Pound-to-Euro Week Ahead Forecast: Maintain a Constructive Stance

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling looks poised to make further gains against the Euro, but a data-heavy calendar will also bring two-way risks.

The Pound-to-Euro exchange rate (GBP/EUR has exited a selloff linked to the euphoria surrounding Germany's big spending plans and looks to be attempting a rebound.

The Euro starts the week softer after German PMI surveys for March showed that hopes for a German spending-fuelled rebound in sentiment are somewhat premature, with Services PMIs disappointing and manufacturing still in contractionary territory.

By contrast, the UK Service PMI beat expectations by a wide margin as private sector activity recovered to a six-month best.

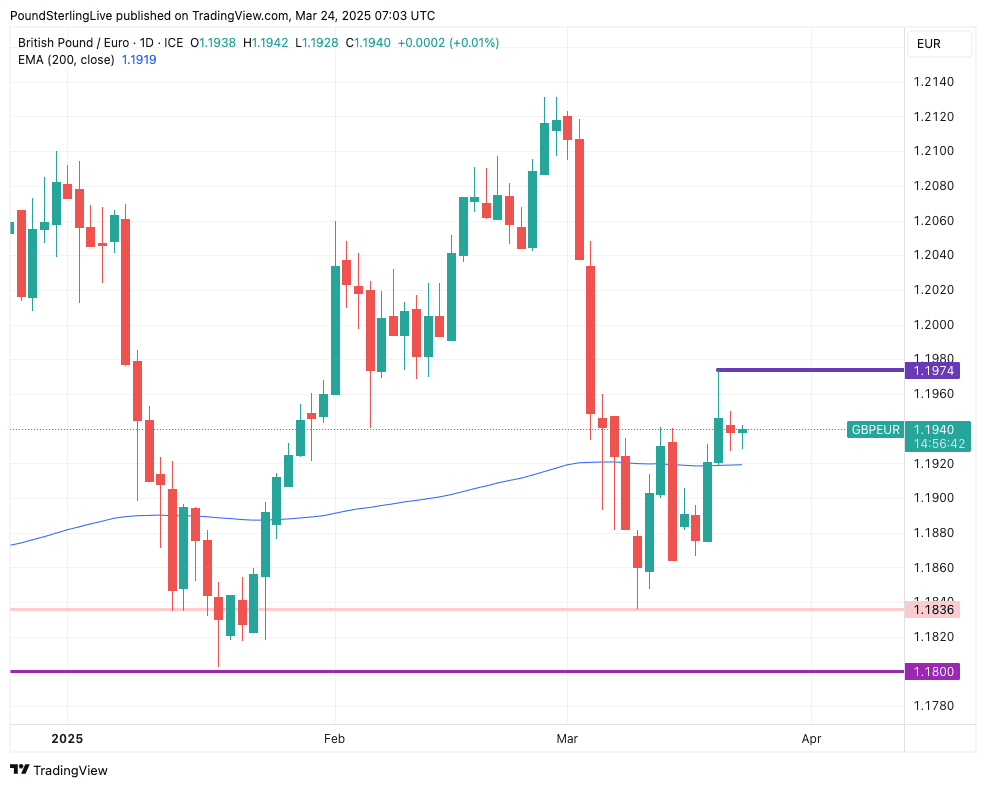

Following these data, GBP/EUR is up 0.15% on the day at 1.1956, and we see scope for gains to 1.1975 this week.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

GBP/EUR now trades back above the nine-day exponential moving average (EMA), confirming near-term momentum is constructive, putting a retest of 1.1975 in scope. This target is also the location of the 50-day and 100-day EMA, which could form a strong confluence of resistance to further gains and will attract as an initial target for EUR sellers.

Support now comes in at 1.1919 in the event of weakness, which is the location of the 200-day EMA (see the blue line in the chart):

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

More broadly, the Pound remains supported by the UK's high bond yields relative to those of Europe, which is why the recent Euro rally had a limited ability to pressure GBP/EUR below 1.1836.

For this to happen, we would need to see some independent UK weakness or political uncertainty build, which is unlikely at this stage.

The coming week is a busy one in the UK, with a number of data releases to watch, a speech from the Governor of the Bank of England and the Spring Statement from Chancellor Rachel Reeves.

British Pound Calendar

Picture by Kirsty O’Connor / HM Treasury.

Monday, March 24

📌 S&P Global Flash PMIs (Mar)

Sterling firms after S&P Global's services PMI rose to 53.2 in March, easily beating estimates for 51.2 and marking a notable uptick from February's 51.

Manufacturing is, nevertheless, in trouble, with the Manufacturing PMI slumping to 44.6 from 46.9.

However, because manufacturing now represents a small portion of the broader economy, the composite PMI, which gives a sector-adjust reading, read at 52. This is a marked increase on February's 50.5 and is the biggest rise in six months.

"An upturn in business activity in March brings some good news for the government ahead of the Chancellor’s Spring Statement," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "However, one good PMI doesn’t signal a recovery. The economy is eking out modest growth, with employment still falling and confidence close to two-year lows."

📌 BoE Governor Bailey Speech (18:00 GMT)

🔹 GBP Impact:

A hawkish tone (concern over inflation, rate cut caution) could lift GBP. A dovish tone may signal future easing, pressuring GBP.

Wednesday, March 26

📌 CPI (Feb)

Expected:

Monthly: +0.5%

Annual Headline CPI: 2.9%

Annual Core CPI: 3.6%

Previous:

Monthly: -0.1%

Annual Headline CPI: 3.0%

Annual Core CPI: 3.7%

🔹 GBP Impact:

A higher-than-expected print could delay BoE rate cuts, supporting GBP.

A cooler-than-expected CPI would reinforce disinflation and increase easing expectations, likely weighing on GBP.

📌 Chancellor Rachel Reeves Budget Update (12:30 GMT)

🔹 GBP Impact:

Fiscal stimulus or prudent budgeting could support GBP if seen as growth-positive or fiscally responsible. Loose spending without funding clarity might raise debt concerns, which are mildly bearish for GBP.

A repeat of the Liz Truss 'mini budget' currency collapse is highly unlikely.

Friday, March 28

📌 Final Q4 GDP (QoQ & YoY)

Expected (QoQ): +0.1%

Expected (YoY): +1.4%

Previous: +0.1% QoQ, +1.4% YoY

🔹 GBP Impact:

As a final print, market impact will be limited unless revised. A surprise upward revision could boost GBP modestly.

📌 Retail Sales (Feb)

Including Fuel:

Expected: -0.4% MoM (0.6% YoY)

Previous: +1.7% MoM (1.0% YoY)

Excluding Fuel:

Expected: -0.5% MoM (0.4% YoY)

Previous: +2.1% MoM (1.2% YoY)

🔹 GBP Impact:

A sharp drop in sales could signal weakening demand, negative for GBP. If data surprises positively, it may support GBP by reducing growth concerns.

Euro Calendar

Image © Adobe Stock

Monday, March 24

📌 Eurozone Flash PMIs (Mar)

Eurozone services PMI read at 50.4, which was below the consensus expectation for 51 and down on February's 50.6.

Manufacturing is still in contraction at 48.7, while the composite PMI read at 50.4, which was up a shade on the previous print of 50.2.

All eyes were on the German number, released half an hour prior, where there were hopes for a sentiment boost from the spending 'Bazooka' being worked on by the government. These hopes weren't quite met:

The services PMI read at 50.2, which is below expectations for a reading of 51.4 and actually down on February's 51.1. Manufacturing recovered to 48.3 from 46.5, leaving the composite PMI at 50.9, below expectations for 51.2.

In all, this is a bit of a sobering outturn in light of the recent "EURphoria" and a reminder that the benefits of a German fiscal stimulus will play out over the longer term.

Tuesday, March 25

📌 Germany IFO Business Climate (Mar)

Business Climate Index:

Expected: 86.7 | Previous: 85.2

Expectations Component:

Expected: 87.5 | Previous: 85.4

Current Assessment:

Expected: 85.5 | Previous: 85.0

🔹 EUR Sensitivity:

A continued improvement in sentiment, especially expectations, could boost EUR by suggesting greater business confidence. A disappointment may suggest Germany’s recovery remains fragile, potentially weighing on EUR.

Thursday, March 27

📌 Eurozone M3 Money Supply (Feb, YoY)

Expected: 3.8%

Previous: 3.6%

🔹 EUR Sensitivity:

A faster M3 growth rate could suggest credit creation and monetary expansion, potentially supporting EUR modestly. Weak growth would point to tepid economic activity, likely neutral to mildly negative for EUR.

Friday, March 28

📌 Eurozone Economic Confidence (Mar)

Expected: 96.7

Previous: 96.3

🔹 EUR Sensitivity:

A rise in sentiment would reflect growing optimism, supporting EUR. A flat or weaker print could indicate sluggish confidence, softening EUR outlook.

📌 Germany Unemployment Change & Rate (Mar)

Unemployment Change: Expected: +10K | Previous: +5K

Unemployment Rate: Expected: 6.2% (unchanged)

🔹 EUR Sensitivity:

Rising unemployment could raise labour market concerns, weighing on EUR. Stable/lower unemployment may support EUR via signs of underlying strength.

📌 France & Spain – EU Harmonised CPI (Mar, Preliminary)

France CPI (YoY):

Expected: 1.1% | Previous: 0.9%

Spain CPI (YoY):

Expected: 2.6% | Previous: 2.9%

🔹 EUR Sensitivity:

Higher inflation prints in France or Spain may delay ECB rate cut expectations, supporting EUR. Lower CPI would reinforce a disinflationary narrative, potentially weakening EUR.