Aggressive RBNZ To Drive More New Zealand Dollar Weakness in 2025 says Westpac

- Written by: Gary Howes

Image © Adobe Images

The New Zealand Dollar is seeing a spell of outperformance at the start of 2025, but analysts at Westpac think it's too soon to expect an outright turnaround.

This is largely because analysts at the antipodean lender think the Reserve Bank of New Zealand (RBNZ) will continue to slash interest rates, potentially even 'overcutting' them.

"We expect underperformance of the NZD given the shocking state of the current account, low/negative interest rate differentials and also the structurally weak fiscal position," says Kelly Eckhold, an economist at Westpac.

"Despite the substantial easing already undertaken, the RBNZ intends to front-load the easing intended in 2025," she adds.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The RBNZ has been clear that it will 'front load' its rate cuts, i.e. it will cut aggressively in order to get ahead of the economic slowdown and, hopefully, stimulate a recovery.

However, the rule of thumb in global FX markets is that aggressive rate cuts tend to lower a currency's value.

This is proving true for the NZ Dollar, which was one of 2024's major underperformers.

Eckhold says there is even the possibility that the RBNZ will drive the OCR down to 2.5%, which is notable given the global context of relatively higher interest rates (for example, markets now think the Federal Reserve might cut rates by just 25 basis points over the entirety of 2025).

Relativity is important: if the RBNZ is 'outcutting' its peers, then the scope for NZD to underperform peer currencies is high.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Westpac thinks there is a real chance that this means the RBNZ "may over-ease in 2025."

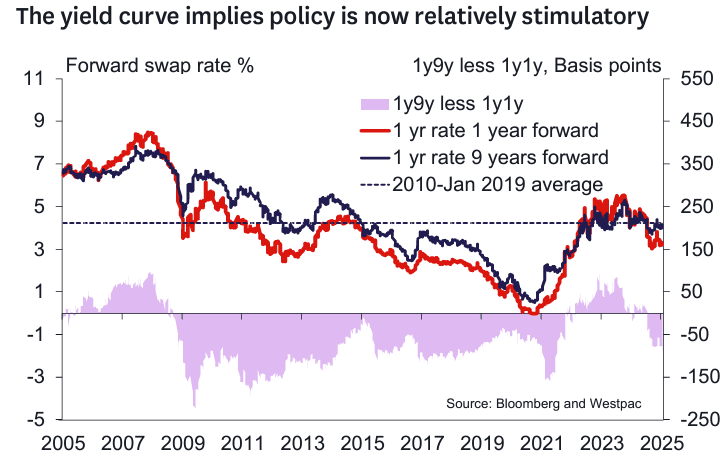

Her studies suggest that the cuts that have already been delivered are working and are already boosting the economy:

"Cuts after February will likely be stoking the economy and setting up the next cycle. Watch this space! says Eckhold.

Should the RBNZ cut rates too far, then Westpac thinks there will be grounds for the central bank to pivot and start raising interest rates in 2026.

Such a shift points to the potential for NZD outperformance later in 2025.