Bank of England to Cut Just Once More: Inflation Reactions

- Written by: Gary Howes

Image © Adobe Images

The Bank of England has its hand tied by rising inflation.

The National Institute of Economic and Social Research says interest rates will remain higher for longer than previously anticipated and to expect only one more 25 basis point rate cut in 2025.

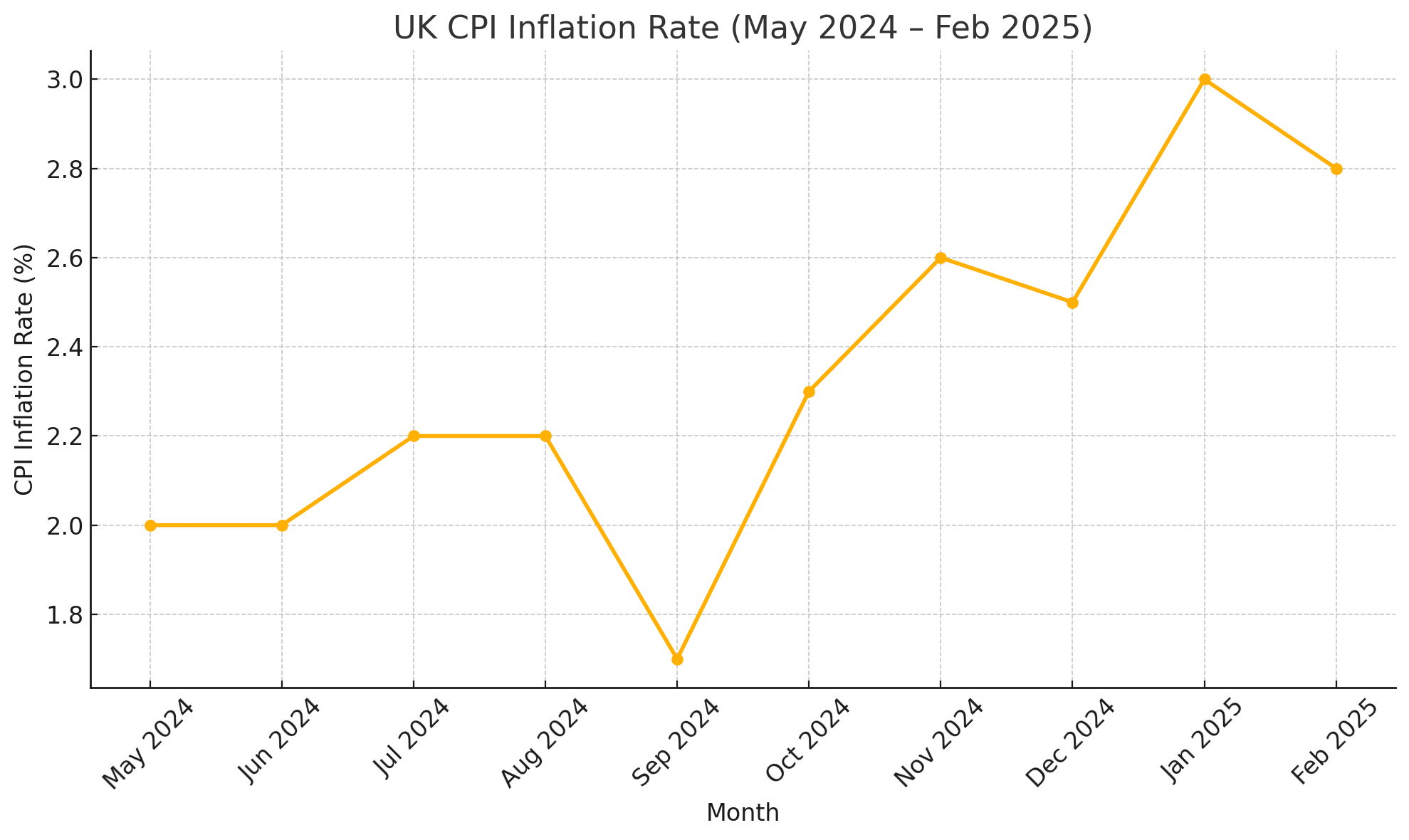

The call follows the release of February inflation data, which confirmed inflation is anchored well above the Bank of England's 2.0% target, meaning policymakers will find it increasingly difficult to justify further rate cuts.

To be sure, the headline reading of 2.8% was below consensus expectations and down on January's 3.0%, but economists think this is a pullback in an uptrend.

Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee, says higher National Insurance contributions and energy & water prices are likely to push CPI inflation above 4%.

"5% plus on the cards for the autumn," he says.

The NIESR says it forecasts inflation to remain above the Bank of England’s 2% target in 2025 given increased public spending, persistent wage growth and global trade fragmentation.

"We therefore think there will only be one more 25 basis point interest rate cut in 2025," says Monica George Michail, NIESR Associate Economist.

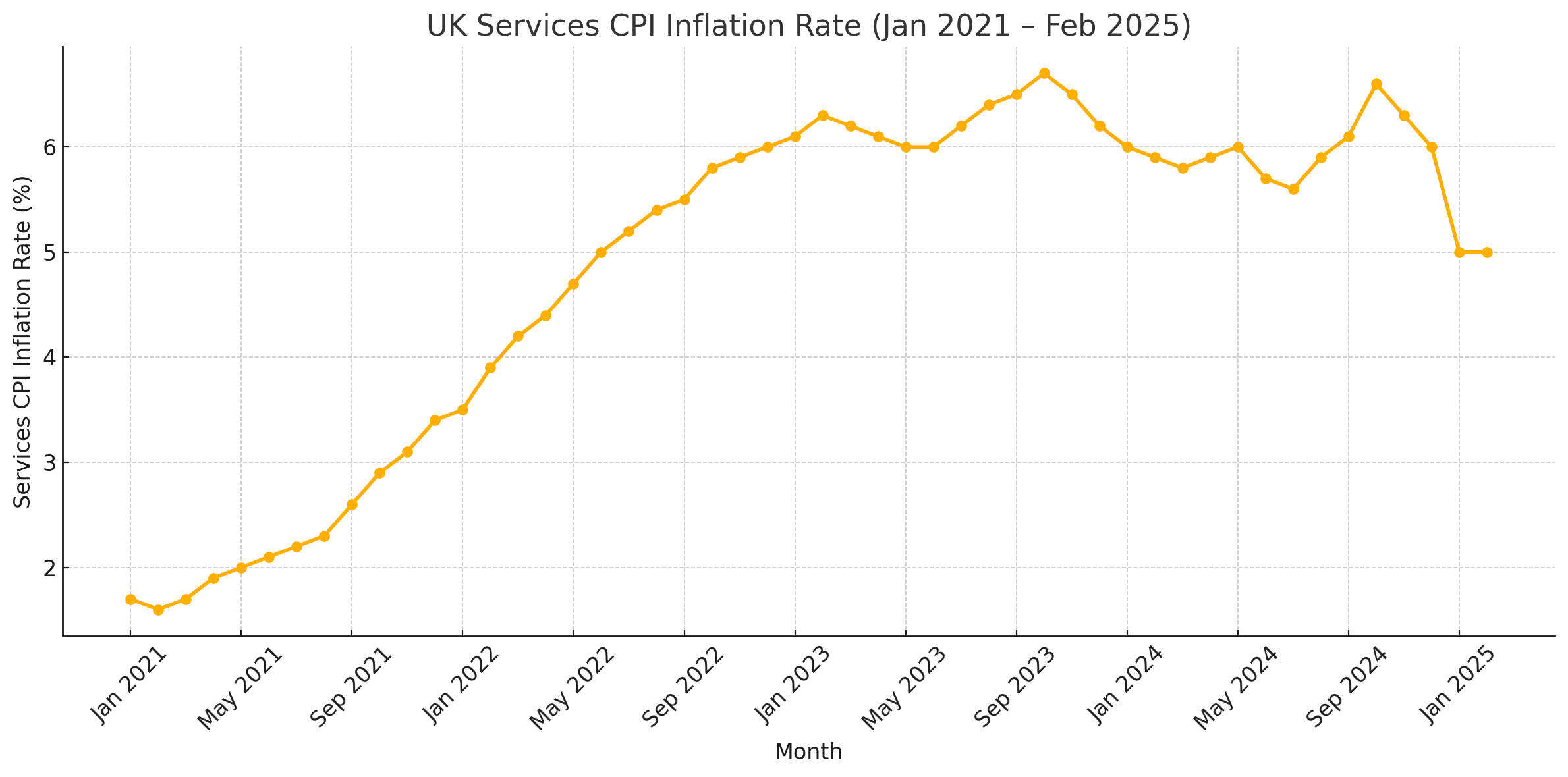

According to Rob Wood, Chief UK Economist at Pantheon Macroeconomics, the Bank's preferred measure of underlying services inflation, excluding indexed and volatile components, rents and foreign holidays, rose 4.5% year-over-year, up from 4.2% in January, and 4.1% three-months-on-three-months, up from 3.7% in January.

"So underlying inflation pressure remains stubborn," he explains. "The persistence of underlying inflation is increasingly shifting the risks towards the MPC cutting only once more this year."

Projections from Capital Economics indicate inflation will be back above 3.0% in April and around 3.5% by September, confirming the direction of travel remains up.

Above: Services CPI inflation must fall drastically if headline CPI is to fall to 2.0% on a sustained basis.

Following the release of the February figures the market raised implied odds of a May cut to 80%, suggesting it sees the next cut coming sooner rather than later.

The indications from economists we follow is that May could become the final one of the year.

"We have pencilled in the Bank pausing the rate cutting cycle in August and resuming rate cuts in November. The risk is that the pause becomes official in May and/or lasts longer," says Paul Dales, Chief UK Economist at Capital Economics.

However, Sanjay Raja, UK Economist at Deutsche Bank, has a different account of the latest inflation figures, seeing evidence that inflation in the services sector has turned a corner.

"All told, today’s inflation data should be music to the MPC’s ears. Inflation momentum is slowing. Services prices – once deemed too sticky in the UK – are coming off faster than expected," he notes.

Deutsche Bank thinks the case for sequential rate cuts is rising.

"The MPC can start to contemplate a faster dial of restrictive policy. As we’ve noted many times, risks are skewed to a faster drop in Bank Rate over the next 6-9 months," says Raja.