Euro-Dollar Dip Buying Confirms Move to 1.12 Still in Play

- Written by: Gary Howes

Image © Adobe Images

The Euro retains support heading into 'Liberation Day'.

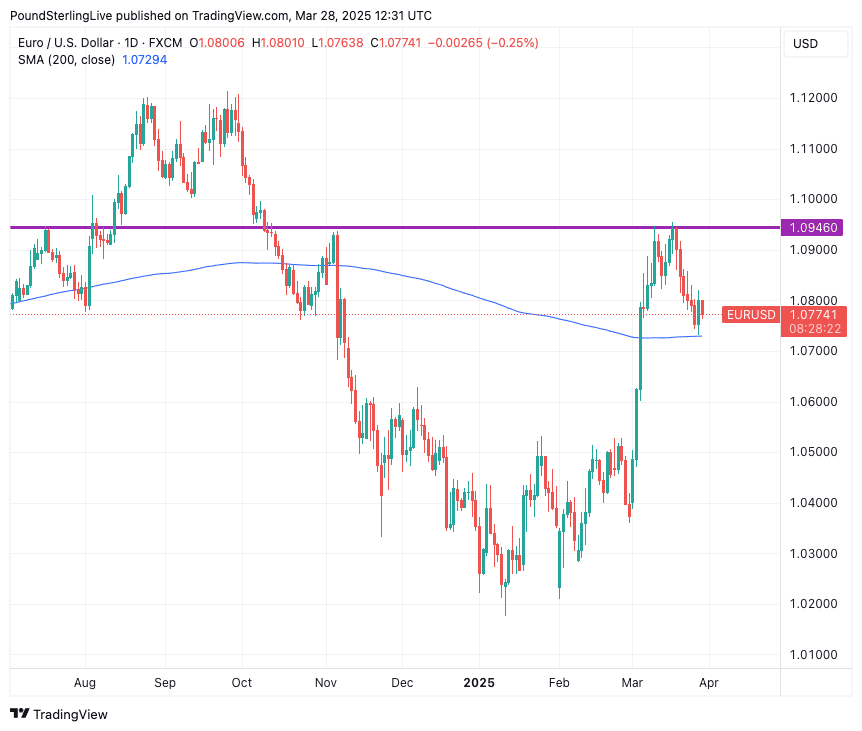

Euro-Dollar dips are being bought at the 200-day moving average (MAV) note analysts, pointing out that this should keep the single currency supported into next week's 'Liberation Day' tariff announcements.

"Quarter end flows seemed to be the driver of FX price action yesterday led by corporates but they were only able to send EUR/USD down to the 200dma before short term profit taking took it off the lows," says W. Brad Bechtel, Global Head of FX Research at Jefferies LLC.

Above: EURUSD at daily intervals.

"Given month-end USD flow dynamics, we would expect interest to buy EUR/USD dips back towards the 200Day MAV at 1.0727," says Jeremy Stretch, FX strategist at CIBC Capital Markets.

He says that should the MAV hold, CIBC's strategists view the correction from recent 1.0950 highs as constructive and provide better buying levels.

"Looking for an eventual return towards September 2024 highs at 1.12," says Stretch.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Bechtel at Jefferies thinks most participants are "definitely bullish the EUR/USD still, on a medium term outlook, despite this little consolidation we are seeing the past few days."

He adds that a lot of investors are hanging on the sidelines waiting for the April 2 'liberation day'.

The event will see the U.S. announce its biggest package of tariffs yet, with markets apparently unsure quite how to trade the event.

Analysts we follow are still unsure as to whether they will play USD positive as per the old-fashioned reaction function or whether 2025's penchant for selling USD on tariff headlines will prevail.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

There are also important inflation numbers due from Germany and the Eurozone next week, which can hold investor interest.

Flash inflation figures in France and Spain undershot expectations, and point to an ongoing disinflation in the Eurozone, that offers the European Central Bank optionality.

"The moderation in price pressures coincides with ECB Vice Chair De Guindos who has suggested that disinflationary process is continuing and that the price goal is set to be reached in coming months," says Stretch.

He explains that should the German/EU data mirror that in France and Spain, pricing for an April rate cut will build.

However, the case for an April 'skip' was evident in recent money flow data that showed banks are lending more amidst signs of a revival in investment intentions.

A Eurozone measure of money supply - the narrow M1, which consists of cash and overnight bank deposits – rose by 3.5% year-on-year in February.

This is the fastest pace of growth in over two years.

"Euro-zone money and lending growth continued to accelerate in February, supporting the case of those at the ECB who would prefer to pause interest rate cuts in April," says Jack Allen-Reynolds, Deputy Chief Euro-zone Economist.