U.S. Dollar Surprisingly Soft After Powell Casts Doubt on December Rate Cut: Trading Point

Written by Raffi Boyadjian, Lead Market Analyst at Trading Point.

Federal Reserve rate cut expectations were dramatically pared back on Thursday after Jerome Powell rounded up the week’s hawkish rhetoric by adding to the sense of caution about the pace of easing.

Speaking at a Dallas Fed event, Powell said, "the economy is not sending any signals that we need to be in a hurry to lower rates," as he emphasised the solid jobs and growth data.

Expectations for a 25 basis point rate cut in December have fallen to around 63% from about 85% prior to Powell’s remarks, while the next cut isn’t fully priced in until June.

After that, investors see just one more additional 25bp cut by the end of 2025.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Interestingly, Treasury yields and the U.S. dollar only managed to briefly spike higher before pulling back somewhat, suggesting that the repricing in Fed fund futures didn't come as too much of a surprise for the bond market.

A bigger factor behind the Fed’s unease about cutting rates too quickly is likely to be the recent disappointing data on inflation.

Although policymakers have not been pretending that they’re happy with how slowly inflation has been falling, they perhaps haven’t been as forthright as they could have been at venting their frustration.

But it seems that their concerns seem to be growing, with Powell describing the recent trend as a "sometimes-bumpy path".

Clearly, the Fed was hoping that this week’s CPI and PPI reports would have surprised to the downside, and according to Powell’s own projections, core PCE will edge up to 2.8% in October. This is hardly an indication that inflation is about to hit 2% soon and the markets are having a bit of a reality check after largely ignoring Wednesday’s CPI data.

The euro staged a rebound on Friday with no clear catalyst for the move. The failure of the U.S. dollar to extend its rally after Powell’s hawkish comments likely made way for a technical rebound, which may not last long as the odds for a 50-bps rate cut by the ECB in December have been steadily rising in recent days.

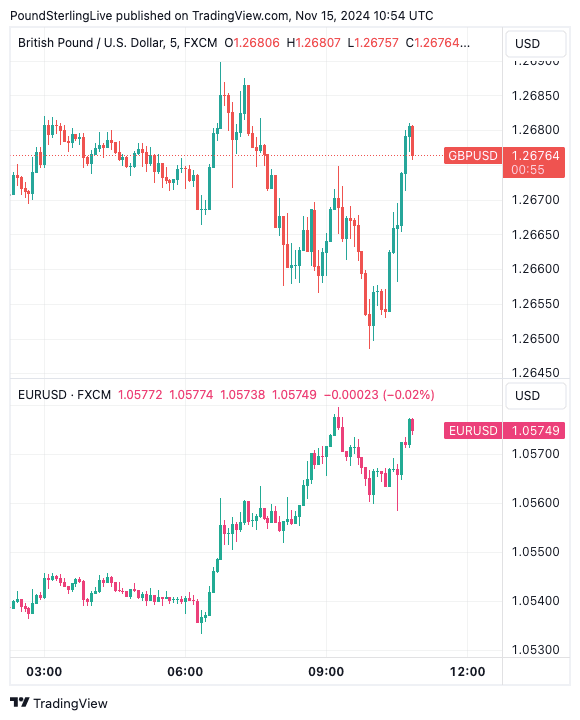

The pound was steady around $1.2665 despite the UK economy growing by less than forecast in Q3, while the Australian dollar edged up on data showing that retail sales in China jumped by more than expected in October.

Above: GBP/USD and EUR/USD showing early rebound potential.

The biggest gainer, however, was the yen, which reversed its downfall following remarks by Japan’s finance minister, Katsunobu Kato, who warned that the recent declines are 'one-sided', and the government will "take appropriate action against excessive moves".

The dollar fell back from above 156 yen to around 155.40.

The reaction on Wall Street was a bit more notable, as the S&P 500 slipped by 0.6% and the Nasdaq 100 closed 0.7% lower.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Still, the selloff is contained considering the strong post-election rally and a 5.8% slump in Tesla stock, which fell on reports that the incoming Trump administration will scrap Biden’s tax credit for electric vehicles.

Disney was a bright spot, however, as its shares soared by 6.2% after the company reported that its streaming business swung into profit in the 2024 fiscal year. The earnings spotlight later today will fall on Alibaba.

US retail sales data will also be crucial for the markets as an upbeat report could further dash December rate cut hopes.