Euro Running on the Fumes of Tariff Optimism

- Written by: Gary Howes

Above: Howard Lutnick (centre) is preparing tariffs on the EU, due to be announced next week.

The Euro could be reflecting an overconfidence heading into "Liberation Day".

This is the moniker U.S. President Donald Trump has bestowed on his April 02 tariff announcement that will see the rollout of a barrage of new punitive trade measures.

Citi FX strategists view "Liberation Day" as the catalyst for EUR weakness.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, the Euro is not reflecting any nerves as of yet: the Pound-to-Euro exchange rate is comfortably in the middle of its multi-month range and the Euro-to-Dollar exchange rate is nearly 4% higher than where it started the year.

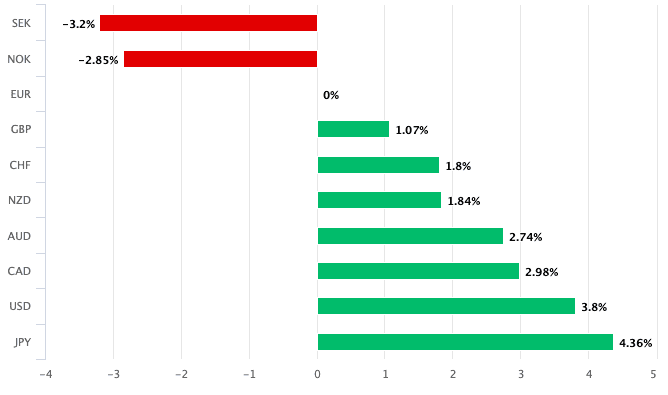

In fact over the course of the past month, EUR is the third-best performing G10 name.

"EUR resilience in the face of worrying developments on the trade front is either impressive or optimistic," says Daragh Maher, Senior FX Strategist at HSBC. "It feels unsustainable.'

Only the Scandies have outperformed EUR over the past month.

According to HSBC, the market's optimistic stance on the EUR reflects a selective reading of tariff headlines, with a choice to focus on Trump's suggestion upcoming tariffs will be "lenient".

This means traders are choosing to ignore a 25% tariff on EU auto exports and ignore headlines that double-digit tariffs are to be layered on top.

Trump also made a threat on Wednesday that tariffs on the EU could be much larger than planned if it cooperates with Canada to hurt the U.S. Again, the EUR looks to be ignoring this.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"If the European Union works with Canada in order to do economic harm to the USA, large scale Tariffs, far larger than currently planned, will be placed on them both in order to protect the best friend that each of those two countries has ever had!" Trump posted on Truth Social.

The scale of the threat and current levels in spot exchange rates could suggest EUR is running on the fumes of optimism.

"We continue to see tariff risks as underpriced, particularly in FX and equities," says a note from Citi's currency desk.

"The inertia in the FX market might simply reflect confusion about what this all might mean," says Maher.

According to reports, European trade chief Maroš Šefčovič's was told of the tariffs by U.S. Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer. Photographer: Claudio Centonze. Copyright: European Union.

Indeed, FX trading veteran Brent Donnelly at Spectra Markets says that at this juncture, "tariffs are untradable."

Others agree. JP Morgan's London trading desk says in a daily briefing that "the market has learnt its lesson, shooting first and asking questions later was a painful experience post-inauguration and therefore a sense of calm is perhaps the best reaction here until we understand the end game."

"In the relative world of FX, the logic might be that all ships are sinking, so there might be no currency implication," points out Maher.

The Pound retains support against the Euro on strong hints the UK will be relatively unaffected by next week's "Liberation Day" tariffs.

CNBC said the U.S. President may not take all of the non-tariff barriers into account when setting tariff rates. He specifically mentioned VAT taxes, which will be welcomed by the UK.

Image: Official White House release.

"That could be notable for the UK given the lack of a goods sector imbalance," says Jeremy Stretch, an analyst at CIBC Capital Markets.

CNBC's Eamon Javers said, "A White House official tells me the president is signalling he may not take all of the non-tariff barriers into account when he calculates tariffs on given countries. Those non-tariff barriers, they say, include VAT taxes."

Previously it was mooted that countries that charge VAT could be in line for tariffs, which brought the UK into focus. But dropping the VAT threat means the UK will unlikely feature on Trump's radar.