Eurozone Recovery Remains Elusive: S&P Global PMI

- Written by: Sam Coventry

Image © European Union - European Parliament, Reproduced Under CC Licensing.

A survey released on Wednesday showed that the eurozone economy barely expanded in February as weak demand and job losses offset a modest recovery in manufacturing.

Striking contrasts between Germany’s stabilisation and France’s sharp contraction highlighted the region’s fragility.

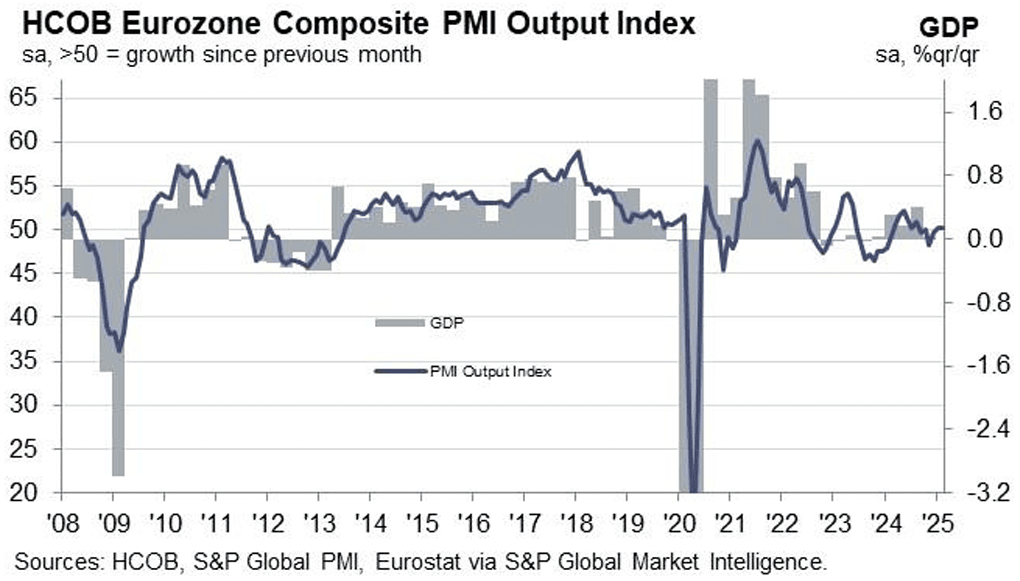

The HCOB Flash Eurozone Composite PMI, compiled by S&P Global, held steady at 50.2 from January, indicating marginal growth for the second straight month. However, business sentiment declined, and inflationary pressures resurfaced, casting doubt over the recovery’s sustainability.

"This suggests continued muddling through around 0%. That's not great, but there's at least no sign of activity deteriorating further. The weakness was concentrated in France as Germany and the rest of the eurozone showed expanding output," says Bert Colijn, Chief Economist for the Netherlands at ING Bank.

"The eurozone economy is barely moving at all,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. "Services are struggling to sustain growth, while manufacturing remains in decline despite signs of improvement."

The services sector, which has been the region’s main growth driver, saw its PMI drop to 50.7 from 51.3, a three-month low. Meanwhile, manufacturing showed signs of stabilisation, with the PMI rising to 47.3, a nine-month high, though still in contraction.

Diverging National Trends

Germany, the eurozone’s largest economy, saw growth accelerate to a nine-month high, with its PMI rising to 51.0 as services expanded and manufacturing’s downturn eased.

France, however, posted its steepest economic decline in nearly 18 months, with its PMI plunging to 44.5, driven by a sharp drop in services activity.

“The French economy is in recession with no end in sight," said Tariq Kamal Chaudhry, economist at Hamburg Commercial Bank. “The latest decline is particularly concerning as it stems from the services sector, which had previously shown more resilience."

The rest of the eurozone showed solid growth, helping offset weakness in its two largest economies.

Weak Demand, Job Cuts, and Inflation Concerns

According to the Eurozone PMI, new orders declined for the ninth straight month, reflecting muted domestic and export demand.

Employment fell, with manufacturing job losses hitting a 4.5-year high, outweighing slight hiring in services. Input costs surged at the fastest pace in nearly two years, fueled by rising wages in services and higher goods prices, pushing output price inflation to a 10-month high.

"Even though the European Central Bank seems convinced that inflation is under control, cost pressures do continue to creep up for businesses. In February, the PMI again flagged rising input costs that are being priced through to the consumer to some extent," says Colijn.

With France dragging down growth, Germany stabilising but fragile, and inflationary pressures mounting, analysts say the ECB may have to delay rate cuts despite slowing economic momentum.

"Economic output in the eurozone is stagnating," de la Rubia said. “Without stronger demand, a meaningful recovery remains elusive."