Pound Sterling in Post-Bank of England Bounce

- Written by: Gary Howes

Image © Adobe Images

The British Pound rose after the Bank of England held interest rates and warned further cuts were conditional.

The Bank's Monetary Policy Committee (MPC) voted by a decisive 8-1 majority to hold rates, which signals more members have become increasingly concerned about inflation's ascent since February.

With inflation set to reach 4.0% in the coming months, there is a worry that current forecasts for a steady retreat in 2026 back to the 2.0% target won't transpire.

"While inflation is expected to fall back thereafter, the Committee will pay close attention to any consequent signs of more lasting inflationary pressures," said the Bank's statement.

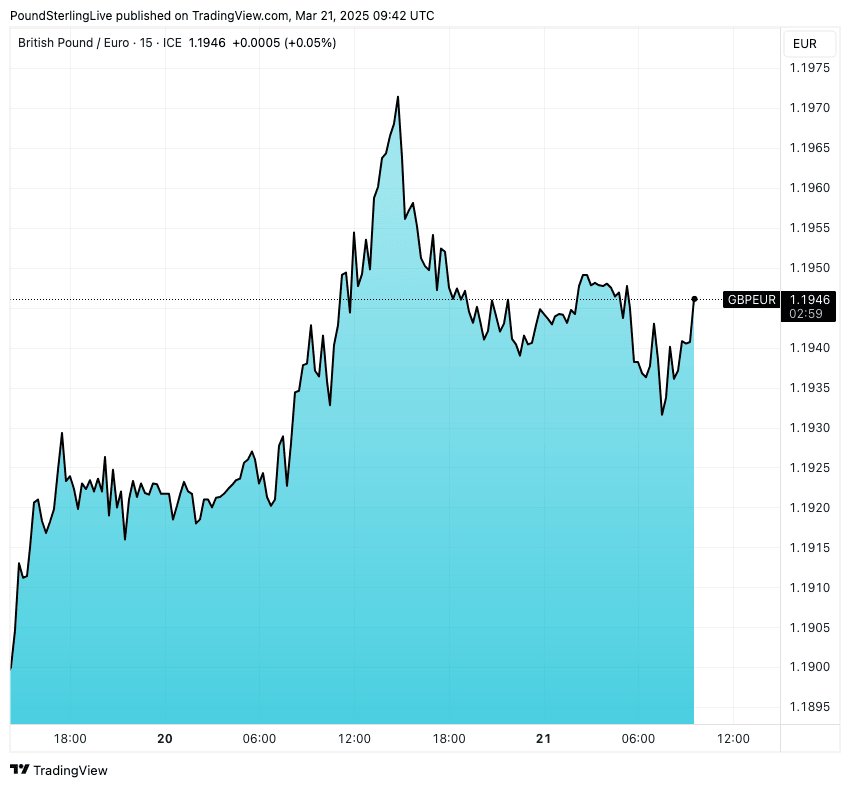

Following the policy update, the Pound-to-Euro exchange rate has extended a daily gain to 1.1965 (+0.30%).

"Sterling gains against the euro (EUR/GBP 0.835) after a slightly stronger than expected labour market report and the Bank of England’s status quo in a 8-1 vote," says Mathias Van der Jeugt at KBC Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound-to-Dollar exchange rate is at 1.2964, which is 0.30% lower on the day courtesy of a broad-based rally in the USD.

However, the chart does show GBP/USD rose on the Bank's decision, suggesting the decline would be deeper were it not for this 'hawkish' tilt at the Bank.

"For GBP, a slight bid in the back of the labour market report and the BoE was perhaps expected," says Kamal Sharma, FX strategist at Bank of America. "We remain structural GBP bulls. We continue to favour GBP longs vs CHF and EUR."

Above: GBP/EUR at 15-minute timeframes shows a clear post-BoE spike.

The decision follows the release of another set of solid wage figures earlier in the day, which suggests the economy is still a long way off from the strong deflationary trends required to bring Bank Rate back to 2.0%.

The Bank's inflation expectations survey was released on March 14 and shows a worrying rise in inflation expectations that warns of entrenched inflationary behaviour amongst workers (wage demands) and businesses (price hikes).

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Andrew Wishart, an economist at Berenberg Bank, says the upcoming lift to the national insurance tax will also add to labour costs that will ultimately be paid by consumers.

"Resilient demand and narrow profit margins suggest that firms will be able to pass much of the increase in their costs onto customers in the form of higher prices. Therefore, we doubt that the downward trend in services price growth that has been in place since late-2023 can continue," he says.

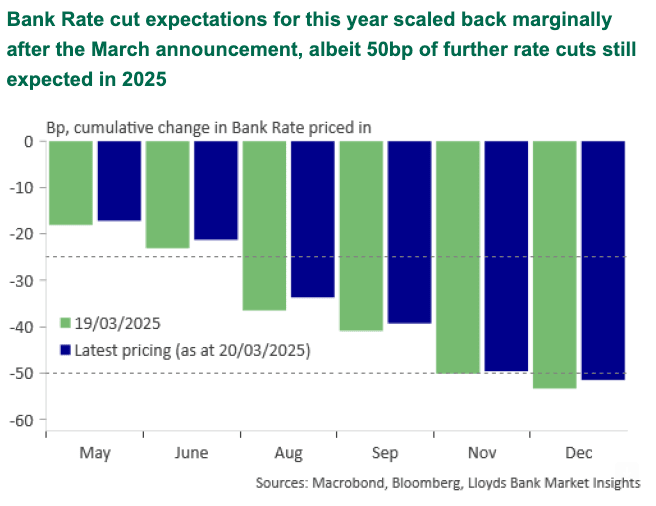

Image courtesy of Lloyds Bank.

Berenberg says the Bank looks as though it could be set to keep interest rates at current levels and there is "no guarantee" of another cut.

If this is correct, the market must price out further rate cuts, which will support UK bond yields and the British Pound.

"Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further," read the Bank's statement.