Inflation Could Rise to 5%

- Written by: Gary Howes

Above: Services sector inflation is still burning hot at 5.0%. Image © Adobe Images.

A leading national newspaper says today's surprise fall in inflation "will boost" the Chancellor of the Exchequer, Rachel Reeves.

However, Reeves would do well to avoid mentioning inflation altogether in her upcoming media rounds, as it is about to go significantly higher.

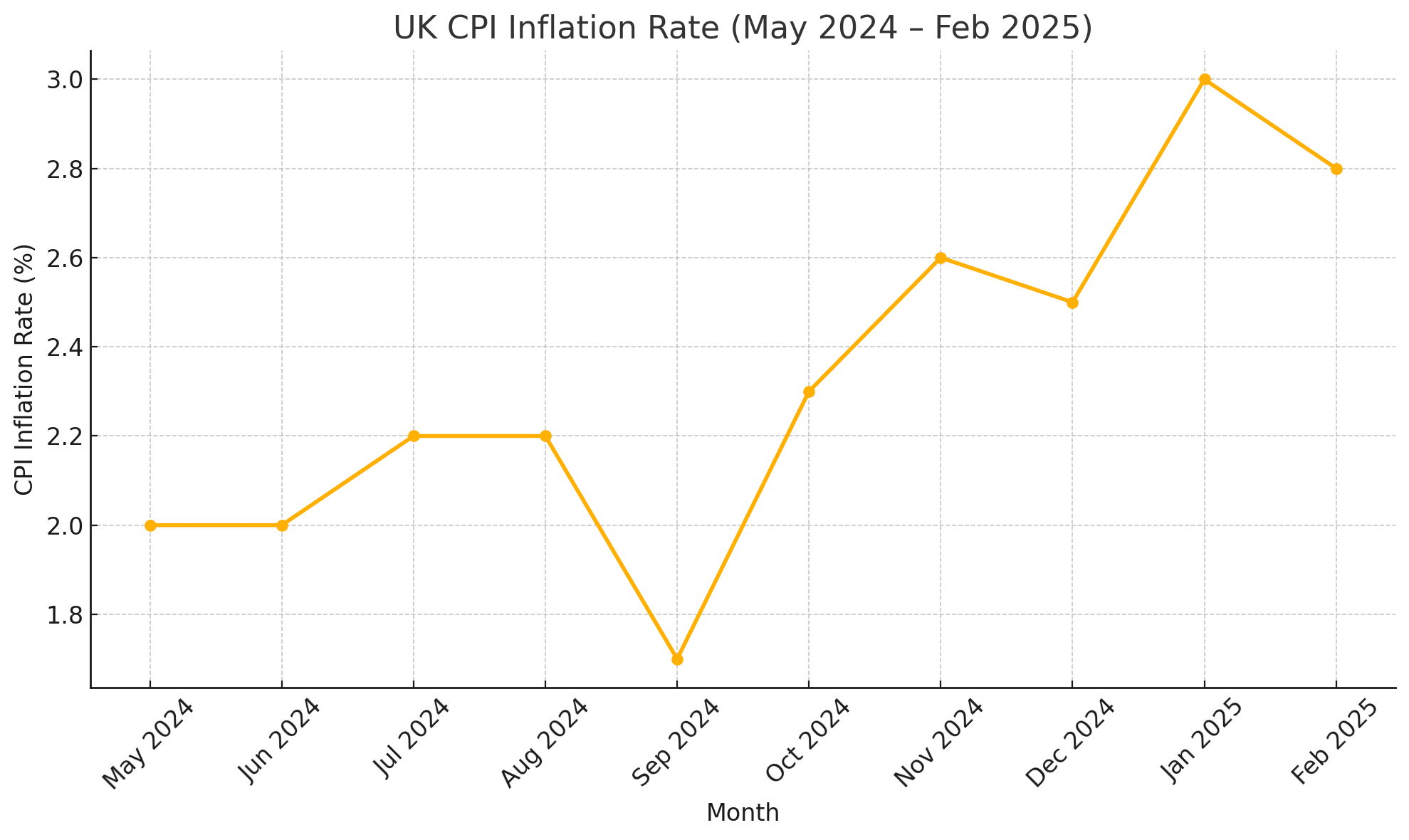

The consumer prices index (CPI) eased from 3% in January to 2.8% in February, according to the Office for National Statistics (ONS).

Economists had expected inflation to remain unchanged, having jumped from 2.5% in December.

The decline was largely driven by a fall in clothing.

Above: Inflation has risen over the course of the past year.

However, dig into the figures and we see services inflation - which covers inflation in the biggest sector of the UK's economy - is at 5%. In short, headline inflation cannot fall to 2.0% on a sustained basis with services this hot.

Add to this upcoming bill increases and tax hikes, and the cocktail of pressures for 5.0% inflation emerges.

Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee, says higher National Insurance contributions and energy & water prices are likely to push CPI inflation above 4%.

"5% plus on the cards for the autumn," he says.

The Bank of England is now priced at 80% to cut interest rates again in May, but subsequent cuts will be almost impossible to deny if upcoming data prints signal a march to 5.0% inflation.

"Underlying inflation pressures are strong and rising," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics. "Risks to our inflation forecasts lie to the upside."

Pantheon Macroeconomics says rising inflation and signs that UK economic growth has bottomed mean the Bank of England will likely cut interest rates on just one further occasion this year.