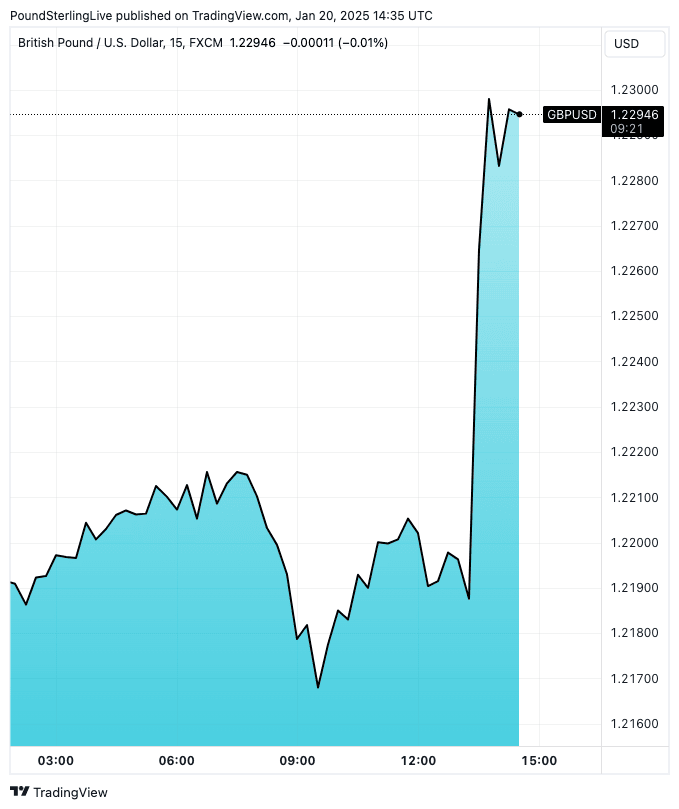

Pound to Dollar Rate Jumps 1% on Day-one Tariff Reprieve

- Written by: Gary Howes

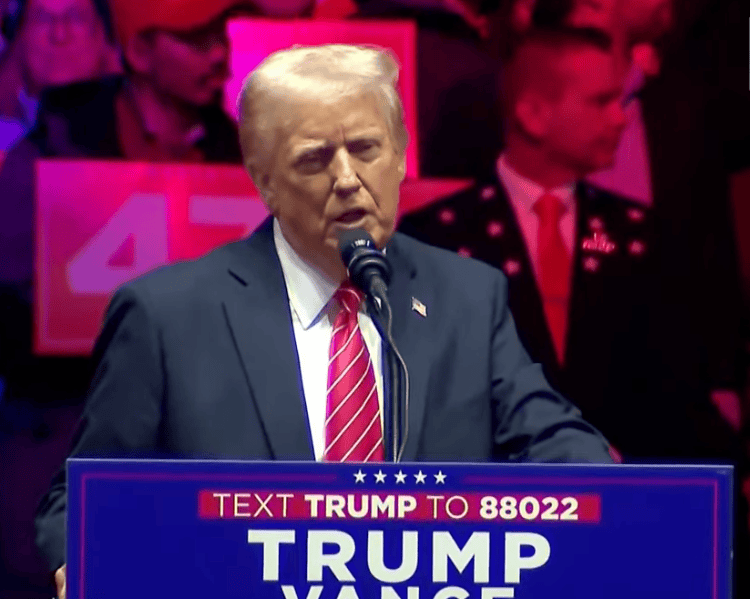

Above: Trump speaks on the eve of his inauguration.

The Dollar has fallen following a news report Donald Trump won't be dealing with the topic on his first day in office.

Instead, the president will oversee a barrage of executive orders focussed on domestic issues.

Traders are citing a Wall Street Journal article that confirms tariffs are not an immediate priority:

"The President-elect Donald Trump is planning to issue a broad memorandum Monday that directs federal agencies to study trade policies and evaluate U.S. trade relationships with China and America’s continental neighbours."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Dollar's decline suggests markets saw a real risk of tariff announcements, widely held to be inflationary and pro-Dollar.

The Pound to Dollar exchange rate is a per cent higher at 1.23, and the Euro to Dollar exchange rate is 1.23% higher at 1.0398.

The commitment to "study" and "evaluate" trade relationships suggests tariffs might not be an issue for his first week in office. Previously, investors were pricing an approximate 65% chance tariffs on China and Mexico would be announced, with a 45% chance Canada would also be targetted.

The memo nevertheless singles out these three countries as being priorities.

Importantly, this suggests a blanket tariff is increasingly unlikely.

It is this universal tariff that market participants see as a worst-case outcome for markets and the most bullish outcome for the U.S. Dollar.

Any sign Trump will prefer a more nuanced and targetted approach lessens the prospect of this extreme outcome. Indeed, tasking agencies to study the issue hints at a relatively low-key risk compared to the universal tariff.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.