Record-breaking Demand for UK Debt

- Written by: Gary Howes

Chancellor Rachel Reeves is interviewed by CNBC at the World Economic Forum in Davos, Switzerland. Treasury. Picture by Kirsty O’Connor / Treasury.

Strong demand for UK sovereign debt will help the Chancellor sleep easier.

This week's auction of UK sovereign debt has uncovered significant demand, with subscriptions outstripping supply by a record margin.

The UK's Debt Management Office said it raised £7.9BN in cash after offering gilts that expire in 2040, but the order book stretched to £119BN. "A busy week of supply has been met with record-breaking order book sizes," says Sam Hill, Head of Market Insights at Lloyds Bank.

"I am delighted with the successful outcome of this offering, which provides a clear demonstration of the excellent support we have continued to receive from our investor base over the course of this 2024-25 financial year," says Jessica Pulay, Chief Executive Officer of the DMO.

Solid demand comes amidst growing concerns for the UK's fiscal dynamics.

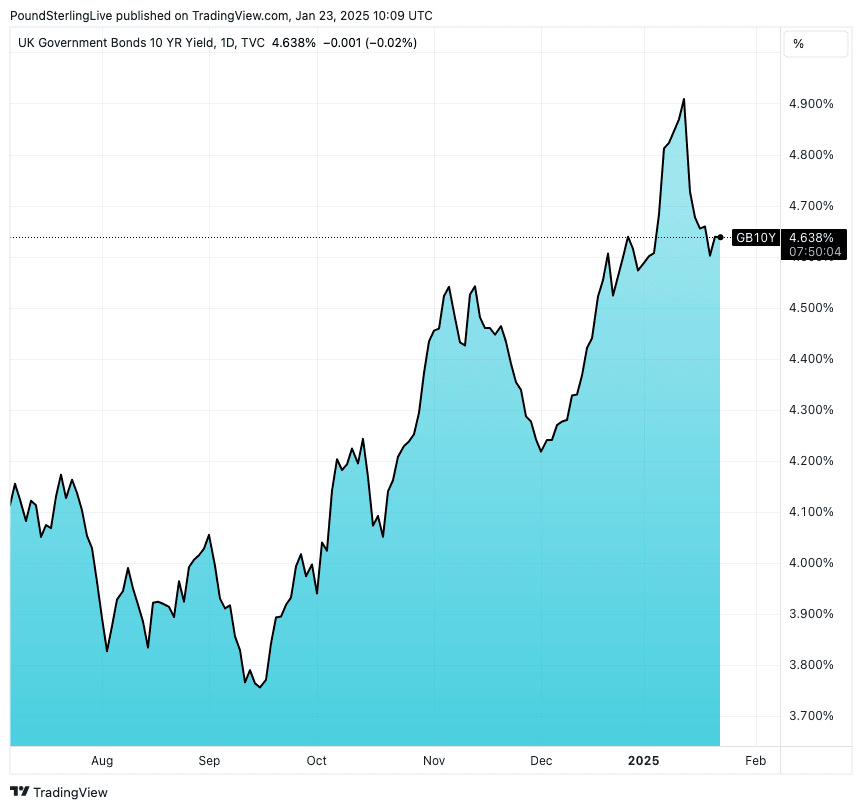

Above: The yield on ten-year UK government bonds has put a strain on the government's finances. Strong demand is keeping a lid on how far and how fast they can rise.

This January saw the yield offered by the UK ten-year bond (gilt) rise to its highest level since the 2008 financial crisis, confirming investor jitters over the UK's borrowing needs at a time of stagnating economic growth.

Economists say the rising cost of debt will force Chancellor Rachel Reeves into more damaging tax rises and spending cuts, potentially exacerbating the fiscal problems the country faces.

But for now, the yield is simply too tempting for many to ignore, having the effect of ratcheting up demand. "This week's syndications highlight yield appetite supersedes fiscal concerns for now," says Hill.

"Moreover, secondary market performance has improved recently with gilts finding support," he adds.

The analyst explains higher outright yield levels make for more favourable comparisons versus other asset classes, such as equities or credit, from a historical perspective.

Although some investors will be of the view that the weak fiscal fundamentals are still a headwind for bond ownership, Hill says outright and cross-asset yield comparisons have reached levels that make them interesting to others.

Demand in France and Spain is also strong, with France seeing a solid order book of EUR134bn for its 2042 syndication.

Spain's 2035 syndication attracted an order book totalling EUR143bn.

"Order book volumes of over ten times the issue size is surely indicative of underlying demand, even accounting for an element of possible inflation to secure allocations," says Hill.

The outperformance of French and Spanish bonds hints that markets are ignoring fiscal challenges, with both the French and Spanish governments unable to pass their respective budgets due to a fragmented political landscape.

This confirms that attractive yields can help investors climb a wall of worry, for now at least.