Dollar Reaching a Turning Point as Trumphoria Fades: LGT

- Written by: Gary Howes

Image © Adobe Images

The Dollar is reaching a turning point as 'Trumphoria' looks set to fade and equity market valuations clash with rising bond yields.

This is according to the Liechtenstein Global Trust (LGT), the largest royal family-owned private banking and asset management group in the world.

"The US dollar has performed well in recent months, but momentum in the greenback is expected to slow and even reverse," says a note from LGT, detailing the firm's latest investment outlook.

The call follows a period of strong momentum for the Dollar and stock markets, with the latter reaching new highs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But LGT says the Dollar now looks overvalued, which amplifies downside risks, "particularly as the Fed’s rate cutting cycle (albeit slowed by persistent inflation) will continue in 2025."

"While US inflation remains somewhat stubborn, much of the positive economic news is likely already priced into the dollar. Meanwhile, worries about dual deficits, potential US debt concerns and thus reduced US credibility, and the risk of economic and political shocks in the US introduce meaningful headwinds for the US dollar over the medium term," says LGT.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Analysts say the U.S. remains the undisputed leader in terms of expected economic and earnings growth, "leaving the rest of the world in the dust".

However, now is the time to turn more cautious.

"The strong momentum that has driven the US stock market to new highs over the past two years has recently waned. After Donald Trump’s re-election, US equities recorded high inflows, while international investors’ cash holdings have fallen to unusually low levels, indicating that they are fully invested," says LGT.

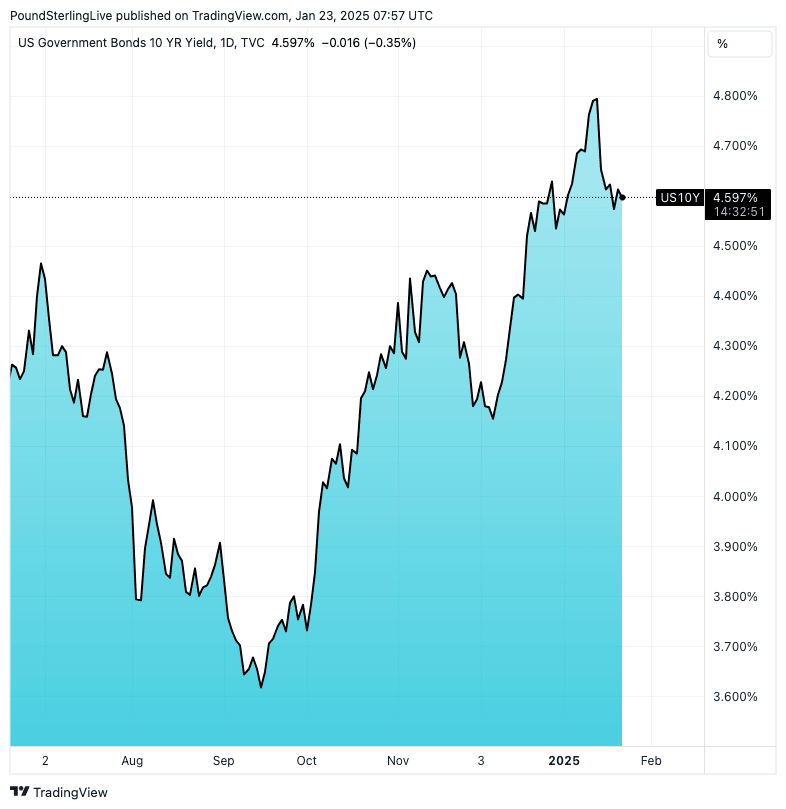

Above: The ten-year bond yield rises into "the danger zone".

"The market reaction after the elections - also known as "Trumphoria", indicative of the almost euphoric investor sentiment - is currently accompanied by low market breadth and is reflected in high valuations."

LGT says it is downgrading its stance on U.S. equities to neutral, noting that high valuations and low breadth are running into tighter financial conditions.

Rising bond yields are raising the cost of finance in the U.S., with the bellwether 10-year U.S. Treasury bond yield rising back into what LGT describes as the "danger zone" of 4.5-5.0%.

"While US fundamentals appear enviable and justify some valuation premium, risks are emerging from euphoric sentiment, tighter financial conditions and uncertainties related to the regime change in the White House. We prefer a more balanced approach and downgrade US equities to neutral," says LGT.