Euro-Dollar: ECB Hold to Offer Tariff Buffer

- Written by: Gary Howes

Image © European Union, reproduced under CC licensing.

The Euro faces tariff risks, but ECB policy expectations offer an offset.

This is because new lending data suggests that the European Central Bank (ECB) may not need to cut interest rates in April.

Data on money flowing through the Eurozone economy from the ECB shows banks are lending more amidst signs of a revival in investment intentions.

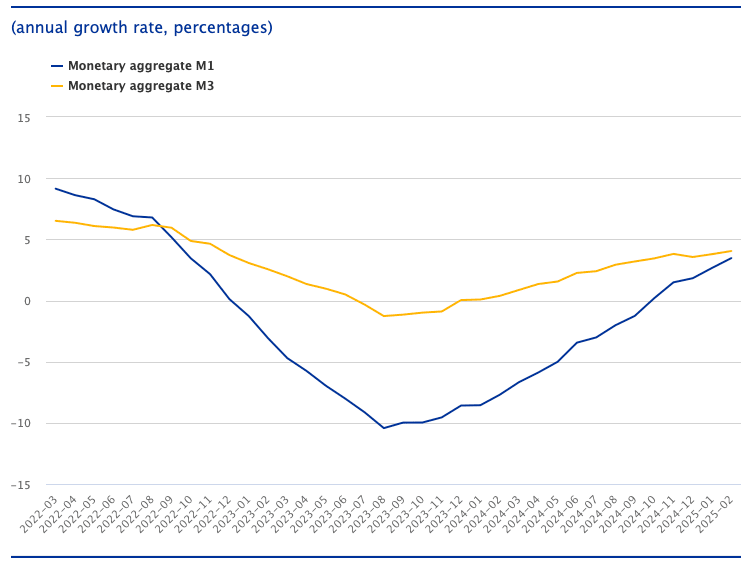

The Eurozone's measure of money supply - the narrow M1, which consists of cash and overnight bank deposits – rose by 3.5% year-on-year in February.

This is the fastest pace of growth in over two years.

"Euro-zone money and lending growth continued to accelerate in February, supporting the case of those at the ECB who would prefer to pause interest rate cuts in April," says Jack Allen-Reynolds, Deputy Chief Euro-zone Economist.

A skip would shore up Eurozone bond yields and underpin Euro exchange rates.

Economists say the improvements confirm ECB interest rate cuts continue to have the desired effect on the economy.

"With lending growth accelerating out of stagnation, this represents a careful improvement of monetary conditions. Given the pace, though, it is also clear that the ECB is still not stimulating the economy," says Bert Colijn, Chief Economist for the Netherlands at ING Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Meanwhile, economists at Wells Fargo raised their forecasts for the Eurozone economy, citing additional positive developments in recent months.

"Landmark fiscal stimulus from Germany has in our view brightened prospects for both Germany and the broader Eurozone, prompting us to raise our 2026 Eurozone GDP growth forecast to 1.6%," says Nick Bennenbroek, International Economist at Wells Fargo.

However, that the upgrade comes in 2026 underlines the longer-term nature of the German fiscal 'bazooka', which propelled the Euro higher in March.

Near-term risks for the single currency build through April as significant tariffs are introduced on Eurozone exports by the U.S.

Nevertheless, Wells Fargo says the improving 'bigger picture' means "more careful and considered deliberations by ECB policymakers at upcoming meetings."

It now forecasts 25 basis points of ECB rate cuts in June and September, taking the policy rate to a low of 2.00% by September, compared to a previous outlook for a policy rate low of 1.75%.