Trump Crashes the Dollar's Fed-themed Party

- Written by: Gary Howes

Image: Official White House release.

The Dollar would have been much stronger were it not for the U.S. President.

The Federal Reserve kept interest rates unchanged and said it maintained a strict data-dependent approach with regard to further moves, which will have disappointed those wanting rates to fall faster.

In fact, the Fed decision was, on the whole, a 'hawkish' one, which has bolstered an under-fire Dollar that was ripe for a relief rebound.

It maintained the target range for the federal funds rate at 4.25% to 4.50% and said future adjustments to interest rates would depend on incoming data and economic risks.

Step in U.S. President Donald Trump with these comments:

"The Fed would be MUCH better off CUTTING RATES as U.S. tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!"

So what should have been a moment in the spotlight for the Fed was gatecrashed by the President, who would typically not be expected to interfere with independent bodies such as the Fed.

"It is normal for heads of government to want looser monetary policy. And sometimes it is also normal for them to express this wish publicly. What is not normal, however, is for a president to comment on every, and I do mean every, FOMC decision," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The intervention shows the White House wants lower interest rates regardless of clear indications inflation is rising, which completely upends the Fed's mandate to bring inflation back to the 2.0% target.

For investors, the intervention is another dose of uncertain U.S. policy, and the rulebook says currencies hate nothing more than uncertainty; it is largely due to unpredictable policy that the USD has come under pressure since January's inauguration.

"What is truly alarming is that the US President apparently still does not understand the fundamental link between tariffs, inflation and interest rates," says Leuchtmann.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Since Trump took over, U.S. policy has been highly uncertain, and the Dollar's weakness is a function of this.

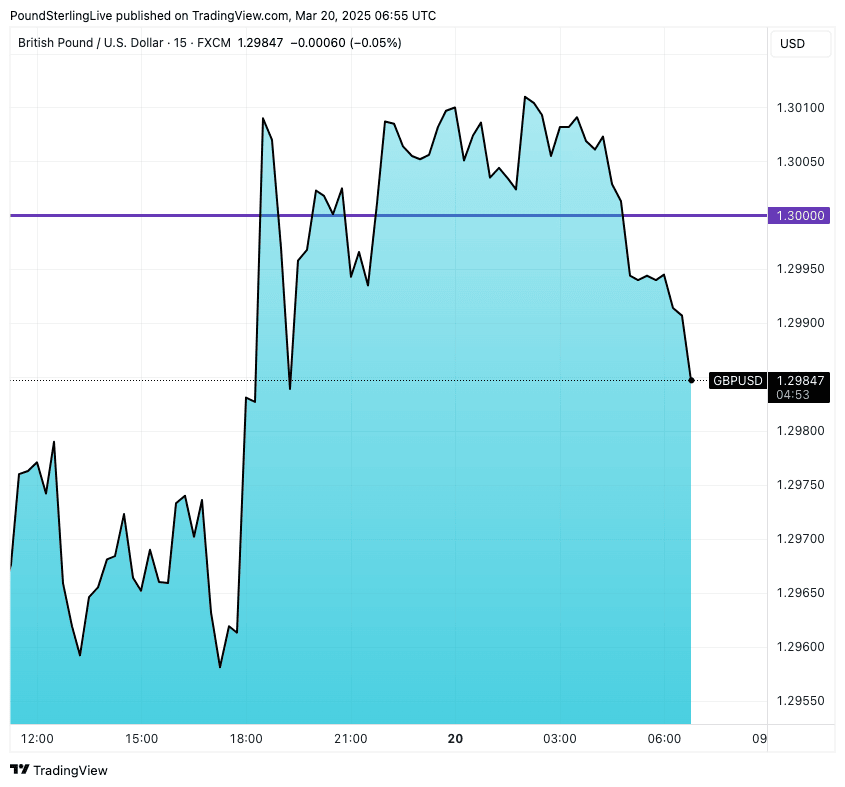

Thanks to Trump, by the time of writing on Thursday, the GBP/USD exchange rate remains within touching distance of 1.30, whereas in 'normal' times, a 'hawkish' Fed would have sent the currency to 1.29 and potentially below.

Above: GBP/USD rallied to 1.30 as markets grappled with Trump and the Fed's messaging.

The Federal Reserve thinks that now is not the time to cut interest rates, as it notes that economic activity continues to expand at a solid pace.

It says the unemployment rate, with stable labour market conditions, has remained low, which should give it time to sit back and let recent rate cuts run through the economy.

Inflation remains somewhat elevated, but it also says uncertainty about the economic outlook has increased.

Given this, the Federal Reserve says it remains attentive to risks that could affect its dual mandate of maximum employment and stable inflation.

With the Fed decision out the way, foreign exchange market attention will increasingly focus on the April 02 tariff announcements that will be the most far reaching yet.

This means risks to the USD remain elevated and GBP/USD weakness should be shallow.