Pound to Canadian Dollar Week Ahead Forecast: Minor Uptrend to Meet Key Resistance

- Written by: Gary Howes

Image © Bank of Canada

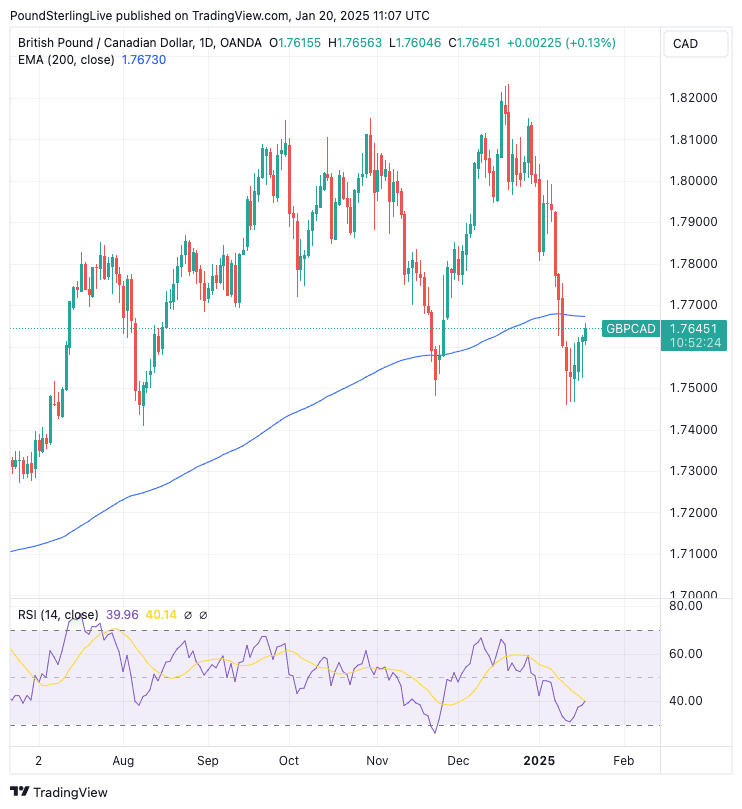

A minor rebound in the Pound to Canadian Dollar (GBPCAD) will be tested by technical resistance this week. A break above here can occur if Trump hits Canada with import tariffs.

Pound Sterling looks like it wants to rise for a fourth consecutive day on Monday, with a small rally rising up to meet the 200-day exponential moving average (EMA).

This technical level now forms a resistance barrier that could challenge Sterling's rebound potential and ultimately thwart the recovery.

While below the 200 EMA - currently at 1.7668 - GBPCAD is in a downtrend, meaning we view rallies such as these as short-lived in nature. As a consequence, the setup suggests GBPCAD can rise a little further, consolidate but ultimately break down and hit new multi-month lows at some point in the coming weeks.

However, a key risk to this setup is Donald Trump's return to the White House, with the new President promising an avalanche of day-one policy changes.

Betting markets are showing the odds of Trump announcing tariffs in his first week are high. Polymarket, the betting marketplace, shows the odds of China and Mexico being targetted this week are at about 65% odds.

Canada is the third most likely target, with punters reckoning on a 45% chance Trump deals out import tariffs in the first week. This suggests markets are not quite pricing CAD for a worst-case scenario, which would pose downside risks for the currency.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

If this does play out, then GBPCAD's recovery can extend above that technical resistance level, although we are not convinced a major turnaround is likely.

This is because Pound Sterling is on a weaker fundamental standing in 2025.

In 2024, the fundamental GBP setup was bullish, with a strong economy commanding higher interest rates at the Bank of England. Now, the UK economy has slowed down, and there is limited prospect of a pickup.

This means less by way of taxes for the government to pay for its significant borrowing plans, which has made investors nervous about the UK fiscal outlook. One expression of this nervousness is a selloff in the Pound.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

"Overall, we see little reason for sterling to recover," says Chris Turner, an analyst at ING Bank. "While we do not think this is a Liz Truss-style moment for UK sovereign risk, we do think the solution to the current challenges is sterling negative."

Turner explains that for the UK to improve its fiscal standing, the government would need to cut spending. The Bank of England could assist by cutting interest rates (lowering Gilt yields), or a combination of both steps occurs.

The options ahead are fundamentally unhelpful for those wanting a stronger Pound.

With this in mind, Tuesday's UK job report will be important. The consensus looks for the unemployment rate to edge up to 4.4% from 4.3% in light of survey evidence of growing job losses and a slowdown in hiring intentions. In particular, the PMI surveys have been warning of a deterioration in the labour market for a couple of months now.

"Employment indicators are pointing firmly to a decline in payrolled employment in the coming months," says Sam Hill, Head of Market Insights at Lloyds Bank.

The Pound is likely to fall should unemployment rise faster than was expected and the opposite reaction is likely if the data proves stronger than expected.

The Bank of England is watching employment and wage dynamics, judging that high wages are inflationary and must be met with higher-for-longer interest rates.

However, rising unemployment will suggest to the Bank that wage pressures will fall notably in the coming months, which will allow them to cut interest rates further.

Money market pricing shows investors have raised bets for more rate cuts from the Bank of England this year, which has contributed to the weaker Pound. However, the market is still only expecting two rate cuts, with a third being a possibility.

For the Pound, rising expectations for rate cuts will result in weakness and this is why we forecast GBP/CAD downside in the coming days, judging that the process has further to run.