Pound-Dollar Forecast of 1.26 is Off the Mark Says HSBC

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate will end the year higher, according to the consensus. However, analysts at HSBC reckon this is way too optimistic.

Investment bank forecasters reckon the current trend of GBP/USD weakness will ultimately run its course and a decisive turnaround will see the pair track higher again through the second half of the year.

An overvalued dollar is expected to reach an exhaustion point, while memories of GBP outperformance in 2023 and 2024 remain strong in analysts' minds, leading them to project more of the same in 2025. (For a look at the consensus forecasts taken around the turn of the year, see here.)

However, HSBC analyst Daragh Maher says the GBP setup is increasingly dovish, and the consensus will be disappointed.

Following news that UK retail sales shrank in December, defying expectations for expansion, the Pound extended its 2025 decline against the Dollar to 1.2161. "Another day, and another dovish nugget for GBP to digest," opines Maher.

He says there are clear structural issues now in play for the currency:

"This time around it was softer than expected UK retail sales. While softer than expected UK inflation carried ambiguous implications for GBP as a currency caught between structural fiscal concerns and cyclical unease, weaker activity signals are simply negative."

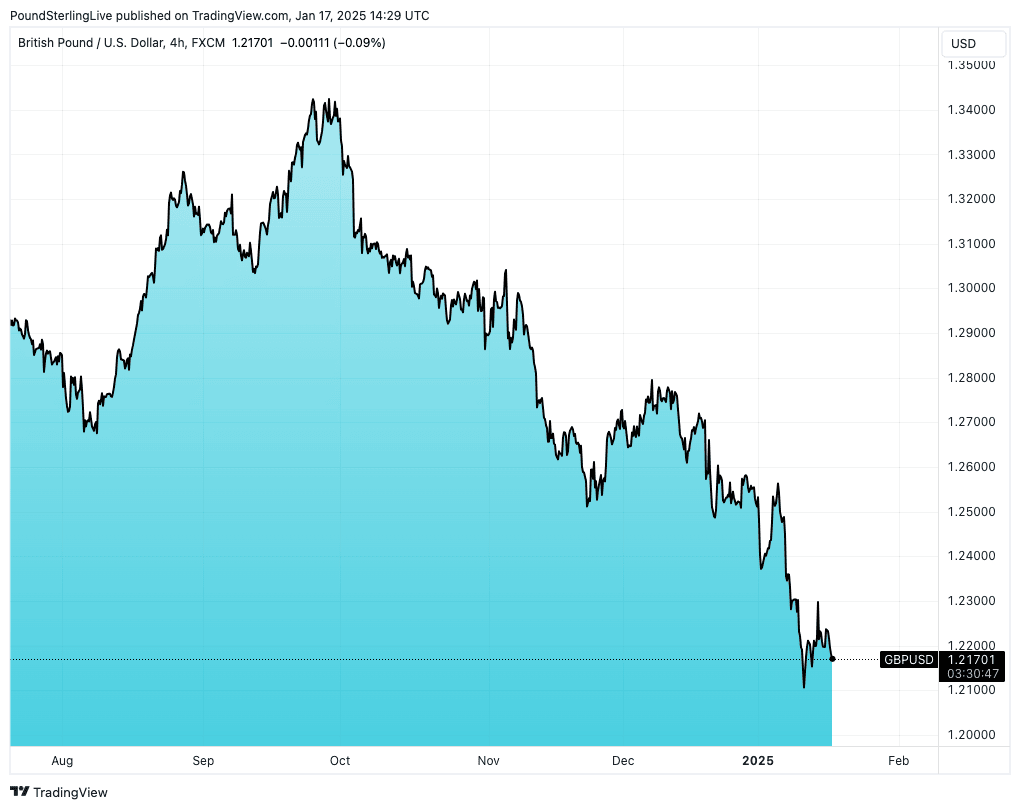

Pound Sterling has lost 4% of its value against the U.S. Dollar already in 2025 as a multi-month downtrend extends steadily to the next big round number target of 1.20.

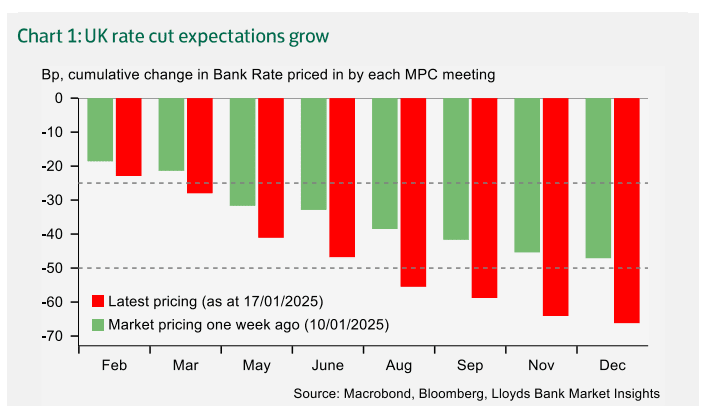

Above: Rate cut bets are growing, but the market isn't yet even priced for three cuts this year, suggesting there is ample scope to grow. Image courtesy of Lloyds Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The case is building for the Bank of England to accelerate the pace it cuts interest rate cuts, but the problem for GBP is that the market is still behind the curve.

"November GDP data confirmed that the economy is stagnating. Today’s unexpected drop in retail sales during December

suggests little respite. In the space of two weeks, the market probability of a 6 February BoE rate cut has gone from 60% to over 90%. But we suspect there is scope for a further dovish reappraisal with not even three 25bp cuts fully priced in," notes Maher.

British Pound outperformance in 2024 was driven by an expectation that the Bank of England would cut rates at a slower pace than other major central banks amidst a robust economy and still-elevated inflation.

"A consensus among FX forecasters, taken only a week ago when spot GBP-USD was 1.2150, is that it will finish the year at 1.26. This seems notably optimistic to us," notes Maher.

For a look at the consensus forecasts taken around the turn of the year, see here.