Euro-Dollar Pullback Has More Space to Run

- Written by: Gary Howes

Investors are betting the EU will respond symbolically.

Euro's setback against the Dollar is likely to be short-lived.

The Euro is in a near-term corrective phase that sees it unwind overbought conditions, helped by conciliatory commentary from the White House.

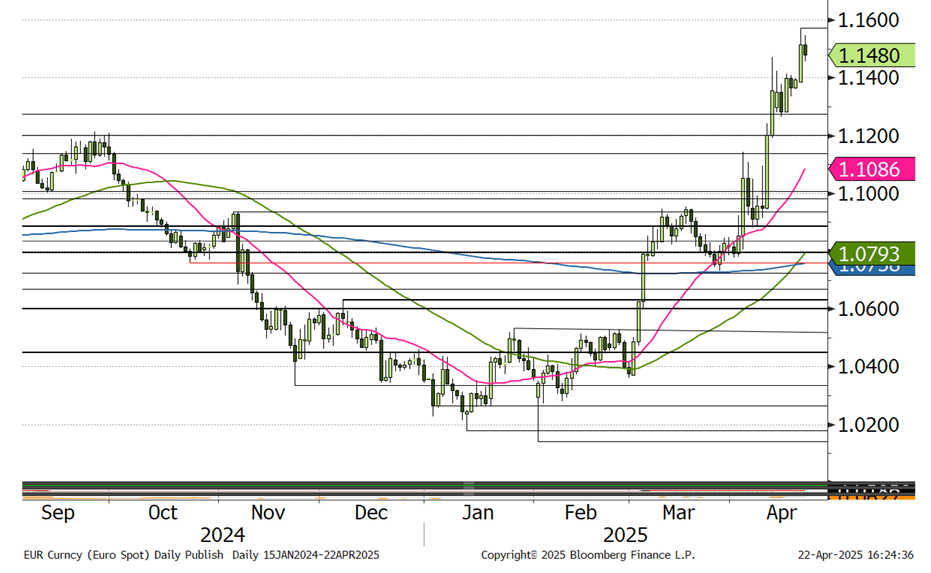

The Euro-to-Dollar exchange rate (EUR/USD) retreated to a new interim low of 1.1307 overnight from the high of 1.1572 reached on Monday.

"EUR/USD bulls managed to stretch gains to 1.1573 before profit taking hit. That dip could extend near-term, with a decent amount of space to the first support band at the 2023 peak at 1.1276," says Nick Kennedy, FX analyst at Lloyds Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

That recent high in Euro-Dollar followed an extraordinary attack on the U.S. Federal Reserve by President Donald Trump who made clear his desire for lower interest rates.

The market selloff that followed Trump's attack has since forced a rethink, with the President changing tone on Tuesday, telling reporter: "told reporters Powell could be "a little more active in terms of his idea to lower interest rates."

The softening in rhetoric encouraged a market recovery, which included the Dollar.

Also helping was a softening in trade rhetoric: Trump said Tuesday he will not "play tough" with China and that the current 145% tariff on goods imported from China will be "significantly reduced" once he makes a deal with Chinese President Xi Jinping.

Treasury Secretary Scott Bessent added that the current tariff situation with China is "unsustainable" and a de-escalation in the near term is expected.

"Markets are rejoicing in the temperature reduction, and we await either stagflationary recession, a complete unwind of the tariffs, or something in between," says Brent Donnelly, analyst at Spectra Markets.

"The dollar is enjoying some support thanks to a recovery in US market sentiment. At the moment, no other G10 currency has a higher beta than the dollar to US trade news, and Treasury Secretary Scott Bessent’s seemingly conciliatory comments on a US-China trade de-escalation could favour a USD stabilisation," says Francesco Pesole, FX Strategist at ING.

Above: EUR/USD chart courtesy of Lloyds Bank.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

These developments have helped Euro-Dollar unwind from overbought conditions, although we are by no means witnessing a massive selloff and there is a decent chance traders are using the pullback to buy more euros.

"The EUR’s modest weakness is likely just a pause following its impressive rally from recent lows just above parity," says Shaun Osborne, Chief FX Strategist at Scotiabank.

"We look to near-term support below 1.14," he adds.

Kennedy says the mid-term trend remains clearly upward, 1.1615/16 the next resistance band above, ahead of 1.1685/1.1712. Expect dips to continue to draw buyers aiming for those higher levels.

"The cross would need to fail at 1.12 to prompt a more pronounced correction back," he explains.

ING thinks the balance of risks remains skewed to the downside for USD in the near term, "but we don’t expect a repetition of the one-way traffic in dollar selling we have witnessed of late."

"Looking a few weeks ahead, our preference is for a stabilisation in the dollar rather than another structural weakening," says Pesole.