Pound to Canadian Dollar Week Ahead: 1.81 and BoC Decision Eyed

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar is under pressure against the British Pound. The midweek Bank of Canada interest decision will prove the week's calendar highlight.

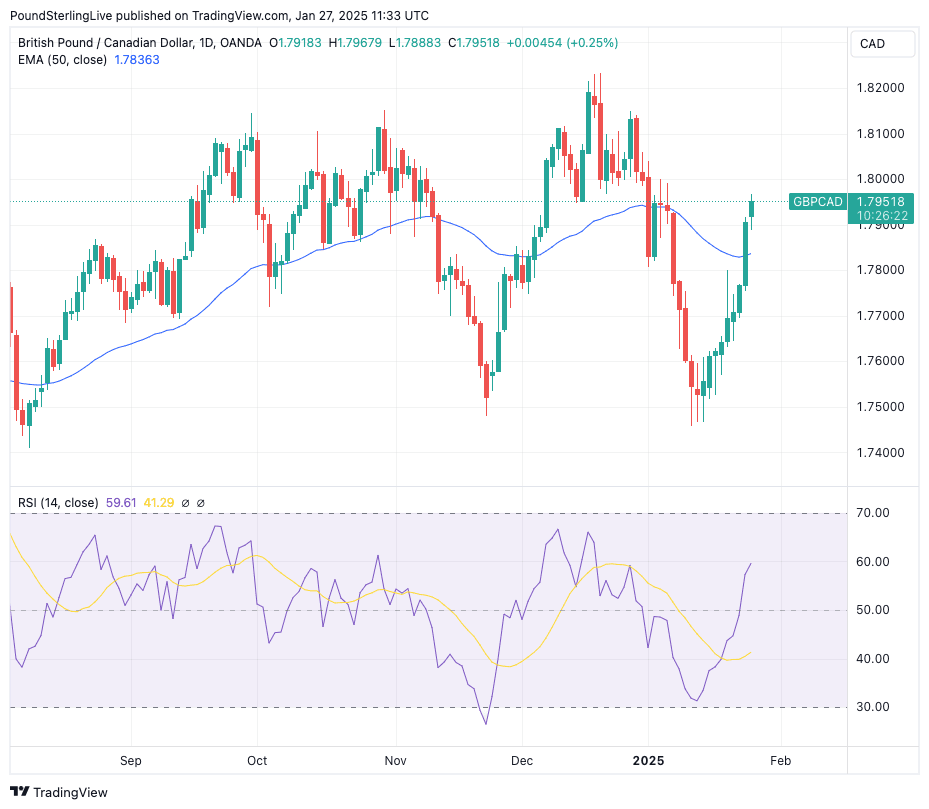

The Pound to Canadian Dollar exchange rate (GBPCAD) is trending higher again and looks set to challenge the 1.81 interim resistance target in the coming days.

Following a notable selloff early on in the year, the subsequent turnaround in GBPCAD is proving just as impressive, with the pair looking to record a ninth consecutive daily advance.

The Relative Strength Index (RSI) is at 59.55, meaning the GBP is still some way off from being overbought. That the RSI is pointing higher is meanwhile consistent with near-term upside momentum.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Looking at the bigger picture, GBPCAD has been trending in a wide, sideways-orientated channel since August 2024, and it is too early to say whether this will break. This is why we would expect the rally to ultimately fail in the 1.80-1.82 resistance area has been the case over recent months.

It would take the imposition of significant Canada-specific tariffs from President Trump to drive a break to fresh multi-year highs above 1.82.

Deutsche Bank analyst George Saravelos says the very real prospect of a Canada-U.S. trade war represents the worst-case scenario for the economy and the Canadian Dollar, which could fall to a record low against the U.S. Dollar.

"In the event U.S. tariffs go ahead, we think Canada will retaliate with tariffs of its own, likely in the same product categories as the 2018 Trump tariff episode. However, unlike in 2018, the Canadian government has also put the idea of export taxes on commodities on the table – by far the most potent weapon in Canada's arsenal," says Deutsche Bank's Saravelos.

Should Trump proceed with a 25% tariff, Deutsche Bank thinks "the hit to Canadian aggregate demand will be large and pull Canada into recession."

With these risks in mind, all eyes turn to the Bank of Canada (BoC) midweek for signs as to how tariff uncertainty might influence interest rates. The rule of thumb is that any hint of caution consistent with a willingness to lower rates further will weigh on CAD.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

"If the US imposes tariffs to Canada, the BoC may respond by cutting below neutral to use the CAD as a buffer," says Carlos Capistran, an economist at Bank of America.

The consensus thinks the BoC will cut rates this week but signal a willingness to pause (in light of still-high core inflation in Canada) and wait to see how the trade issue pans out.

To be sure, it is hard to gauge how the language associated with such guidance might sound, given the unknowns.

There is a reasonable chance that a decision to pursue a wait-and-see approach is read as 'hawkish' as it signals no immediate concerns at the BoC. Here, CAD could rally.

However, any suggestion that the BoC stands ready to act with force in the event of trade tariffs could convey a 'dovish' stance that would weigh on CAD and pressure GBPCAD to the topside of the multi-month range.

"With a 25bp BoC rate cut decision fully priced-in, we believe US tariff decision on Canada before February 1 and BoC's forward guidance on how it would respond to potential US tariffs will matter more for USDCAD," says Bank of America.