Euro to Dollar Week Ahead Forecast: Constrained by Risk of Tit-for-Tat Tariff Spat

- Written by: James Skinner

Image © European Union - European Parliament, Reproduced Under CC Licensing.

The Euro to Dollar rate showed remarkable resilience in an almost disorderly global market rout last week but it could be dampened and constrained to a level path just above the nearby 1.0850 area in the days ahead if the risk of an imminent tit-for-tat tariff spat with Washington weighs on the single currency.

EUR/USD fell less than one percent on Friday as an escalating trade spat between Washington and Beijing exacerbated an earlier rout in global markets and prompted some other currencies to fall as much as 5% against a resurgent US Dollar, leading to sharp gains by the euro in many cross rates.

However, the pair could ebb further with the euro also unwinding earlier gains on may crosses this week if Brussels also engages in a tit-for-tat tariff spat with Washington following the Wednesday implementation of the “individualized reciprocal higher tariff,” rate of 20% announced in the US last week.

“So far markets seem unconcerned about the potential negative impacts of US tariffs on the European economy. Markets are pricing three more interest rate cuts from the ECB by year end, similar to what was priced before the tariff announcements,” says Kristina Clifton, a strategist at Commonwealth Bank of Australia.

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of March rally and selected moving averages indicating possible areas of technical support. Click for closer inspection.

“The European economy is already weak and the tariffs will be another headwind. If Europe retaliates to US tariffs, the negative impacts for Europe will be larger. In our view, EUR/USD is at risk of a sharp correction lower in coming weeks. Support at 1.0804 (61.8% fibbo) is within reach,” she adds, in a Sunday note.

A widely touted retaliation against the new US tariff regime could come from Brussels as soon as Wednesday, which would risk a counter-response from Washington after President Donald Trump said last week that retaliation from others would merely beget even higher US tariffs.

This, and fear about the impact on the Euro Area economy, could weigh on EUR/USD and other Euro pairs in the days ahead at least, however, some around the market see the outlook for the Euro improving of late due to the deteriorating prospects of the US dollar, which has fallen heavily against all G10 peers this year.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

“We are making a major shift in our Dollar view for the year ahead: we now see Dollar weakness of the first quarter persisting and deepening further,” says Kamakshya Trivedi, head of global FX, interest rates and emerging market strategy at Goldman Sachs.

“We have previously talked about the risk case of a shift in the relative growth outlook reversing the “exceptional” positioning that underpins the Dollar’s strong valuation. In light of recent events, we are now making that our base case,” Trivedi and colleagues add, in a Friday research briefing.

Trivedi and colleagues raised their forecasts for numerous currencies relative to the Dollar on Friday including the Euro, which is now seen rising to 1.12, 1.15 and 1.20 over the next three, six and 12 months, respectively, reflectinge upgrades from earlier projections of 1.07, 1.05 and 1.02, respectively.

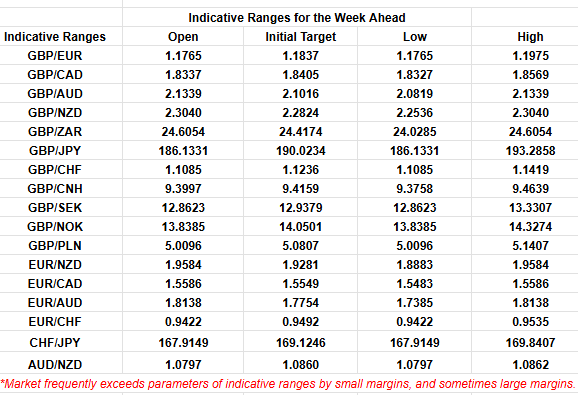

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

Another possible headwind for the greenback and support for the Euro up ahead is the quasi peg that exists between the trade-weighted Dollar and trade-weighted Renminbi due to Beijing’s basket-based approach to its managed-floating exchange rate, and the pressure exerted on the Renminbi by the new US tariffs.

So far Beijing has maintained USD/CNH and USD/CNY within narrow ranges that have belied the risks posed to the Chinese economy by the new US tariff regime but it also hasn’t done much of anything to prevent either the US Dollar or the Renminbi from depreciating meaningfully against other currencies.

This is why even as USD/CNY and USD/CNH fell slightly through much of the first quarter, the RMB/CFETS index also fell to six-month lows before trading sideways and then rising in the latter half of March, leading the Federal Reserve’s Broad US Dollar Index and the ICE US Dollar Index to follow suit from March 16/17.

“China’s leadership isn’t too concerned about escalation. In these circumstances, a substantial weakening against the dollar still seems likely (our end-year forecast is 8.0),” says Leah Fahey, a China economist at Capital Economics, in a Friday note. “But if the dollar remains under pressure, then the bilateral exchange rate wouldn’t need to adjust as much in order to achieve a sizeable exchange rate offset against tariffs.”