Reeves Needs to Find £15BN: Nomura

- Written by: Gary Howes

Above: File image of Rachel Reeves. Picture by Kirsty O'Connor / HM Treasury.

The rise in borrowing costs means Chancellor Rachel Reeves is on course to find an additional £15BN to maintain her fiscal 'headspace'.

According to research from Nomura, if remedial measures are needed, Reeves will prefer to cut spending and not raise taxes.

"Should yields remain at current levels the UK’s fiscal rules look to be on shaky ground," says Nomura economist George Buckley. "To maintain the same fiscal headroom with yields at current levels could require around £15bn of remedial measures."

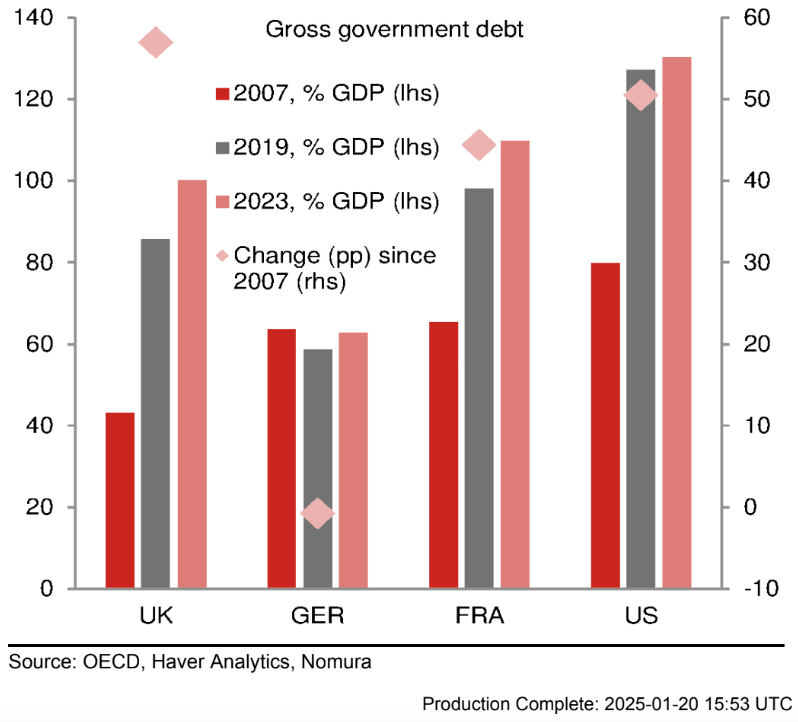

Above: The UK has seen the largest rise in national debt/GDP

The call comes after a crucial benchmark of UK borrowing costs rose to its highest level since 2008, signifying markets are demanding greater returns for lending to the government.

This is usually a result of expectations for an increase in the supply of bonds, the I-owe-you government's issue to lenders, amidst uncertainty about whether demand can keep pace.

The UK fiscal rules are a set of principles designed to ensure sustainable public finances, typically including limits on borrowing, a commitment to reducing debt as a percentage of GDP, and maintaining balanced budgets over the economic cycle.

The rules are a crucial commitment by the government to lenders that provide market certainty. A breakdown in credibility could lead to market dysfunction, ever-higher borrowing costs and, ultimately, default.

"Should the rules be missed we don’t think the Chancellor has the option of doing nothing/delay – alongside last October’s fiscal largesse (a similar loosening to that of Truss two years earlier) ignoring the fiscal rules would risk a further market response," says Buckley.

If action is to be taken, Nomura thinks the government will cut borrowing and avoid raising taxes.

"If a fiscal response is required, spending cuts look more likely than tax rises, based on past comments by the Chancellor/Treasury sources. Still, the room for manoeuvre is very limited with unprotected departmental spending already tight," says Buckley.

The government last October announced £40BN in new taxation on businesses, which economists blame for a collapse in economic growth.

The research comes on the same day a cross-party House of Lords Economic Affairs Committee calls for urgent reform to the health-related benefits system, having conducted an inquiry into the relationship between the welfare system and long-term sickness.

Britain now spends more on sickness benefits - £65BN - than it does on defence at £57BN. The figure is expected to reach £100BN by the 2030s.

The Lords report finds that if 400K people who are out of work due to illness could find jobs, it could save around £10BN through higher tax revenue and reduced benefit cost.