On-point Wage Data Prompts Unwind of Pound Sterling Strength

- Written by: Gary Howes

Image © Pound Sterling Live

Just-released wage data are no smoking gun for an August interest rate cut, however Pound Sterling's bullish run could be entering a consolidative phase against the Euro and Dollar.

The Pound to Euro exchange rate has withdrawn to just below the 1.19 level following news UK wage figures remain high and unemployment low. The Pound to Dollar exchange rate has pared recent gains and is sitting just above 1.30.

The ONS said annual growth in employees' average regular earnings (excluding bonuses) was 5.7%, which aligned with consensus expectations. When bonuses are included, the figure also stood at 5.7%, as expected.

The foreign exchange market reaction was muted because the data met market expectations. We think it would have taken a notable beat on expectations to drive the Pound to fresh highs owing to the already overbought condition of the Pound's rally.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Indeed, the risks to the Pound were to the downside heading into the report, and even a slight miss could have prompted some profit-taking on the July rally.

UK employment rose 19K in the three months to May, which was just ahead of the 18K the market was expecting. This resulted in an unchanged unemployment rate of 4.4%, which was expected.

The message from the labour market is clear: the labour market is still tight, and wages are too high for the Bank of England to hit its 2.0% target sustainably.

Sure, we have had two successive months where headline inflation has read at 2.0%, but economists agree that inflation will now start to climb again as wages keep the pressure on business margins and demand in the economy steady.

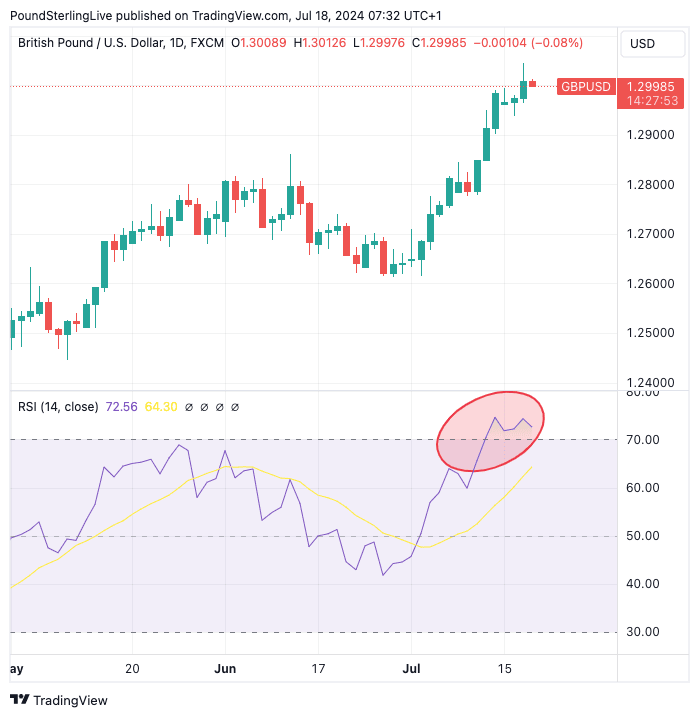

Like numerous GBP exchange rates, GBP/USD is screaming overbought on account of the RSI exceeding 70 (lower panel). A pullback or consolidation is likely. Track GBP/USD with your custom alerts; find out more here.

There remain some signs of 'loosening', as the ONS said the number of vacancies in the economy has fallen by 3.3% in the most recent quarter. Vacancies have been falling for two years now, but are still well above pre-pandemic levels.

Some economists will point to this as evidence of increasing 'slack' in the market. However, we have been hearing this claim for months now, and falling vacancies are yet to deliver the deterioration in conditions required to bring wages down conclusively and invite the Bank of England to enter a concerted interest rate cutting cycle.

The Bank of England heads into its August 01 interest rate cut with no 'smoking gun' required to pull the trigger on an interest rate cut: service sector inflation is far too high, the labour market is robust and wages are elevated.

Cutting interest rates under such circumstances would be curious and would raise questions about the Bank's credibility.

"This labour report probably puts the final nail in the coffin for the August rate cut. Potentially there is some doubt over the September meeting, never mind August, with some likely to need a clear downward trend in services and wages by then," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

Market pricing now shows investors think September is a more credible start date for a rate cutting cycle, but this will require August's data releases to show the necessary slowdown in conditions.

The Pound will remain supported by the UK's high interest rates that attract capital from investors seeking out higher returns relative to elsewhere.