Buy Pound Sterling, UK Pessimism Overdone: BCA Research

- Written by: Gary Howes

File image of Rachel Reeves. Picture by Kirsty O'Connor / Treasury.

Buy the British Pound and UK bonds; the pessimism towards the UK is overdone.

This is according to Dhaval Joshi, Chief Counterpoint Strategist at BCA Research, who says there is an "over-pessimism" towards the UK, and debt concerns are more pressing in France.

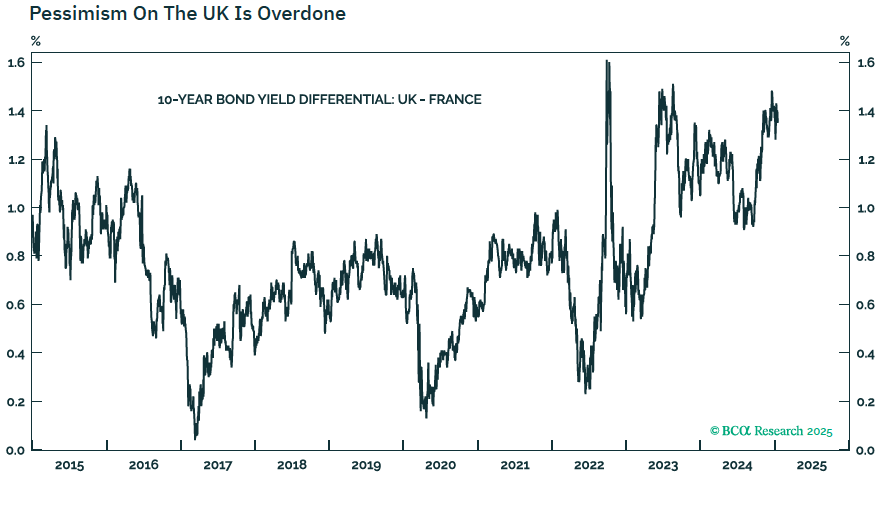

Dhaval recommends investors go long UK gilts vs French OATs, both tactically and longer term, as the UK-France 10-year yield spread has recently widened to 150+ bps, making UK gilts the cheapest versus French OATS in a decade.

He also thinks buying the pound is another expression of this view.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

BCA Research is an independent research provider and forecaster, founded in 1949. Its latest research shows UK debt sustainability, combined with its political stability, is much more favourable than that of France.

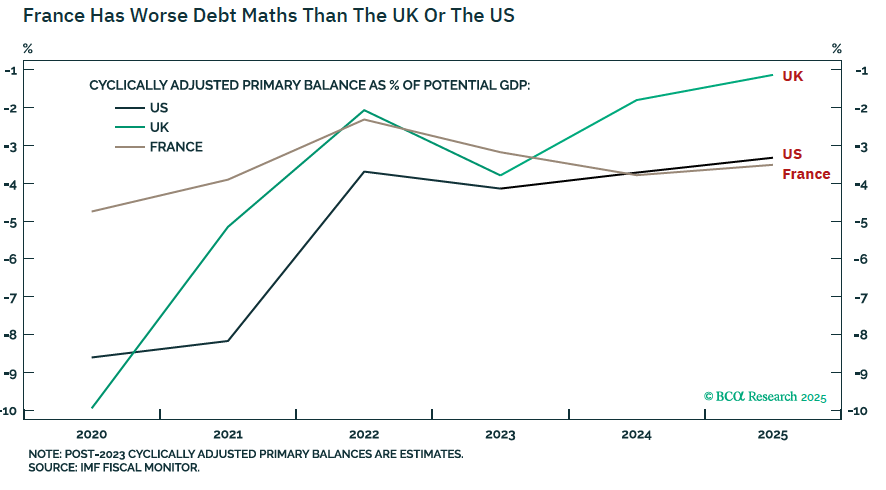

"The bond market vigilantes are right to warn about government debt sustainability in the US, the UK, and France. But some governments have worse maths than others," says Dhaval.

Image courtesy of BCA Research. NOTE: the axes are inverted!

The Pound has come under pressure in 2025 as investors fret about the sustainability of the UK's debt profile amidst evidence the economy is teetering on the verge of recession, meaning Chancellor Rachel Reeves won't receive the taxes she needs to fund her ambitious spending plans.

Bond investors - creditors to the UK government - want to know if the government finances are on a healthy trajectory if they are to continue lending. The spike in bond yields seen last week suggests nervousness, which ultimately saw the Pound drop from recent highs against the Euro and other currencies.

The Pound to Euro exchange rate fell from a 2025 high of 1.2096 to a low of 1.1805. The Pound to Dollar exchange rate fell from a high of 1.2576 to a low of 1.21. Both pairs have since stabilised and formed a base.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

BCA's analysis shows that the maths of UK debt sustainability combined with its political stability is much more favourable than the maths of France's debt sustainability combined with its political instability.

However, in absolute terms, Dhaval points out that we are not yet at the peak pain points that marked excellent bond-buying opportunities in October 2022 and October 2023.

Dhaval also stresses that the UK's rising debt costs have marched in lockstep with those of the U.S. and other major economies, confirming there is no significant UK-specific concern.

"The [bond market] vigilantes may have to push yields higher until something ‘breaks’ in the financial markets or unleashes a 'Liz Truss moment' somewhere in the global financial system. From a tactical perspective, this means that it is also too early to go aggressively underweight stocks versus bonds," says Dhaval.

Image courtesy of BCA Research.

Given his findings, Dhaval thinks fading UK pessimism could offer a tactical award. He says to go "long UK gilts versus French OATs."

"Another way of playing the over-pessimism on the UK is to go long GBP/USD which is also oversold based on its collapsed 65-day complexity," he says.

Buying the Pound would fit with the consensus expectation amongst the investment bank community that the Pound will ultimately reach a turning point and recover. A look at the consensus forecast for GBP/USD and GBP/EUR at the start of the year shows expectations for another year of outperformance.

Analyst Ruth Gregory at Capital Economics thinks market nerves will settle, and the Chancellor will be able to muddle through.

"Our base case is that a stabilisation and eventual fall back in gilt yields will allow the government to muddle through and wait until the next fiscal event on 26th March before making any decisions on taxes and spending. However, a significant worsening of the bond market sell-off could force the government to announce contingent tax hikes and/or lower spending and the Bank of England to buy gilts to restore orderly market conditions," she says.

But analyst Darah Maher at HSBC isn't convinced: "A consensus among FX forecasters, taken only a week ago when spot GBP-USD was 1.2150, is that it will finish the year at 1.26. This seems notably optimistic to us.

He says the UK's data pulse is weakening and the Bank of England will cut by more than the market expects, which should result in a weaker Pound.