Pound to Dollar Week Ahead Forecast: Trump 'Day One' Calls Eyed

- Written by: Gary Howes

Above: File photo from Trump's first inauguration. Official White House Photo by Shealah Craighead.

Pound Sterling is forecast to remain under pressure against the Dollar in a week that sees the new U.S. President take office.

Make no mistake, it's all about the U.S. political scene this week and the nature of Donald Trump's 'day one' policy proclamations, as these will drive the wider market and impact the 'big dollar'.

"Donald Trump's inauguration on Monday will be the main event," says Galina Pozdnyakova, Research Analyst at Deutsche Bank.

Market participants will be looking for early announcements on tariffs, taxes and immigration. However, for foreign exchange traders, it is tariffs that will attract the most interest.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Global stocks rose and the Dollar weakened last week as markets consolidated ahead of concrete policy proposals that will mark a new era in the US. This allowed the Pound to Dollar exchange rate to arrest recent declines and consolidate around 1.22.

"The relief rally may not last, with attention turning to U.S. politics and President-elect Donald Trump's inauguration on Monday. Since the Presidential election, markets have been gripped by uncertainty over what Trump may do in office. Questions over how high tariffs will rise," says Philip Shaw, an analyst at Investec.

The rule of thumb is that any move towards a blanket tariff for all U.S. imports would boost the Dollar. This is because such a universal tariff is inflationary for the U.S., which will prompt the Federal Reserve to keep interest rates unchanged for much longer.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Also, this is a negative for the likes of the Eurozone, Canada and China, which rely heavily on the U.S. market to absorb their exports.

But should Trump adopt a more nuanced and transactional approach to tariffs, then relief can set in as this is tantamount to watering down his tariff plans.

Here, the Dollar would fall and the Euro and Pound would rise.

"From Monday we should start to gain some clarity," says Shaw.

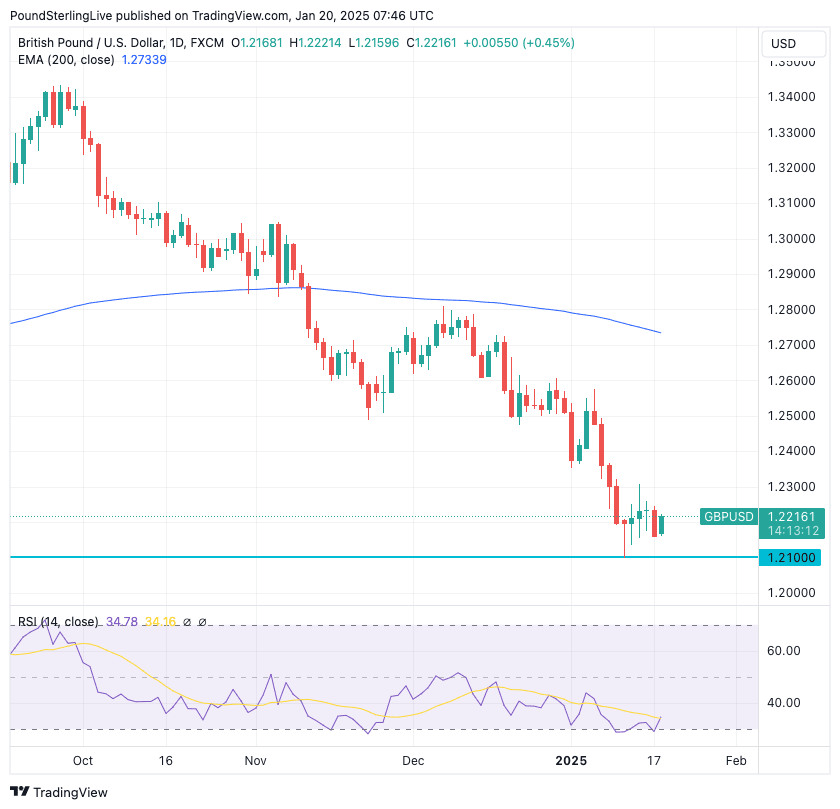

Ahead of these events, the Pound to Dollar exchange rate (GBP/USD) retains a negative technical setup that advocates for further downside and any periods of strength are expected to be consolidative and short-lived.

This means we could struggle to see GBP/USD extend much above 1.23.

The preferred targets are to the downside and last week's Monday low of 1.21 is the first line of support that can be prodded. Below here is the psychologically important 1.20, although there is no real technical support here. Instead, it is towards 1.1850 that some real relevant levels start to emerge.

Momentum indicators continue to point lower and advocate for further losses.

GBP has been hit by a run of poor data over recent weeks that speaks of an economy that has run out of momentum owing to the significant taxes placed on businesses by the government. In addition, an inflation-busting increase to the minimum wage is due to come into effect, as is further red tape on employing people.

All these points to the labour market as a key cost driver and headwind for businesses operating in the UK, and this is why this week's labour market report will be of particular interest: are businesses over-egging the negativity, or are they making operational changes?

The answer is likely to influence expectations for the amount of interest rate cuts the Bank of England will likely make this year.

The consensus expects the unemployment rate to edge up to 4.4% from 4.3%, reflecting survey evidence of growing job losses and a slowdown in hiring intentions. In particular, the PMI surveys have been warning of a deterioration in the labour market for a couple of months now.

Employment indicators are pointing firmly to a decline in payrolled employment in the coming months," says Sam Hill, Head of Market Insights at Lloyds Bank.

The Pound is likely to fall should unemployment rise faster than was expected and the opposite reaction is likely if the data proves stronger than expected.

"A payrolls rise would be a big surprise, suggesting business sentiment is overegging the jobs slowdown and likely pushing the market back to pricing fewer than two cuts," says Robert Wood, an economist at Pantheon Macroeconomics.

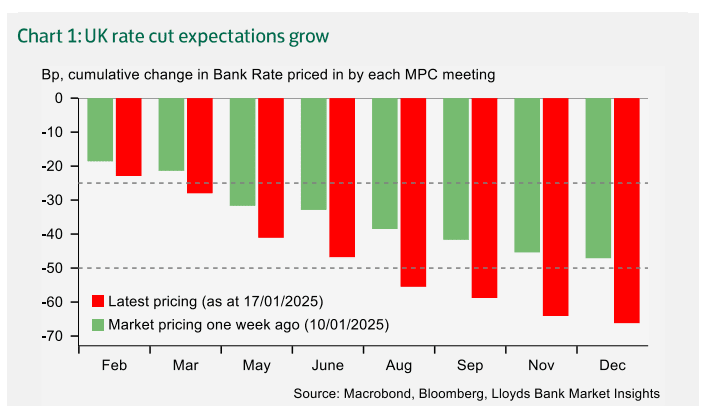

Above: Markets see more rate cuts ahead than was the case just one week ago, and there is scope for this trend to continue.

Of importance to traders will be the wage data that is released alongside the job figures. Here, The consensus expects wages to rise 5.5% in November, up from 5.2% in October. In isolation, the rule is that the pound will fall if wages undershoot expectations, but it will rise if the data beats.

The Bank of England is watching employment and wage dynamics, judging that high wages are inflationary and must be met with higher-for-longer interest rates.

However, rising unemployment will suggest to the Bank that wage pressures will fall notably in the coming months, which will allow them to cut interest rates further.

For the Pound, rising expectations for rate cuts will result in weakness, and is why we forecast further weakness in the coming days, judging that the process has further to run.

Money market pricing shows investors have raised bets for more rate cuts from the Bank of England this year, which has contributed to the weaker Pound. However, the market is still only expecting two rate cuts, with a third being a possibility.

Most economists we follow suggest four cuts is the most likely outcome. This means the market can continue to 'price in' rate cuts from here, resulting in further weakness in Pound Sterling.