UK Private Sector Effectively in Recession

- Written by: Gary Howes

Image © Adobe Images

The UK private sector, then the engine of the UK economy, has stagnated and could be in the throes of recession.

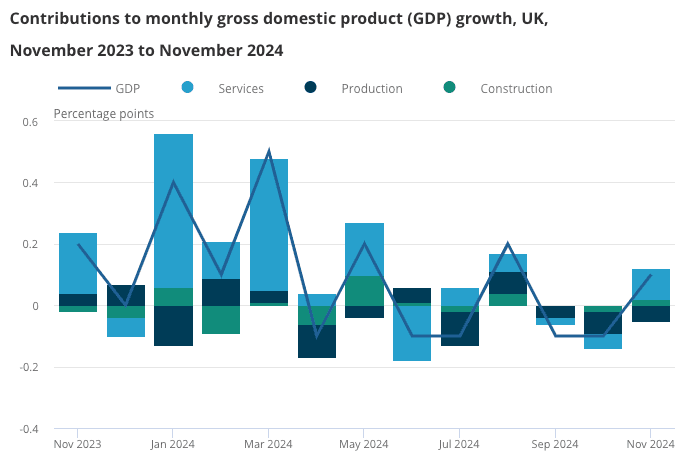

This after the economy snapped a run of consecutive monthly declines by growing 0.1% in November, however, this paltry growth has base effects and health spending to thank.

The services sector, the largest sector in the economy, made a 0.1% contribution said the ONS; yet, over three months, services output was 0%.

Within services, the best performing of the fourteen sub-sectors was health, explains Sam Hill, Head of Market Insights at Lloyds Bank. Here, the output boost was merely attributable to the absence of doctors' strikes in the more recent period. "In other words, it is hard to be particularly optimistic," he explains.

"Education output surprisingly rebounded despite weakening school attendance due to surging flu cases and healthcare recovered some of its previous odd weakness as GP appointments continue to surge," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

This suggests the growth is flattered by base effects and government spending, effectively underlining the fact the UK's private sector is in recession.

"We are, for all intents and purposes, in a private sector recession," says Matt Lewis at TopMoneyCompare.com.

Small and medium-sized businesses, which account for the majority of UK economic output, have been warning the new government's opening gambit in office would lead us to where we are today.

"Stagnant Britain," says Ben Perks, Managing Director at Orchard Financial Advisers. "The figures show the smallest of increases but there is no feel of growth on the streets. The government needs to take action to kickstart this economy and quickly."

A £40BN national insurance tax raid, inflation-busting minimum wage increases, significant growth in new regulations and consistently negative messaging about the country's finances from the government since winning the election have all contributed to the decline in the economy.

"The mood in the business community has been decimated due to current government policy," says Rakesh Dua, CEO at DUA Accountancy & Business Consultancy. "The business owners I speak to are asking why they should take risks, why carry on hiring, why invest when growth is not there, and why take on more fixed costs. They're also wondering whether their customers will accept further price rises."

The Institute of Directors says disappointing growth figures leave "the door open to stagflation concerns".

The IoD's Economic Confidence Index for November reached a new post-Covid low "after business leaders were left reeling from a worse-than-expected Budget for business".

Overall, the economy was bigger in March than in November, "and recent employment indicators don't offer much hope for improvement," says Hill.

Looking ahead, he says these growth data provide "further signals of stagnation" and that December growth needs to recover to around 0.25% m/m for the fourth quarter GDP to come in flat.

This now appears to be a high bar to leap for an economy that has produced a run of -0.1%, -0.1% and 0.1% over the past three months, raising the prospect of a negative quarter of growth.

Such an outcome would not surprise the country's business owners.

"There was negligible growth in November and zero real growth during the quarter. It's hardly surprising, given that Starmerism is based on rules with no vision. There is absolutely no policy that I can see that will provide the stimulus the country needs. There is no big idea beyond ‘we’re fixing what the Tories did’, but it no longer cuts it," says David Belle, Founder and Trader at Fink Money.