Pound to Canadian Dollar Week Ahead Forecast: Loonie Dampened by Softer USD

- Written by: James Skinner

Image © Pound Sterling Live

The Pound to Canadian Dollar exchange rate receded further from the post-Brexit highs of early March last week but it benefits from a double-barreled layer of support just above the nearby 1.82 handle and might even have scope to recover above 1.8427 if the US Dollar weakens afresh up ahead, taking the Loonie with it.

GBP/CAD fell around 1.8% from the highs near 1.8650 seen early on Thursday to the lows at 1.8305 seen late on Friday when the Canadian Dollar showed greater resilience than Sterling amid an almost-disorderly rout in global markets that saw the US Dollar rally back sharply from the prior day’s losses.

However, there may be scope for these losses to reverse somewhat this week as Canada retaliates over the latest changes to US trade tariffs, and if widespread pessimism about the US economic outlook and a deterioration of other similarly-important fundamentals weighs on the US Dollar afresh up ahead.

“Canada is facing some significant headwinds. But narrower spreads and the weaker USD tone should bolster confidence that the 1.48 peak [in USD/CAD] seen at the start of March is unlikely to be revisited any time soon,” says Shaun Osborne, chief FX strategist at Scotiabank.

Above: Pound to Canadian Dollar rate shown at daily intervals with Fibonacci retracements and selected moving averages indicating possible support levels for Sterling. Click for closer inspection.

“USDCAD price action is neutral—consolidative—Friday but a downtrend in the USD continues to develop and the daily DMI is nudging USD-bearish for the first time since September,” he adds, in a Friday research note.

The Canadian Dollar’s resilience and the decline in GBP/CAD were encouraged when the White House said that many products imported from Canada would be exempt from the new tariffs announced last Wednesday.

However, steel, aluminium and some cars are still expected to be subject to a 25% tariff, and the caretaker government has said it intends to retaliate with levies of its own, which would risk a counter-response from Washington and an escalating dispute that might make the Loonie’s gains difficult to sustain.

“So far, markets appear more concerned about tariff risks to the US economy. Our estimates show Canada will be the most significantly impacted of the economies we cover,” says Kristina Clifton, an economist and strategist at Commonwealth Bank of Australia, while tipping USD/CAD to rise as far as 1.4469 this week.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Another possible source of support for GBP/CAD this week would be any renewed weakening of the US Dollar, given the Loonie’s positive correlation with the trade-weighted measure of the currency, which has fallen heavily of late due to growing market pessimism about the outlook for the US economy.

“We are making a major shift in our Dollar view for the year ahead: we now see Dollar weakness of the first quarter persisting and deepening further,” says Kamakshya Trivedi, head of global FX, interest rates and emerging market strategy at Goldman Sachs.

“We have previously talked about the risk case of a shift in the relative growth outlook reversing the “exceptional” positioning that underpins the Dollar’s strong valuation. In light of recent events, we are now making that our base case,” Trivedi and colleagues add, in a Friday research briefing.

Trivedi and colleagues raised their forecasts for numerous currencies relative to the Dollar on Friday and lifted their projection for GBP/CAD, which is now seen at 1.8480, 1.8765 and 1.9182 over the next three, six and 12 months, respectively, reflecting upgrades from earlier forecasts of 1.8834, 1.8688 and 1.8104, respectively.

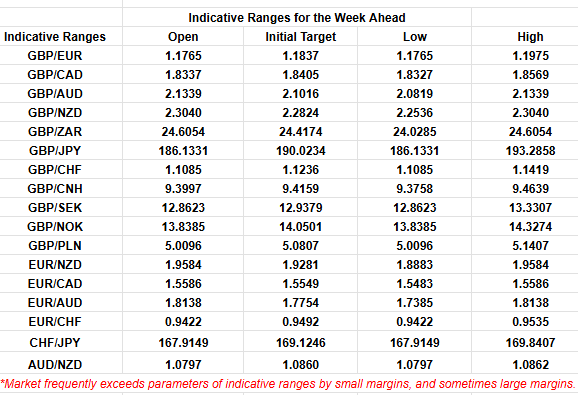

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

Their idea is that White House tariffs will erode the confidence of companies and households, leading expectations of the economy to deteriorate and threatening to undermine the transatlantic growth differential that has sustained an overvalued Dollar and ‘overweight’ US equity markets for a decade or more.

However, it’s possible, if not likely that the tariffs will be bullish for US business investment, production, employment, wages and GDP, but also toxic for profits, margins and stocks through their effect on the outrageous valuations that have prevailed in US equity markets in recent times.

“A potential reversal of this overweight is often cited as a vulnerability for the dollar. Europe's fiscal stimulus in particular has raised the question whether a rotation into European equity markets may already be under way,” says Themistoklis, global head of FX research at Barclays.

“We have already argued that such structural trends in cross-dollar flows do not turn on a dime. Instead, they require deep reversals in underlying macro conditions,” he adds in a late March research briefing.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes