Dollar Rebound Potential in Doubt Following Plunge in Consumer Confidence

- Written by: Gary Howes

Image: Doug Turetsky. Sourced: Flikr, licensing: CC 2.0.

Consumers' expectations are at the lowest in 12 years.

A shock fall in U.S. consumer confidence is putting the dollar's ability to stage a meaningful rebound in question.

The Conference Board's Consumer Confidence Index fell by 7.2 points to 92.9, its lowest level in over two years.

The Expectations Index dropped 9.6 points to 65.2, making for the lowest in 12 years and well below the 80-point threshold that often signals a coming recession.

"A much clearer signal for the dollar is weak consumer confidence, as cooling demand reduces inflationary pressures, creating room for the Fed to cut interest rates. The Dollar Index has been gaining ground, having formed a rally last Wednesday after another FOMC meeting. However, further gains are in doubt due to weak data," says Alex Kuptsikevich, Chief Market Analyst at FXPro.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

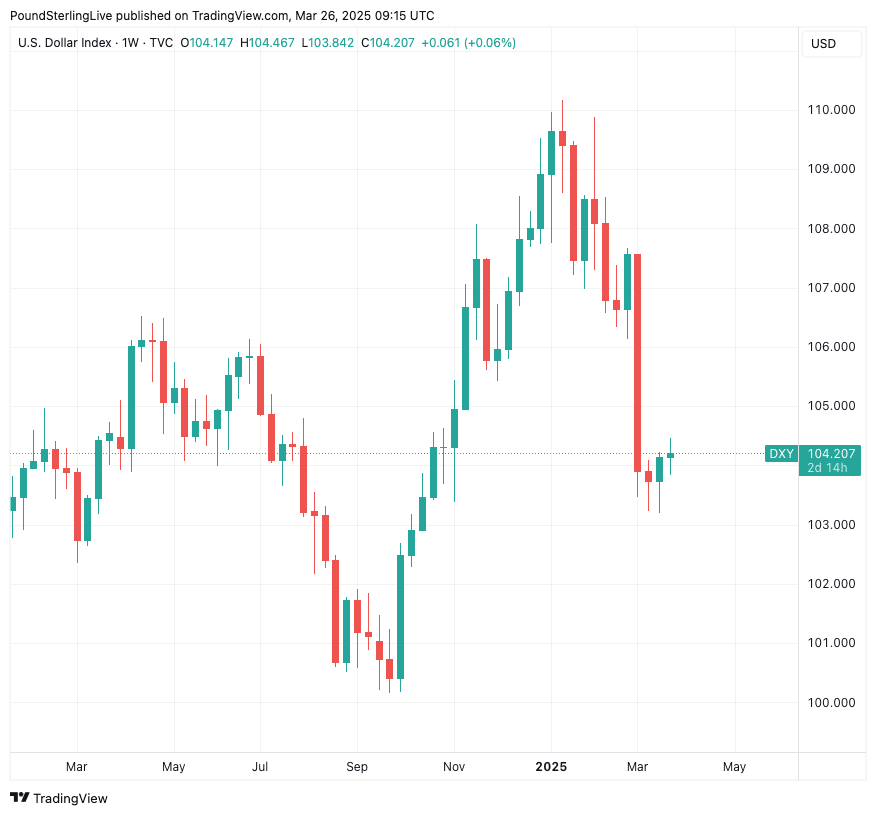

The Dollar index - a measure of broad USD performance - dropped sharply in early March before consolidating and edging higher again.

This has meant that the rally in the Pound-to-Dollar and Euro-to-Dollar exchange rates peaked and started to fall off.

However, the extent of weakness in these two major FX pairs will prove shallow in the event of upcoming data releases reflecting a pullback in confidence.

"The Conference Board’s survey echoes the UMich survey in suggesting the new administration’s plans for tariffs and spending cuts are going down like a lead balloon with households," says Samuel Tombs, Chief U.S. Economist at Pantheon Macroeconomics.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Consumer confidence is the major driver of the U.S. consumption-driven economy. Without it, output inevitably falls.

ING Bank says households were expecting President Trump to lead with tax cuts and deregulation, but instead, we have austerity and the prospect of significant trade tariffs.

"This is prompting anxiety about household finances and job prospects with the concern being this translates into weaker spending," says James Knightley, Chief International Economist at ING.

Above: The Dollar index at weekly intervals.

The Dollar reached its highest level since 2022 on January 13, amidst an ongoing outperformance of the U.S. economy and associated assets, in particular the stock market.

However, U.S. exceptionalism has dissipated amidst U.S. President Donald Trump's ad-hoc approach to tariffs and spending cuts.

Policy uncertainty has triggered a rotation out of U.S. stocks while hitting consumer and business sentiment, inevitably weighing on the Dollar.

And there is more to come, with Trump's biggest tariff announcements to date scheduled for April 02.