Euro to Dollar Rate Week Ahead Forecast: Early Gains to Be Challenged by Trump

- Written by: Gary Howes

Above: Trump speaks on the eve of his inauguration.

The Euro to Dollar exchange rate (EUR/USD) is rising at the start of the week, but technical momentum and fundamental risks associated with the new Trump presidency leave us forecasting more weakness.

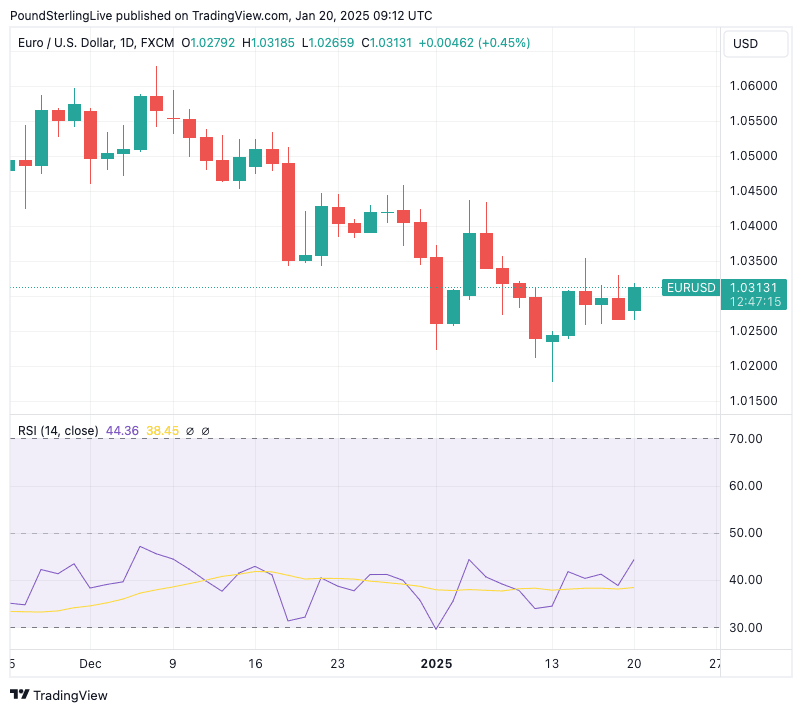

It's a sprightly start to the new week for the Euro to Dollar exchange rate, which is recording a 0.45% daily gain to go to 1.0312.

We notice that the daily Relative Strength Index (RSI) has turned up nicely over recent days and is pointing higher at 44.34, which signals some upside momentum is starting to build. Based on this alone, we would be inclined to suggest this could be a week that sees the Euro close higher than where it started against the Dollar.

Above: The RSI in the lower panel shows some improving momentum. But, for now we think this is just a counter-trend consolidation.

But, gains for Euro-Dollar come on U.S. presidential inauguration day and are defying anxieties about what Donald Trump does in the first hours and days of his second term in office.

Polymarket, the betting marketplace, sees only an 8% chance that Trump will announce tariffs on the Eurozone in the first week. This contrasts with approximately 56% odds for China and Mexico, with Canada slightly lower down at 45%.

The obvious risk for the Euro is that this expectation for Europe to escape scrutiny proves misplaced, and Trump does, in fact, send a warning regarding trade to Europe.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

All eyes are on day-one announcements and those that will follow over the coming days. Expect some big calls, as Trump insiders say the President won't make the mistakes of his first presidential term and will be keen to act early and act hard.

"Financial markets are bracing for a flurry of executive orders ranging from immigration to energy and possibly trade. On tariffs, betting markets are marginally priced in favour of tariff action," says Chris Turner, an analyst at ING Bank.

Trump on Sunday night promised a blitz of executive action on his first day, including sweeping repeals of Biden administration policies, and said his followers would "have a lot of fun" watching him do so.

"Every radical and foolish executive order of the Biden administration will be repealed within hours of when I take the oath of office," he said.

"Somebody said yesterday, 'Sir, don’t sign so many in one day. Let’s do it over a period of weeks.' I said, 'Like hell we're going to do it over weeks.’' We’re going to sign them at the beginning," Trump told supporters on the eve of the inauguration.

Whether tariffs will form part of his early agenda remains to be seen, but markets think there is an above 50% chance of the issue being addressed at some point this week.

For the Euro, the question is to what degree this is already incorporated into valuations.

"We doubt FX markets are fully priced to universal tariffs and EUR/USD would get hit were these to emerge," says Turner.

Analysis from Deutsche Bank suggests markets might still be underestimating the looming Trump shake-up.

"Our conclusions are not optimistic: despite recent moves, the market is not pricing sustained macro divergence between the US and the rest of the world, nor a big trade war," says George Saravelos, an analyst at Deutsche Bank.

"We enter 2025 maintaining our dollar bullish view," adds Saravelos. "The greenback has the potential to exceed its Volcker all-time highs, equivalent to a EUR/USD drop to 0.95."

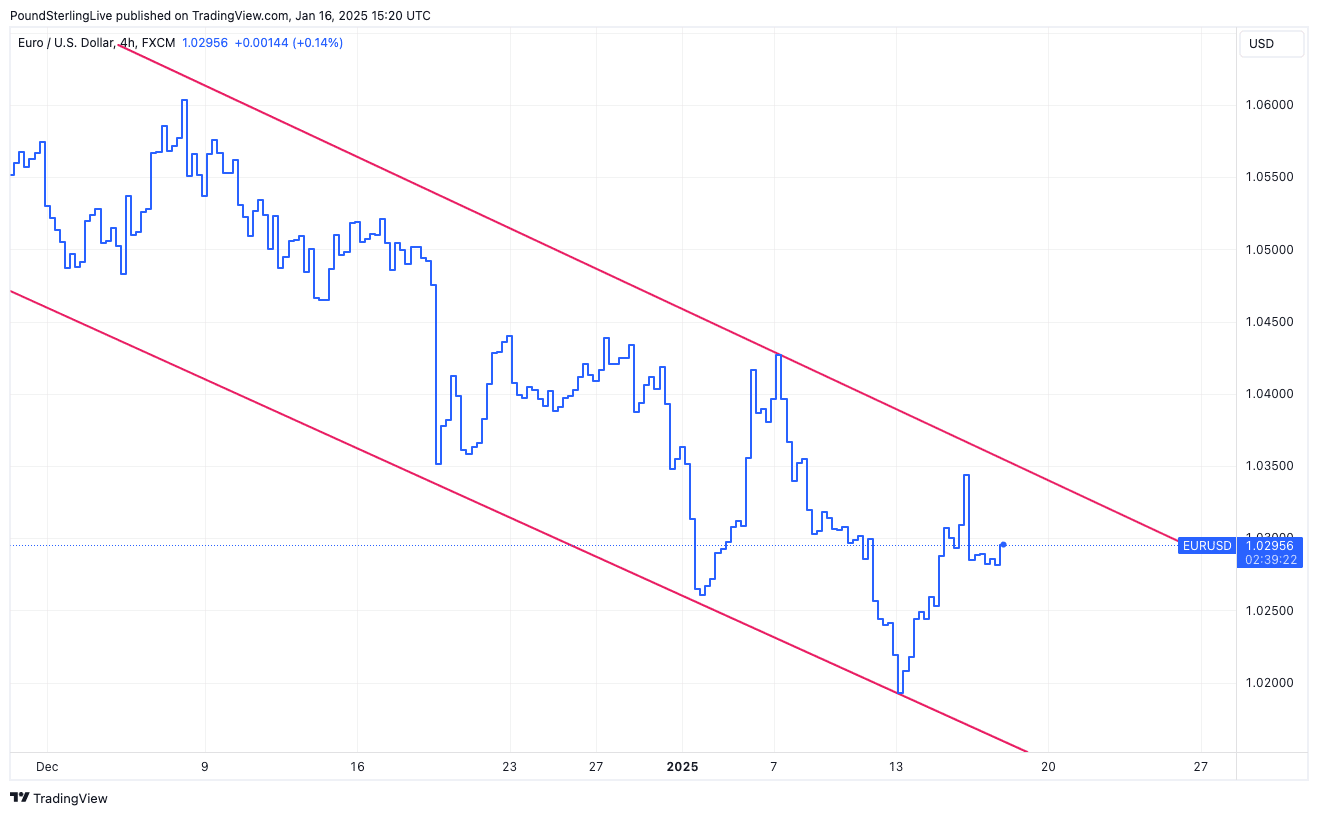

From a technical perspective, Euro-Dollar trades below its 200-day moving average and will remain in a medium-term downtrend while below here. This means periods of strength will be considered to be counter-trend relief rallies that ultimately give way to bigger moves lower that will bring fresh multi-week lows.

Above: EURUSD is in a clearly defined downward-facing channel.