Pound to New Zealand Dollar Week Ahead Forecast: More Weakness to Play Out

- Written by: Gary Howes

Image © Adobe Images

The Pound looks set to experience further weakness against the New Zealand Dollar in a week dominated by UK labour market and NZ inflation statistics.

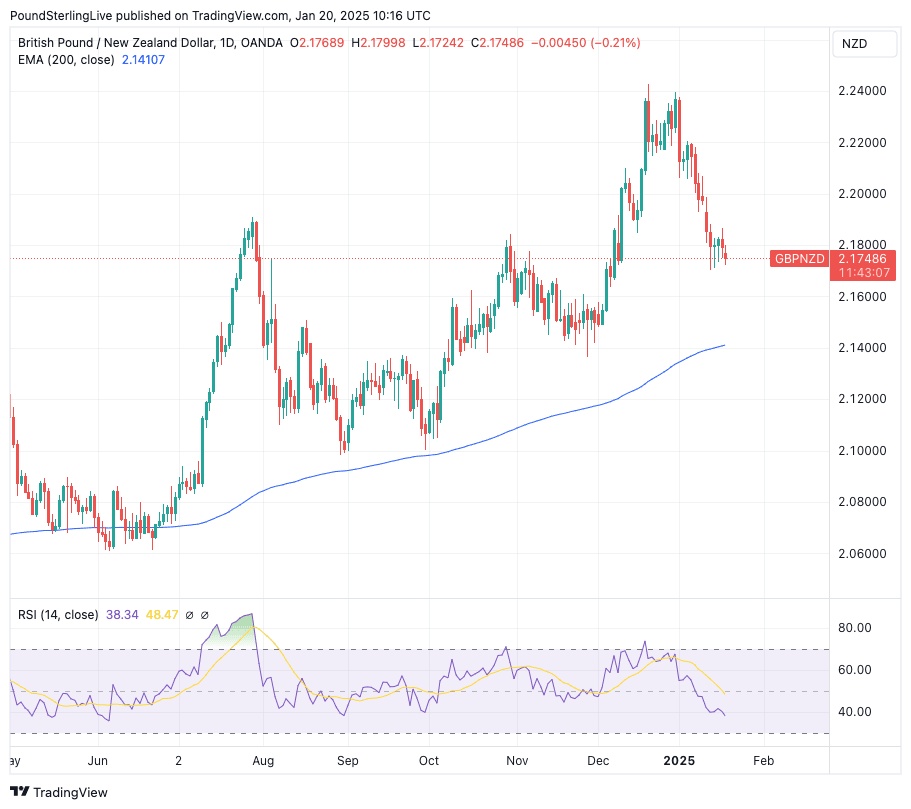

The Pound to New Zealand Dollar (GBPNZD) exchange rate is undergoing a counter-trend pullback that sees it reverse from its highest levels attained since 2015.

We think the pullback is not done, and there is scope for a retracement to extend to the 200-day exponential moving average, currently at 2.14, at some point in the coming two weeks.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Elsewhere on the charts, the Relative Strength Index (RSI) is at 38 and is pointing lower, advocating for further losses in the coming five days.

Tactically, we look for consolidation above 2.17 into Tuesday's New Zealand inflation release and UK jobs report and for the trend lower to extend into the wake of the data releases.

The consensus looks for New Zealand to report quarterly inflation growth of 0.4%, and for annual growth to fall to 2.1%. Anything below here can weaken the Kiwi Dollar as it invites more aggressive rate cuts at the Reserve Bank of New Zealand (RBNZ).

Above: GBPNZD at daily intervals with the RSI in the lower panel, which advocates for near-term weakness.

But we think there is already a heap of 'dovishness' baked into the market's expectation of the RBNZ and think it is becoming less of a headwind. Indeed, analysis from ANZ shows the RBNZ risks overcutting to the extent that the market might have to start pricing in rate hikes towards year-end. This suggests a potential turn in fortunes for the brow-beaten Kiwi.

For the GBP, the opposite is true: there is ample space to increase bets for lower Bank of England interest rates, a trend that is driving GBP lower and hinting that GBPNZD's high of 2.24 reached in December represents a peak.

More broadly, we reckon something has changed for the Pound: In 2024, the fundamental GBP setup was bullish, with a strong economy commanding higher interest rates at the Bank of England. Now, the UK economy has slowed down, and there is limited prospect of a pickup.

This means less by way of taxes for the government to pay for its significant borrowing plans, which has made investors nervous about the UK fiscal outlook.

One expression of this nervousness is a selloff in the Pound.

"Overall, we see little reason for sterling to recover," says Chris Turner, an analyst at ING Bank. "While we do not think this is a Liz Truss-style moment for UK sovereign risk, we do think the solution to the current challenges is sterling negative."

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Turner explains that for the UK to improve its fiscal standing, the government would need to cut spending. The Bank of England could assist by cutting interest rates (lowering Gilt yields), or a combination of both steps occurs.

The options ahead are fundamentally unhelpful for those wanting a stronger Pound.

With this in mind, Tuesday's UK job report will be important. The consensus looks for the unemployment rate to edge up to 4.4% from 4.3% in light of survey evidence of growing job losses and a slowdown in hiring intentions. In particular, the PMI surveys have been warning of a deterioration in the labour market for a couple of months now.

"Employment indicators are pointing firmly to a decline in payrolled employment in the coming months," says Sam Hill, Head of Market Insights at Lloyds Bank.

The Pound is likely to fall should unemployment rise faster than was expected and the opposite reaction is likely if the data proves stronger than expected.

The Bank of England is watching employment and wage dynamics, judging that high wages are inflationary and must be met with higher-for-longer interest rates.

However, rising unemployment will suggest to the Bank that wage pressures will fall notably in the coming months, which will allow them to cut interest rates further.

Money market pricing shows investors have raised bets for more rate cuts from the Bank of England this year, which has contributed to the weaker Pound. However, the market is still only expecting two rate cuts, with a third being a possibility.

For the Pound, rising expectations for rate cuts will result in weakness and this is why we forecast GBP/NZD downside in the coming days, judging that the process has further to run.