Pound Sterling: VAT-exempt

- Written by: Gary Howes

Image: White House Official.

The British Pound stands out as a hedge against looming U.S. tariffs.

The Pound extends a recovery against the Euro and Dollar amidst expectations the UK will be relatively unaffected by next week's "Liberation Day" tariffs.

CNBC said the U.S. President may not take all of the non-tariff barriers into account when setting tariff rates. He specifically mentioned VAT taxes, which will be welcomed by the UK.

"It has been suggested by a White House Official that the US "may" not take non-tariff barriers, including VAT, into their reciprocal measures. If that is correct, that could be notable for the UK given the lack of a goods sector imbalance," says Jeremy Stretch, an analyst at CIBC Capital Markets.

CNBC's Eamon Javers said "a White House official tells me the president is signalling he may not take all of the non-tariff barriers into account when he calculates tariffs on given countries. Those non-tariff barriers, they say, include VAT taxes."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

On February 13 Trump surprised observers by saying he would tariff countries that charge sales taxes like VAT, which would include the UK.

The prospect of a reciprocal tariff on the UK over VAT charges would represent a 'wild card' moment for FX markets, given it is hard to understand why a country's sales tax is discriminatory on foreign imports.

The creative approach to trade policy put the Pound at risk of a negative surprise heading into the April 02 "Liberation Day" tariff announcements.

Any fading risks here would buffer the Pound's status as a hedge against tariffs.

Goldman Sachs Lowers Pound-Euro Forecast

Evidence of Pound Sterling's relative appeal amidst tariff uncertainty follows U.S. President Donald Trump's Wednesday decision to impose a 25% import tariff on all vehicle imports starting on April 03.

The tariff would also apply to all vehicle components, leaving little scope for carve-outs. Trump said these tariffs were non-negotiable.

The developments come ahead of the April 02 "Liberation Day" tariff announcements, which are anticipated to be the most severe of the President's two terms in office.

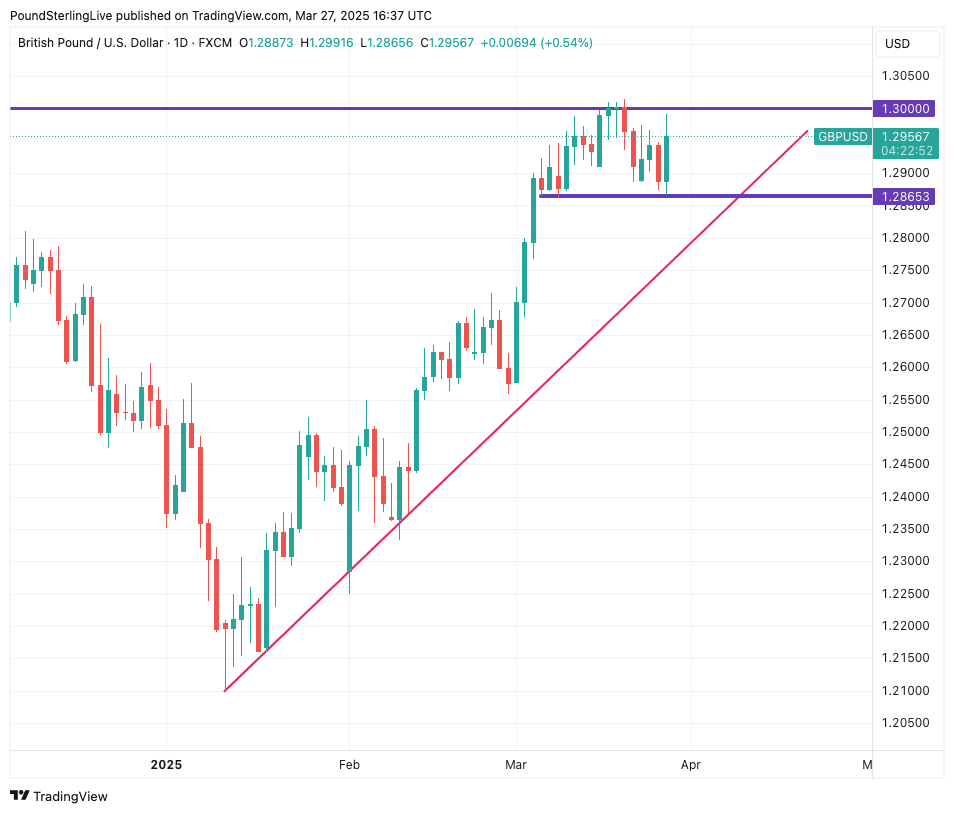

Above: GBP/USD holds an uptrend.

The Pound traded weaker through the mid-week session, having been knocked by a softer-than-forecast set of inflation data, but it recovered late in the day when the tariff headlines from the White House rolled in.

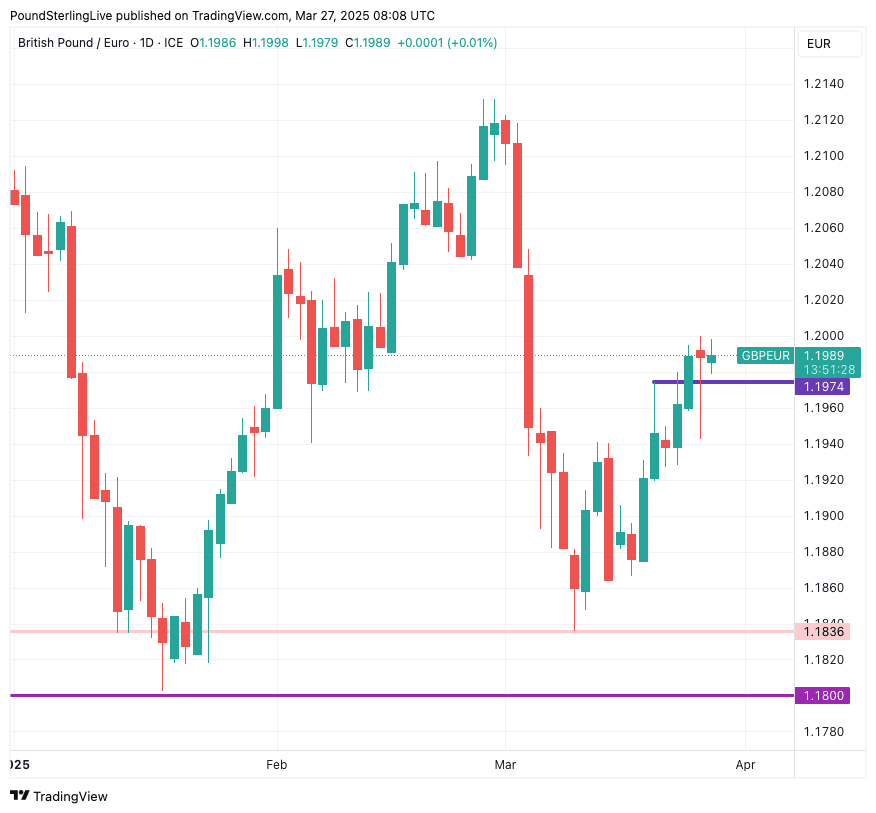

The price action suggests it holds a status as a relative hedge against tariff news: the Pound-to-Euro exchange rate recovered from a low of 1.1924 to the cusp of 1.20 on Thursday.

The Pound-to-Dollar exchange rate has recovered from 1.2870 to 1.2905.

"The Sterling backdrop looks relatively well supported versus the EUR, not least when combined with the fact that the UK looks less exposed than the eurozone to tariff concerns," says Jeremy Stretch, Head of G10 FX Strategy at CIBC Capital Markets.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"Given that UK goods trade remains relatively balanced and or Trump appears to have a favourable view of the UK, relative to his antipathy as regards the EU, suggests an extension in the EUR/GBP downtrend," he adds.

On Wednesday, Trump announced, "We’re going to be doing a 25% tariff on all cars that are not made in the United States. We’re going to charge countries for doing business in our country and taking our jobs, taking our wealth, taking a lot of things that they’ve been taking over the years."

Vehicle tariffs would be collected starting at 12:01 a.m. Washington time on April 03.

Above: GBP/EUR has met and exceeded our Week Ahead Forecast target.

The White House said the tariffs would apply not only to fully assembled cars but key automobile parts, including engines, transmissions, powertrain parts and electrical components. Tariffs on parts will take effect no later than May 3.

These latest tariffs will be particularly harmful for Mexico, Japan, Canada and the EU, which account for the largest exporters of vehicles and components to the U.S.

Foreign exchange markets are relatively calm following the developments, suggesting heightened anticipation of the April 02 tariff calls, which will be far more wide-ranging and net many more countries.

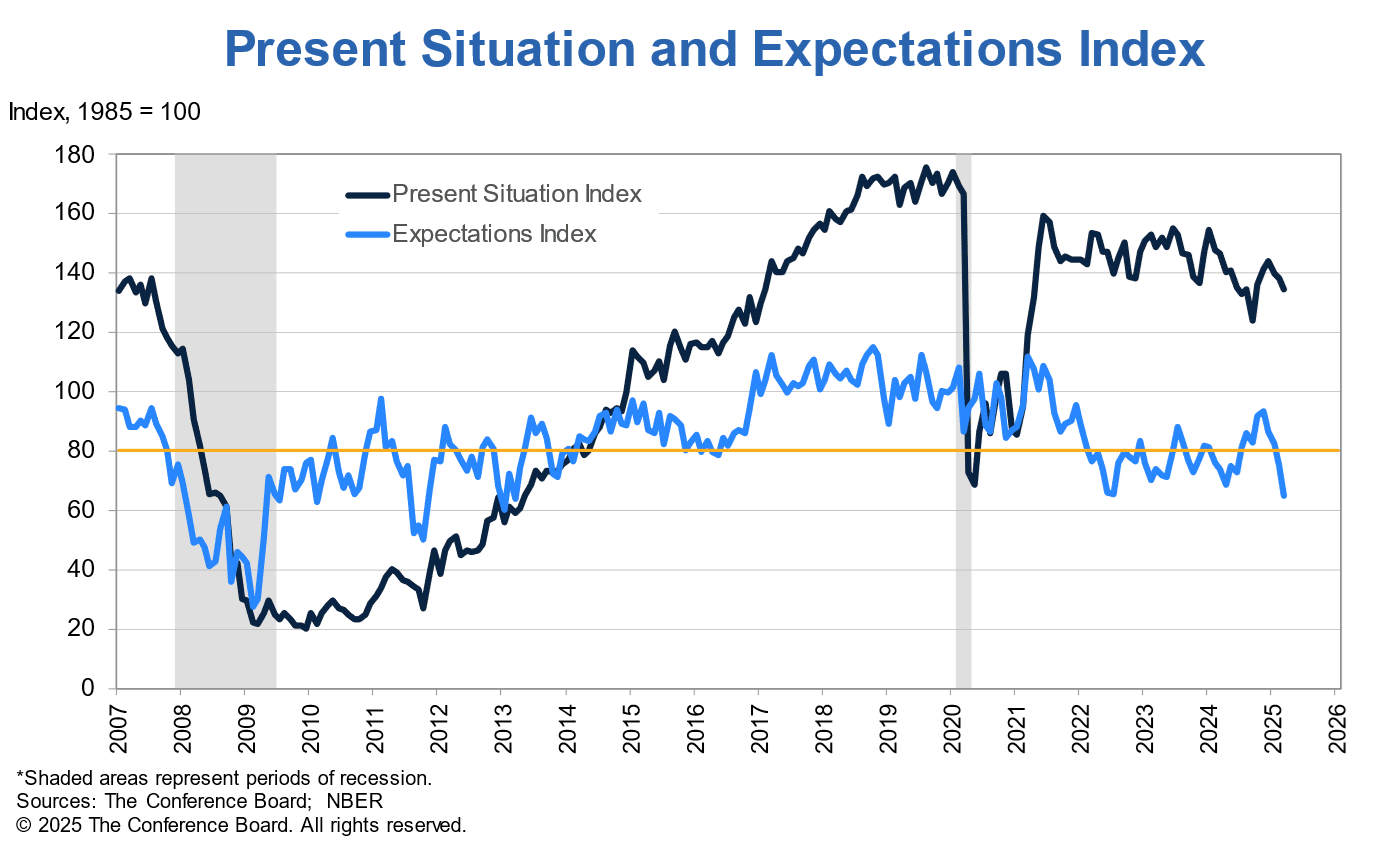

For now, the FX market is betting tariffs are a negative for the Dollar as they will impose greater costs on U.S. consumers, while Trump's ad-hoc policy approach, which is primarily conducted through social media, is hammering consumer confidence.

On Tuesday, the Conference Board said forward-looking expectations amongst consumers had plummeted to a 12-year low, taking it to levels consistent with recession.

Although the Dollar looks to be struggling under tariffs, some major investment banks are holding out for gains in the second quarter, betting that the pendulum will swing once again.

Analysts at Citi and JP Morgan are the latest to think the U.S. currency could be set for a rebound in the coming weeks as the U.S. massively expands its tariff programme on April 02.

"We maintain our forecasts for a USD rebound in Q2," says Daniel Tobon, a currency analyst at Citi. "Tariff risks look underpriced and we expect USD undervaluation to correct on a hawkish April 2 announcement."

"A 10% pts increase in tariff rates would result in 5% strengthening in the broad dollar index," says Arindam Sandilya, an analyst at JP Morgan.

There is also uncertainty as to whether or not the UK could be in for a shock as the April 02 tariffs will target so-called non-trade barriers such as Value Added Tax.

Trump says VAT is unfair to U.S. exporters, which brings the UK into scope for tariffs on April 02.

Until now, the assumption has been that tariffs aren't really a concern for the UK, given its balanced trade in goods with the U.S. But the unpredictability of the Trump White House could soon challenge that assumption.

If the Pound is proving a hedge against tariff noise now, that could change next week if the UK's already poor economic growth outlook takes a knock from unexpectedly large tariffs.