The Finance Industry is Hiring: Leading London Job Index Reports Surprise Surge in Vacancies for August

- Written by: Gary Howes

London's Financial services firms appear to have put Brexit fears behind them and have continue to make new roles available.

The traditional slow jobs month of August dealt surveyors a surprised by recording a 4% month-on-month rise in both jobs available and job seekers.

The data is revealed in the latest monthly Morgan McKinley London Employment Monitor and confirms the surprisingly strong reading for July was not a one-off.

Highlights of the August report include:

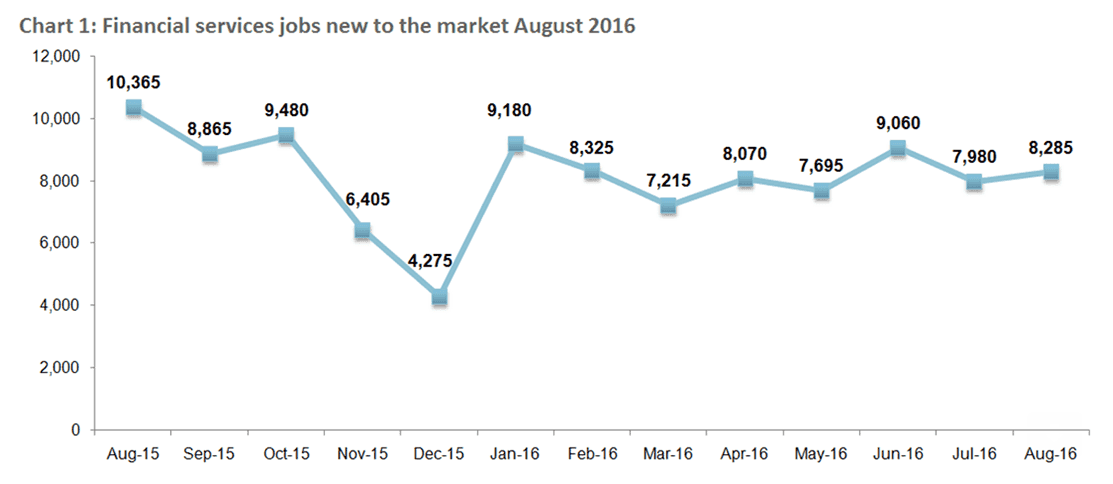

- 4% increase of jobs available, month-on-month

- 20% decrease of jobs available, year-on-year

- 4% increase in professionals seeking jobs, month-on-month

- 6% decrease in professionals seeking jobs, year-on-year

- Fintech revolution brewing

“The British ethos of ‘keep calm, it's business as usual’ is clearly on full display in this month’s numbers,” said Hakan Enver, Operations Director, Morgan McKinley Financial Services.

“Factoring in Brexit, summer breaks and the bank holiday, a 4% increase across the board is remarkable,” continued Enver.

Morgan McKinley attribute some of the resilience in the readings to the Pound having been at its weakest against the US dollar in 31 years, as well as growing concerns about terrorist attacks on the continent which saw more Britons taking staycations during this year’s bank holiday breaks.

In all, 6% more than last year spent their holidays in the UK.

“I suspect the staycation trend influenced this month’s job seeker data, as more people opted to stay closer to home. This allowed more time for professionals to consider their careers and therefore, register their interest with certain recruitment organisations,” said Enver.

Optimism Returns but EU negotiations Cast Shadow Over Months Ahead

Morgan McKinley report a sense of optimism has returned to the City.

A recent EY report found that among the largest financial institutions, fears of post-Brexit chaos have largely subsided, concluding that “the immediate impact of the referendum has not been as stark as many initially feared”.

Explaining the data, Morgan McKinley say a recovering British Pound and news that unemployment has dropped to its lowest rate since 2005, coupled with Prime Minister Theresa May’s announcement that there will be no second referendum on EU membership, have all added to the sense that no crisis is forthcoming.

Some are going even further, speculating that relief from onerous EU regulations like bonus caps and tax-levies could give the British financial industry a healthy boost.

For example, BBVA has come out against the caps, which were put in place in 2014, saying they are restricting the bank’s ability to attract the best executives from the technology sector.

But the outlook isn’t all rosy.

Year-on-year jobs available decreased by 20% and job seekers fell by 6% year-on-year, mirroring the trend of decline during the first half of 2016 (H1).

“There’s no question that 2016 has been a tougher employment climate than 2015”, said Enver “and the ongoing uncertainty as we wait to see the terms of the UK’s negotiations with the EU is clearly casting a shadow over H2”.

Two key negotiation items remain foremost on everyone’s minds.

The first is the right of EU citizens to work in London.

“Free movement of high quality financial and related professional services talent across the EU is essential to the UK remaining a leading financial centre”, said the financial services lobbying group TheCityUK.

The second issue of concern is the retention of passporting rights.

Though it has no intention of relocating its headquarters from London, Lloyd's Chairman John Nelson has made clear that the loss of passporting privileges would require Lloyd’s to move part of its business to an EU member state.

“Failure to protect passporting and to secure the right of EU citizens to live and work in London would certainly have ripple effects on City employment,” said Enver. “Which is why we’ll continue to see industry and political leaders make both issues central parts of negotiations. And the stronger our economy, the stronger our negotiating position”.

Fintech Industry About to Explode

As the fintech industry vies to revolutionise banking, Morgan McKinley argue Britain is determined to lead the charge.

A recent decision by the Competition & Markets Authority (CMA) is expected to help achieve that goal:

The CMA has set a 2018 deadline for UK banks to share, with permission, customer data with third parties so that customers can price compare banks.

“This has been a tumultuous year so far for the technology market, in particular within Financial Services,” says Cem Baris, Technology, Sales and Analytics Director at Morgan McKinley. “With so many factors coming into play there’s pressure on the Financial Services industry to revolutionise its outlook on how it interacts with its customers, keep up with the competition whilst dealing with intense strains to cut costs.”

“The continued rise of the challenger banks and Fintech companies, which on the whole boast strong digital propositions, are the driving force in the consumer and corporate banking world. Low interest rates leave investors to consider options, which gives innovative and customer-friendly led brands coming to market the biggest advantage,” says Baris.

He continues, “Therefore, roles in digital development and design, such as UX designers, UI design and front-end development remain high in demand. With a strong digital proposition comes bundles of quality customer data, the race to even greater sophistication of customer insight means data engineers, data analysts, and data scientists are sought after.”

“Salaries have remained steady. The big companies have become savvy to this generation of talent, as it turns out money is not the only factor. On their list of needs and wants candidates are assessing how creative, agile, fast paced environments and teams are, and do they have latest technology and processes,” says Baris.

Hot skills in demand within data:

- SQL, Hive, Python, Tableau, Qlikview, NoSQL, Hadoop and Spark

- Hot skills in demand within development: Java, .NET, Android and iOS

“During the month of August 16, the average salary change for professionals moving from one position to another stayed at 16%. Whilst still an attractive increase, firms are beginning to stand their ground and be more conscious of costs when hiring new talent,” says Enver.