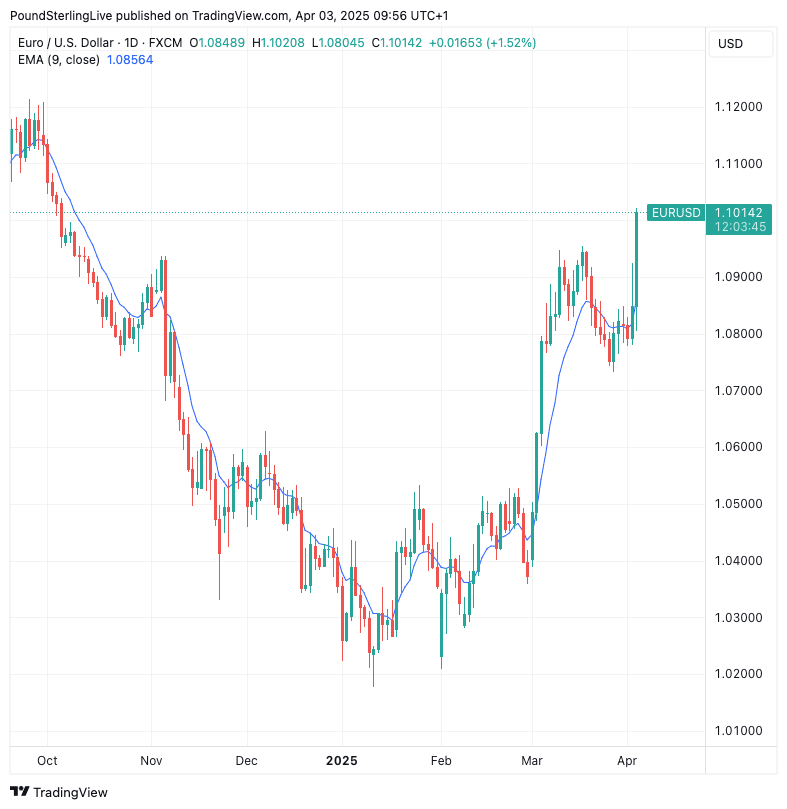

Trump Sends Euro-Dollar Above 1.10

- Written by: Gary Howes

Investors are betting the EU will respond symbolically.

The FX market has punished the U.S. Dollar and bought the Euro, confirming that it is the U.S. economy that will bear the brunt of the new tariffs announced by the White House on April 02.

At the time of writing Thursday, the Euro-to-Dollar exchange rate is 1.40% higher on the day at 1.10.

The currency market's behaviour reflects the reality that domestic consumers and businesses pay for tariffs and the arithmetic suggests the negative hit to the U.S. economy outweighs any losses suffered by the EU via lower exports.

"While a global trade war in theory is a euro-negative, the soft underbelly of the US economy is the dominant factor for EUR/USD right now. A much sharper sell-off in US equities, dragging US rates even lower, adds another nail in the coffin of US exceptionalism and could send EUR/USD over 1.10," says Chris Turner, head of FX research at ING.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Looking ahead, the rally's sustainability will depend on how the European Union reacts to U.S. tariffs, say some analysts.

"If Europe and China do symbolic retaliation and focus more on domestic support measures we could avoid a broad-based global risk reduction event," says Namik Immelbäck, Chief Strategist at SEB, the Swedish bank.

Under a U.S.-focussed selloff, the Dollar would likely stay under pressure, he explains. "Avoiding further escalation makes this a US negative event."

The European Commission President Ursula von der Leyen said on Thursday the EU is finalising a response to tariffs placed on steel and aluminium, suggesting it is still some way off from announcing a response to the April 02 tariffs.

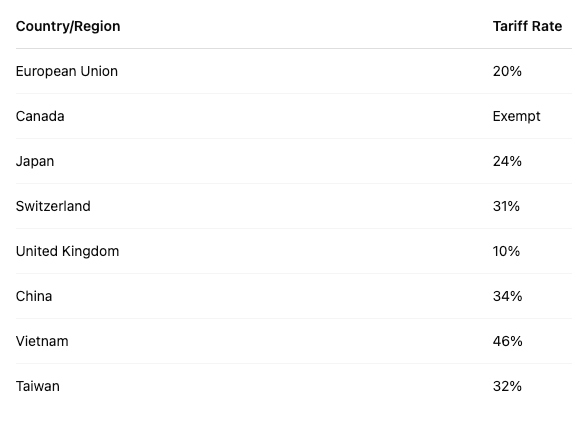

The U.S. announced a 20% flat tariff rate on all EU imports. In response, Von der Leyen said the EU was preparing further countermeasures if negotiations fail.

This is a hard hint that the EU will negotiate on the matter as a preference to upping the ante.

SEB's view is that this path would prove supportive of European assets.

"Harder retaliation benefits no one – this is the game theory outcome the U.S. administration is betting on," says Immelbäck. "So far the comments from Brussels imply a tempered response / avoiding escalation."

Above: EURUSD at daily intervals.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

He says such an approach increases the probability of a U.S. recession, the selling of U.S. equities, "and rate convergence leads to short USD vs Europe in particular."

George Saravelos, chief FX strategist at Deutsche Bank, says the U.S. "administration's approach to calculating the tariffs raises serious concerns about policy credibility, undermining the USD."

The tariffs the U.S. announced on various countries were based on crude calculus: The U.S. took into account its trade deficit with a given country and divided it by that country's exports to the U.S. to arrive at an alleged tariff rate.

For example, the U.S. has a $17.9BN trade deficit with Indonesia via imports amounting to $28BN. $17.9/$28 = 64%. That figure of 64% is claimed by the White House to be a tariff rate imposed by Indonesia on U.S. exports, which it clearly isn't.

The process undermines U.S. credibility and raises investor uncertainty towards U.S. policy and the domestic outlook.

Because tariffs are a tax on consumers, the U.S. economy is effectively facing a massive tax hike.

This is disinflationary, which will make the Federal Reserve's job of containing inflation a whole lot easier.

"The U.S. Treasury Secretary’s communication to the market right after the announcement emphasised fiscal tightening, while fiscal support from the rest of the world looks likely, further undermining relative US growth expectations," says Saravelos.

This implies the U.S. central bank now has more scope to cut interest rates, while other central banks have less scope.

This creates a convergence in interest rates that would drag on the Dollar relative to other global currencies, most notably the Euro.

Looking to potential targets, ING's Turner says major medium-term resistance sits in the 1.11/12 area. "It's hard to call a major break of that unless US activity craters."