London Finance Jobs Avoid Knock-Out Blow from EU Referendum, Business as Usual for Now

The employment landscape in London's financial district may have faltered in the month after the UK referendum, according to a report by recruitment leaders Morgan McKinley, but Brexit failed to deliver the KO blow many had expected.

The number of available jobs in the City of London fell by 12% in July, compared to the precious month of June, as the impact of Brexit on the financial sector started to bite report Morgan McKinley in their latest Employment Monitor report.

The fall was less than many had expected, and undermined doomsday scenarios of the financial district converting to a ghost-town as companies relocated to more EU-friendly domains.

The report comes as front-line economic data for the period after the June 23 referendum remains thin, making it difficult for economists to gauge the real impact of Britain’s decision to leave the EU on the economy.

It will only be in September that hard statistics start to filter through.

Morgan McKinley showed that whilst hiring remained under pressure in July, it had not fallen off a cliff as many doomsayers had predicted:

“The fallout from Brexit is reflected across the board in July’s employment data. Month-on-month available jobs dropped by 12%, a modest decline given the gravity of the referendum.

“Hiring slowed as institutions found themselves in a post-Brexit limbo, but the impact of the referendum was not as aggressive as we expected”, said Hakan Enver, Operations Director, Morgan McKinley Financial Services.

The data showed a more drastic 27% fall in available jobs on a year-on-year basis, however, this was consistent with the general trend lower in the first half of 2016.

A 14% fall in the number of financial professionals seeking employment in July did seem to indicate that Brexit may have ushered in a more cautious job-seeking environment in which employees were much less likely to ‘jump ship’.

Adding to the uncertainty was also a dip in mergers and acquisitions hiring, which is seen as a barometer for the health of the financial sector in general.

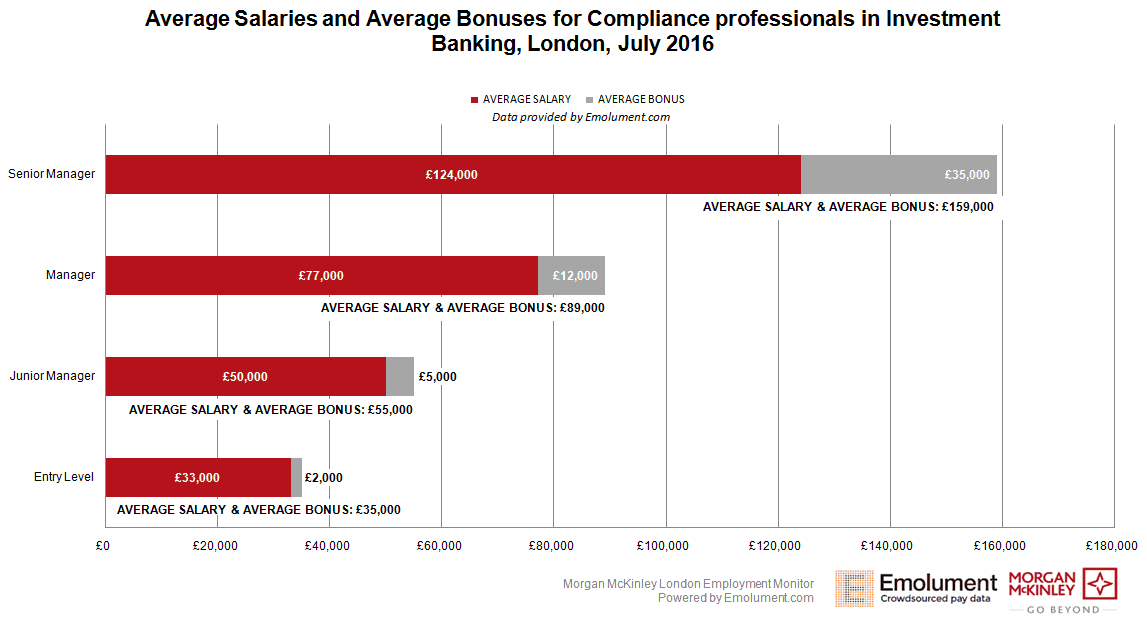

Non-Compliance is not an option

The McKinley report shows that the legal and compliance sectors stood out as areas where hiring was still steady.

The increase in regulation since the financial crisis, and the anticipated changes from Brexit, were factors still continuing to push up the availability of jobs in the sector.

The lack of supply of available qualified individuals however more than the number of openings limited gains.

Relocation Fears Lessen, Aided by Stronger Politicial Leadership

Concerns that many banks and other financial services companies might relocate to another country after the UK left the EU had overlooked important practical and logistical factors, highlighted by McKinley’s Enver:

“An exodus would require individual businesses to potentially relocate thousands of employees, which simply isn’t logistically or financially feasible," said Enver.

“Up to a million Londoners work in the financial sector. Only a small portion of them have the flexibility to up and move to a new country, and no other region can compete with the quantity and calibre of financial professionals”.

Political leadership had provided much needed support

Part of the reason for the surprisingly muted Brexit backlash on the city as a financial centre was as a result of strong political leadership coming from Theresa May’s quick succession, as well as New London Mayor Sadiq khan’s championing of the city and commerce:

“The relatively mild employment backlash can be attributed, in part, to decisive political leadership, and a growing sense that Article 50 will either not be triggered, or that its consequences will be moderate or slow to materialise. “The prompt formation of a new government was encouraging”, said Enver. “And London Mayor Sadiq Khan has emerged as a vocal champion of the City."

Enver noted Khan’s stand against his own party’s leader Jeremy Corbyn who had advocated a financial transaction tax - an idea Khan lampooned as “madness”.

Overall Enver was cautious about the outlook, saying there were two camps - those who thought Brexit would cause a lot of economic damage in the long run and those who thought it would not, but the meantime, he said “business would go on as usual.”