Slump in Retail Sales Sees Pound Extend Pullback

- Written by: Gary Howes

Image © Pound Sterling Live

Pound Sterling continues to retreat from recent highs, helped along the way by UK retail sales data that showed a sharp slump in activity in June.

The Pound to Euro exchange rate retreated further below 1.19 and the Pound to Dollar approached 1.29 after the ONS said sales fell 1.2% month-on-month in June, having grown 2.9% in May.

This was below the consensus expectation for -0.4%. The year-on-year growth was -0.2%, down from 1.3% and below estimates for 0.2% growth.

The ONS said retailers suggested election uncertainty, poor weather, and low footfall affected sales. "Shoppers have clearly been deterred by the soggy summer we've had so far," says Phil Monkhouse, UK Country Manager at Ebury.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"GBP weakens after weaker retail sales data," says Daragh Maher, Head of Research for the Americas at HSBC. "The softer sales data come on the heels of yesterday’s labour market data showing slowing wage growth. Together, they have provided a dovish counterpoint to continued evidence of sticky and elevated services inflation, leaving market pricing for the likely outcome of the August BoE meeting finely balanced,

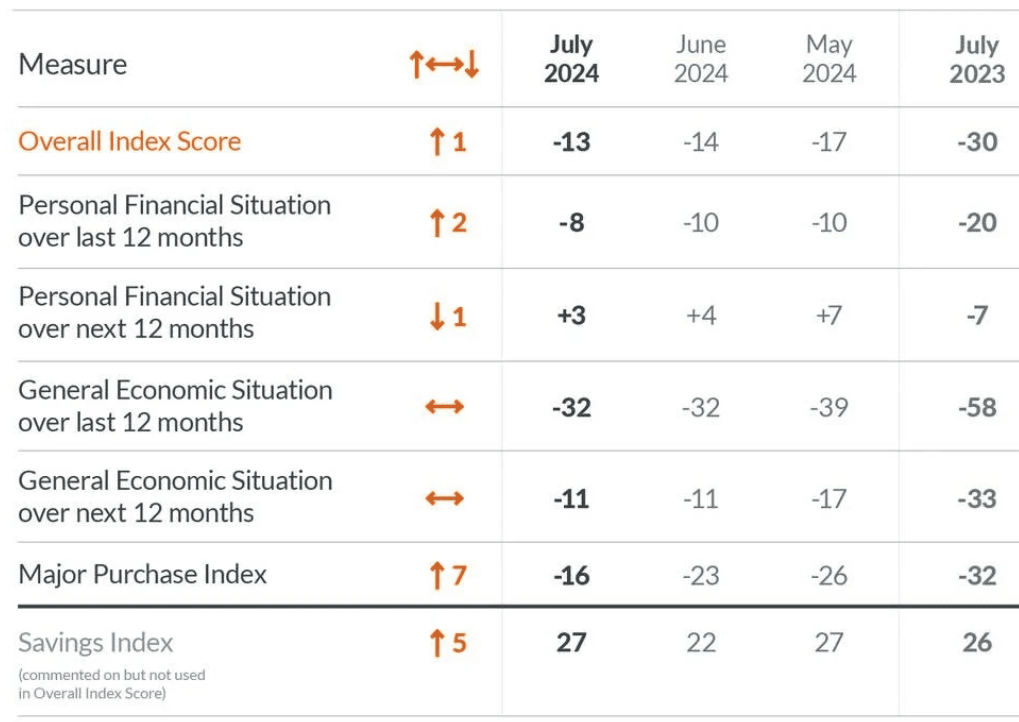

July should see an improvement in retail activity as settled weather falls on the UK, the election is in the rearview mirror, and consumer confidence is improving. Data out Friday from GfK already shows consumer confidence has risen this month. GfK’s composite index of consumers’ confidence rose to -13 in July from -14 in June.

GfK reported a seven-point uptick in the major purchase index (which is a subcomponent of the consumer confidence survey), saying this "is potentially good news for retailers that could translate into improved footfall in the months to come."

"Consumers increasing optimism should ensure GDP continues rising strongly in the second half of the year," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics. "We think that consumers’ confidence will continue trending up as real incomes power forward this year, while the prospect of interest rate cuts from the MPC help too."

For the Pound, the outlook now hinges on the Bank of England's August 01 interest rate decision. Data this week has made the case against a cut as soon as next month, with services inflation rising 5.7% y/y in June.

Such a strong reading suggests broader inflation will start to tick up again in the coming months, particularly as household energy bills are set to start rising again in the Autumn.

Above: The UK's longest-running consumer confidence survey shows continued improvement.

If the Bank forgoes an interest rate hike and continues to urge caution, then the Pound can remain supported as it benefits from one of the highest interest rates in the G10.

Thursday's wage data was more mixed, with some economists saying there is enough of a slowdown in the labour market underway to allow the Bank to cut interest rates.

The Bank says that strong wage growth will keep inflation elevated, but if it thinks wages are coming down it might believe it can cut rates without stoking inflation. It will also be conscious that keeping rates high for an extended period can potentially damage the economy.

August 01's decision is on a knife edge, with several policy setters indicating they were close to voting for a rate hike at the June meeting.

A rate cut is unlikely to materially undermine the Pound's rally if it is accompanied by guidance warning that it is not on a predetermined path to cut rates further.

This could keep the Pound supported into year-end.