London to Remain Europe's Financial Powerhouse, Even if it is on the Outside of the Union say the CPS

- Written by: Gary Howes

The Centre for Policy Studies says while Brexit presents challenges to London’s financial services sector it will continue to dominate its European rivals

Brexit is unlikely to see London lose its status as Europe’s leading financial centre suggests a new report from the Centre for Policy Studies (CPS).

The report comes at a time of heightened anxiety over the City’s place in global finance once it exits the European Union.

Fears were raised at the G20 summit over the weekend when Japan warned its banks may have to relocate headquarters to the mainland should Brexit disadvantage their trading position within Europe.

However, the CPS argue that the UK’s strengths will mean that London continues to be Europe’s leading financial services centre.

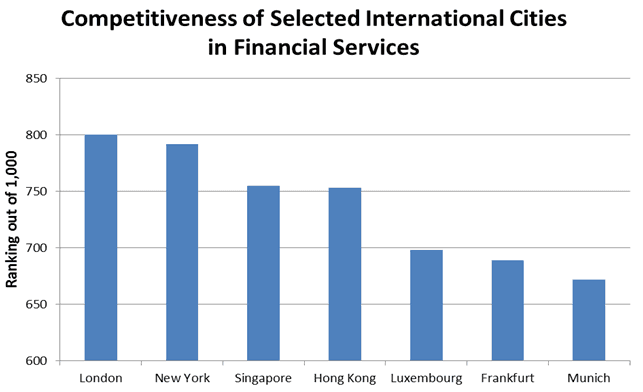

London is ranked the most competitive in the world for financial services, while closest EU rivals rank at 15th and 19th:

"The UK’s strengths as an international financial centre are extremely well established. The UK has the strongest financial services sector in the EU by reason of history, timezone, language, legal system, critical mass of skillsets, expertise in professional services and London’s cultural appeal,” says the report from the CPS.

The Global Innovation Index ranks the UK as the 2nd most innovative country in the world, making the UK excel in areas such as the digital sector and financial services.

Furthermore, the UK is Europe’s leader in terms of its higher education sector and in the protection of creditors.

“Despite claims to the contrary, this means that there is little prospect of London being dislodged as Europe’s leading international financial centre. The inherent advantages and large network of financial and professional services are hard to replicate elsewhere in Europe,” say the CPS.

The UK’s tax competitiveness has also dramatically improved over the past few years, with the number of UK companies seeking to relocate activities out of the UK falling sharply over the period 2012 – 2015.

Analysis from KPMG shows that 58% of financial service industry firms now view the UK as a ‘top three’ tax regime, making the UK the second most attractive regime in Europe.

The decision to cut corporation tax has been particularly welcomed by businesses.

Cutting corporation tax to 19% in 2017 and 17% in 2020 will further support the UK’s competitiveness in tax policy compared to other G7 countries argue the CPS.

“These factors will mean the UK continues to be a competitive place for financial services firms. According to the latest Global Financial Centres Index, the UK ranks the most competitive place for financial services in the world with 800 points out of 1,000 (see Figure 1).

Its closest EU rivals are Luxembourg in 15th place with 698 points and Frankfurt in 19th place with 689 points.

Moreover, many financial firms are still seeking to expand in the UK – for example, the Hedge Fund Skybridge Capital has recently announced plans for expansion while Wells Fargo has announced it will invest nearly $400 million for a City of London office.

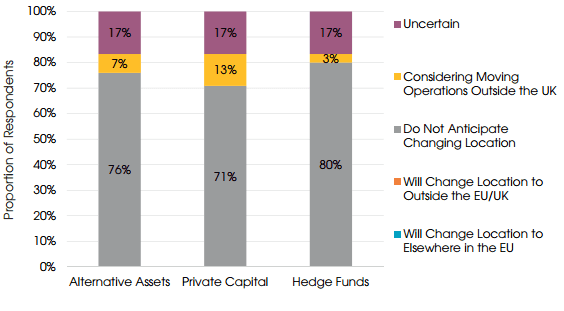

It is also notable that the vast majority of UK-based fund managers will not change the location of their business operations post-Brexit:

The Key Concerns Relating to Brexit

There are of course hurdles for London to leap.

According to the CPS, the primary concern about UK financial services is the issue of “passporting”.

Passporting is a process whereby a firm authorised in one EU member state can carry out activity

in another member state on the basis of its home state authorisation.

A British financial service firm can therefore provide services across the European Economic Area from its UK home.

Importantly, it also means that a Swiss or a US operation can do the same from a subsidiary established in the UK.

Current single market rules mean that financial service firms authorised in one member state can operate across the EU.

While unlikely it is not impossible that the loss of the passport system for UK financial institutions may trigger some migration of global firms’ EU headquarters.

For example, it has been claimed that loss of passporting rights could see UK exports of financial services to the EU halve to around £10bn.

“This could be problematic in the short-term by exacerbating the UK’s record current account deficit. A rapid solution to continued passporting arrangements between the UK and the single market should therefore be a high priority in ‘Brexit’ negotiations,” say the CPS.

Other concerns include that start-ups in EU countries will no longer look to expand in London, perhaps preferring other European financial centres.

Furthermore, there are also concerns about a slowdown in the attraction of EU talent for the purposes of working in UK financial service firms.

For example, 20% of Bulgarian and Romanian nationals in the UK work in banking and financial services, according to The UK in a Changing Europe.

Solutions

The CPS believe there are some prospective solutions to the problems faced by UK financial service firms in a post-Brexit world.

The UK could establish ‘third party’ status in many areas. A recent measure by the European Securities and Markets Authority (ESMA), for example, could provide a blueprint for UK financial service firms.

ESMA’s passporting rules now mean that asset managers in some countries outside the EU can continue offering services to investors across Europe, replacing the previous system of country-by-country private placement authorisation.

It should be noted, however, that third party arrangements do not exist in some areas such as payment systems providers, which could prove to be more problematic.

In addressing concerns about immigration, the UK Government will almost certainly seek to make provisions for skills in the financial services industry within its new so-called “points based” system.

Is Leaving the EU that Bad for Financial Services?

Many financial and banking rules are now set by global regulators, limiting the impact of Brexit on financial service firms.

Since the financial crisis, initiatives have focused on implementing the work of organisations such as the Financial Stability Board of the Basel Committee on Banking Supervision in areas such as resolution, prudential requirements and centralised clearing in the derivatives world.

Furthermore, the single market in services is imperfect, reducing its potential benefits to UK financial service firms.

Services make up 70% of Europe's economies and generate more than 90% of new jobs, yet services account for just 20% of intra-EU trade, according to the UK’s Department for Business, Innovation and Skills.

"Global financial services firms are adept at dealing with local market variations and hidden barriers to trade, such as competing regulatory and tax regimes, offering reassurance that UK financial service firms will be relatively unaffected by Brexit in the medium to long term," say the CPS.

Why Financial Services Firms Could Benefit from Brexit

The CPS argue that there are advantages that must be grabbed by the UK when it comes to Brexit.

One area where UK firms could benefit is in regulatory divergence as Brexit allows them to avoid burdensome EU legislation, such as the bonus cap, restrictive employment rights and proposals for a Financial Transactions Tax (FTT).

These would improve the City’s competitive position with other European centres.

The FTT proposal is to tax transactions of shares and bonds at 0.1% and derivatives at 0.01% where there is an established link to the FTT zone.

Both the European Union and Oxera have stated that the loss of GDP in the affected area will be greater than the expected tax revenue, according to PricewaterhouseCoopers.

Former Governor of the Bank of England, Mervyn King, has also stated that if this tax were imposed in the FTT area, it would lead to more business coming to the City of London.

The UK also has the opportunity to remove itself from the provisions set out by the EU-wide Bankers’ Bonus Cap, which limits extra pay to 100% of a banker’s salary or 200% if shareholders agree. This has had the distortionary effect of driving up salaries in banks and made top bankers’ pay less flexible, making banks and the financial system more fragile, according to the Bank of England.

There are also specific damaging provisions set out by European Union regulation, which the UK will be able to opt out of.

These include specific provisions set out by the Market Abuse Regulation, the Alternative Investment Funds Management Directive (AIFMD) and EU regulation more broadly.