Pound-to-Dollar Forecast: 1.2947 and Above Possible

- Written by: James Skinner

Image © Adobe Images

Image © Adobe Images

A recovery to 1.2947 and above is possible if pessimism about the US economy and a deterioration of other important fundamentals weigh on the greenback afresh.

GBP/USD fell as much as 1.99% on Friday as an escalating trade spat between Washington and Beijing exacerbated an earlier rout in global markets and led the US dollar to rally back sharply from the prior day’s losses, prompting some other free-floating G10 currencies to slide as much as 5% by the weekend.

However, the losses may prove unsustainable in the face of widespread pessimistic takes on how President Donald Trump’s trade tariffs are likely to impact US economic growth, and perhaps more well-founded concerns about what the levies may mean for the world’s overweight position in things like US equities.

“We are making a major shift in our Dollar view for the year ahead: we now see Dollar weakness of the first quarter persisting and deepening further,” says Kamakshya Trivedi, head of global FX, interest rates and emerging market strategy at Goldman Sachs.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements and selected moving averages indicating possible support levels for Sterling. Click for closer inspection.

“We have previously talked about the risk case of a shift in the relative growth outlook reversing the “exceptional” positioning that underpins the Dollar’s strong valuation. In light of recent events, we are now making that our base case,” Trivedi and colleagues add, in a Friday research briefing.

Trivedi and colleagues raised their forecasts for numerous currencies relative to the Dollar on Friday including Sterling, which is now seen rising to 1.32, 1.35 and 1.39 over the next three, six and 12 months, respectively. Those are upgrades from earlier projections of 1.29, 1.28 and 1.24, respectively.

Their idea is that White House tariffs will erode the confidence of companies and households, leading expectations of the economy to deteriorate and threatening to undermine the transatlantic growth differential that has sustained an overvalued Dollar and ‘overweight’ US equity markets for a decade or more.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

However, it’s possible, if not likely that the tariffs will be bullish for US business investment, production, employment, wages and GDP, but also toxic for profits, margins and stocks through their effect on the outrageous valuations that have prevailed in US equity markets in recent times.

“A potential reversal of this overweight is often cited as a vulnerability for the dollar. Europe's fiscal stimulus in particular has raised the question whether a rotation into European equity markets may already be under way,” says Themistoklis, global head of FX research at Barclays.

“We have already argued that such structural trends in cross-dollar flows do not turn on a dime. Instead, they require deep reversals in underlying macro conditions,” he adds in a late March research briefing.

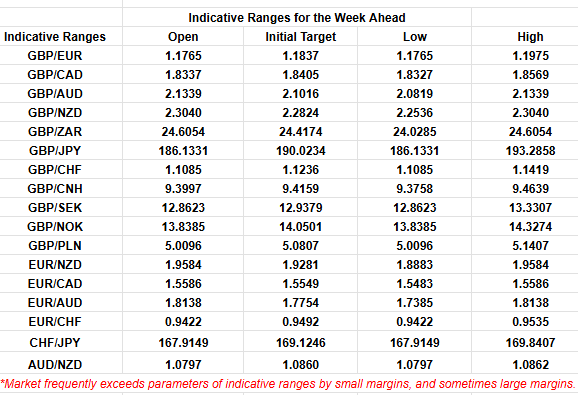

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

Another possible headwind for the greenback up ahead is the quasi peg that exists between the trade-weighted Dollar and trade-weighted Renminbi as a result of the Beijing’s basket-based approach to its managed-floating exchange rate, and the pressure exerted on the Renminbi by the White House’s trade tariffs.

So far Beijing has maintained USD/CNH and USD/CNY within narrow ranges that have belied the risks posed to the Chinese economy by the new tariff regime, and it might continue to yet, but it also hasn’t done much of anything to prevent either the US Dollar or the Renminbi from depreciating against other currencies.

This is why even as USD/CNY and USD/CNH fell slightly through the first quarter, the RMB/CFETS index also fell to a six-month low before trading sideways and then rising in the latter half of March, leading the Federal Reserve’s Broad US Dollar Index and the ICE US Dollar Index to follow suit from March 16/17.

“China’s leadership isn’t too concerned about escalation. In these circumstances, a substantial weakening against the dollar still seems likely (our end-year forecast is 8.0),” says Leah Fahey, a China economist at Capital Economics, in a Friday note. “But if the dollar remains under pressure, then the bilateral exchange rate wouldn’t need to adjust as much in order to achieve a sizeable exchange rate offset against tariffs.”

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks