Just One Bank of England Interest Rate Cut Left Warns NIESR

- Written by: Gary Howes

Image © Adobe Images

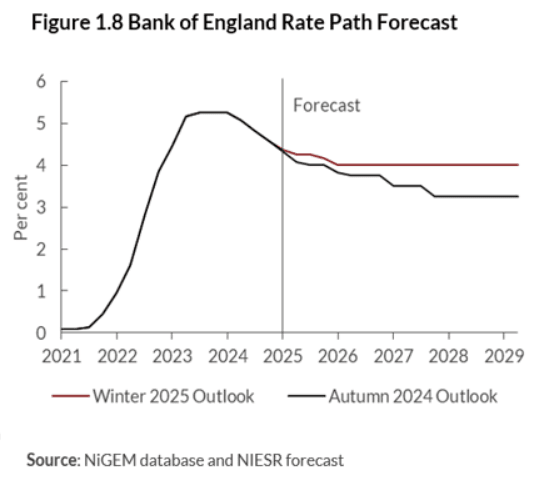

The Bank of England will only get away with one more interest rate cut in 2025, warns an independent research organisation.

The National Institute of Economic and Social Research (NISER) says the door for the Bank to cut interest rates is rapidly closing as it says a jump in government spending will give the UK a sugar rush of economic growth.

Persistent wage growth and a falling Pound will add to inflationary pressures, says the NIESR, adding that it now forecasts inflation to rise to 3.2% in January and to average 2.4% in 2025.

"Persistent wage growth this year, together with an expansionary fiscal policy and exchange rate depreciation, will all act to limit the scope for monetary loosening this year. We therefore anticipate just one further rate cut in 2025," says the NIESR.

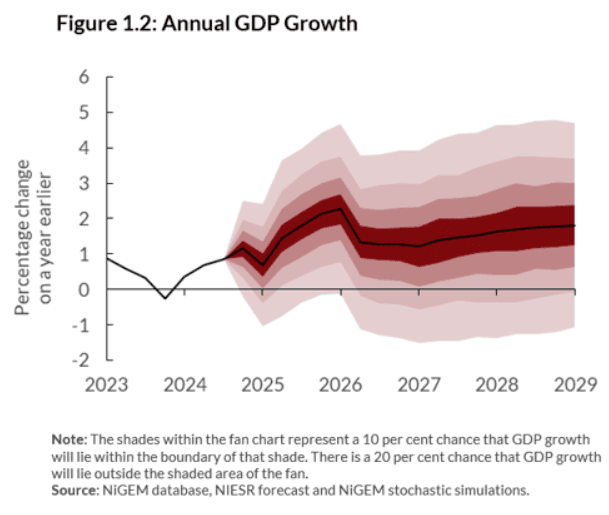

Higher spending will stimulate economic growth to 1.5% in 2025, says the NIESR, which would exceed the Bank of England's forecast for growth to reach just 0.75%.

The Bank's forecast of 0.75% was made in February and represents a significant cut to November's forecast for 1.5% growth. This downgrade prompted the Bank to cut interest rates by 25 basis points and maintain guidance that it would continue to cut interest rates further.

The growth downgrade prompted two policymakers on the Monetary Policy Committee to suggest a 50bp cut was appropriate.

Should the NIESR be correct, then the Bank will be caught wrongfooted by a string of above-consensus economic data readings in the coming months, which would inevitably increase bets that the Bank of England will have to pull the reins on further rate cuts.

This would boost UK bond yields and underpin the Pound.

The consensus of economists think the Bank will get away with at least three more cuts in 2025, but the NIESR prediction joins a growing minority that sees limited scope for this amount of easing.

"Inflation risks remain underappreciated, and the easing cycle may need to be paused later in the year," says Andrew Wishart, Senior UK Economist at Berenberg Bank. "Rising government spending and price pressures could force policymakers to hit the brakes on monetary easing."

The NIESR says growth will be driven mainly by the fiscal expansion announced in the October Budget. This expansion, coupled with continued growth in business investment, will start having a tangible effect in 2025.

Unfortunately for the government, although their spending will boost growth, the NIESR warns people won't feel the effects.

The NIESR says growth won't immediately translate into higher living standards for every household. The living standards of the bottom 40% of households will not return to pre-2022 levels before the end of 2027.

The new forecasts show that real personal disposable income is projected to grow by 1.9% in 2025 and 1% in 2026; however, this will not compensate for the fall in living standards between 2022 and 2024.

Increases in the National Minimum Wage and the National Living Wage will boost disposable incomes. For households earning between approximately £16,000 and £24,000, living standards will be about 12.5% higher relative to the “no uplift” counterfactual.