Pound to Euro Week Ahead Forecast: Recovering as Tariff Spat Restrains EUR/USD

- Written by: James Skinner

Image © Adobe Images

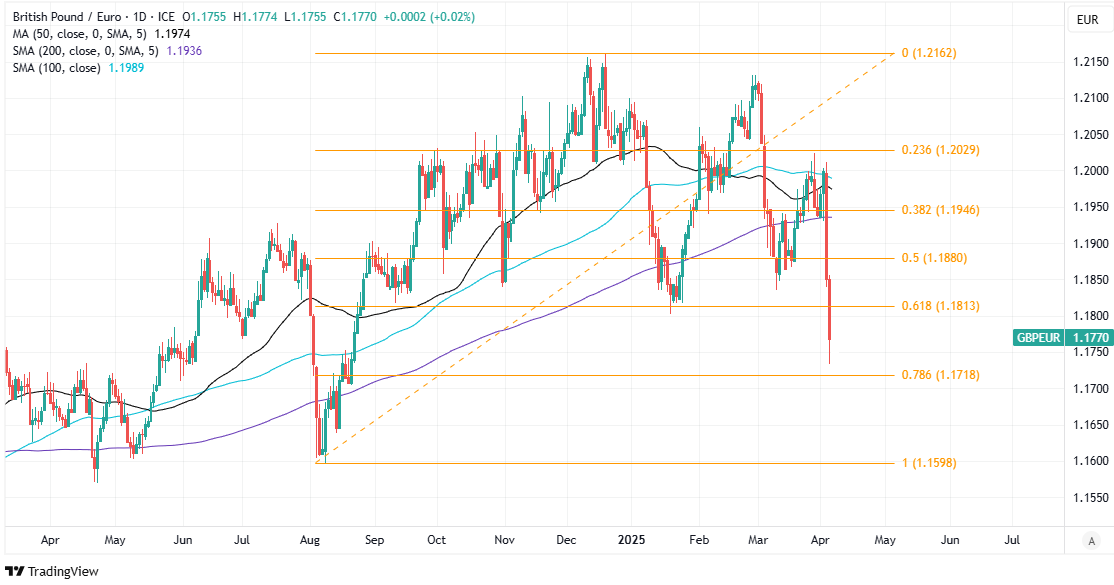

The Pound to Euro rate fell heavily last week but could now see a partial recovery, with technical support levels at 1.1813 and 1.1880 potentially regained, if the risk of a tit-for-tat tariff spat between Washington and Brussels leads EUR/USD to ebb further from its recent highs in the days ahead.

GBP/EUR fell to eight-month lows beneath 1.17 on Friday as the Euro showed greater resilience than Sterling in an escalating global market rout that saw the US dollar come rallying back from the prior day’s losses to the detriment of most other currencies, many of which had rallied sharply on Thursday.

“The sharp spike in the VIX has overshadowed the pound's larger resilience to tariffs - evidenced in the lower UK tariff - resulting in EURGBP trading much cheaper than rate differentials imply,” says Themistoklis Fiotakis, head of FX research at Barclays.

“We assess this to be a temporary bump and expect the pound to rebound vs. the EUR as equity volatility subsides,” he adds, in a Sunday research briefing.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of August to December uptrend indicating possible areas of technical support for Sterling. Click for closer inspection.

Friday saw Sterling fall up to 1% against a euro that climbed much more sharply against some other currencies including the Australian dollar, which fell more than 4% at its lows. However, the single currency’s gains could reverse somewhat this week if Brussels and Washington engage in a tit-for-tat tariff spat.

The “individualized reciprocal higher tariff,” rate of 20% announced by the White House last week will apply to goods imported from the European Union as of Wednesday and a widely touted retaliation could come as soon as Wednesday, which would risk drawing a counter-response from Washington.

“The European economy is already weak and the tariffs will be another headwind. If Europe retaliates to US tariffs, the negative impacts for Europe will be larger,” says Kristina Clifton, an economist and strategist at Commonwealth Bank of Australia.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“The UK is negotiating with the US to reduce the 10% tariff the US has placed on UK goods imports. If the US agrees to lower their tariff, GBP/USD would jump,” she adds, in a Sunday research briefing.

A counter-response might be likely because President Donald Trump said in last Wednesday’s tariff announcement that retaliation by other countries would merely beget even higher US tariffs, and an escalating tit-for-tat exchange would likely see the effects of the euro’s recent outperformance reverse somewhat.

However, toward the end of the week, on Friday, the release of the UK’s February GDP report might also be impactful for Sterling and could see any recovery of the Pound to Euro rate tempered if it shows the economy stalling afresh as high interest rates and downbeat sentiment weigh ahead of April’s fiscal policy changes.

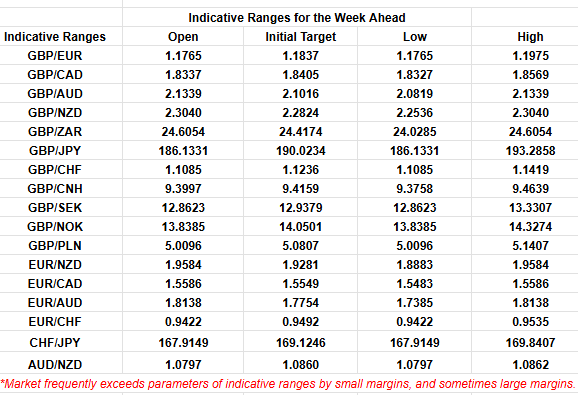

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes