Falling Employment Sees Bank of England Sharpen the Knives

- Written by: Gary Howes

Image © Adobe Images

Rising unemployment and expectations for wage growth to have peaked will allow the Bank of England to cut interest rates in February and perhaps on three further occasions.

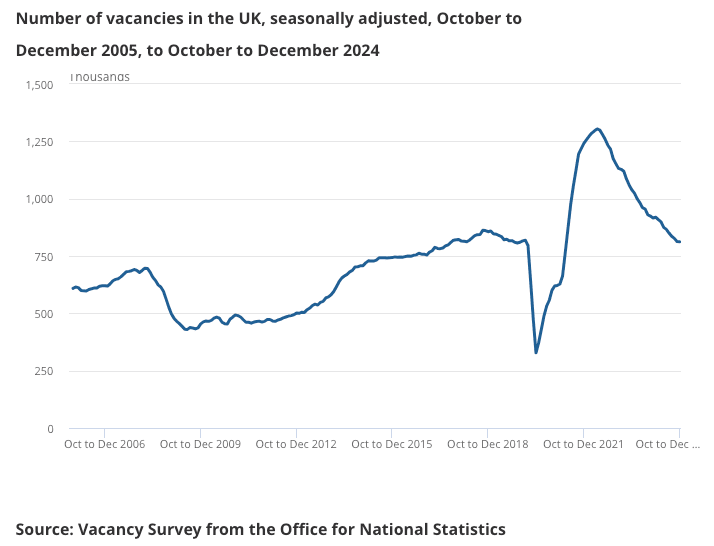

The labour market is loosening with the ONS reporting another drop in the number of vacancies in the economy and a rise in unemployment in the three months to November to 4.4% from 4.3%.

The rise was partly driven by a fall of 47,000 in payrolled employment.

Vacancies were down to 812K in December from 813K in November, marking thirty consecutive months of decline and pointing to an underlying trend of loosening labour market conditions.

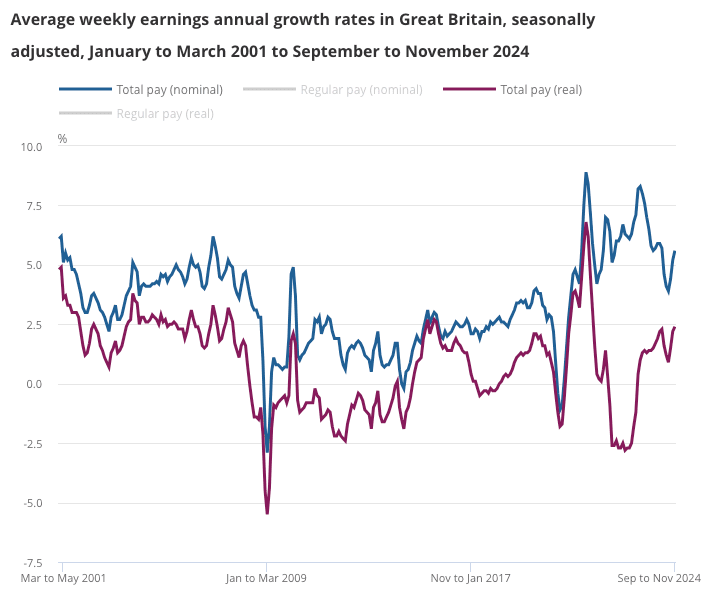

Yet, the Bank of England won't be minded to sound the all-clear on inflation just yet as average earnings rose by 5.6% year-on-year in November from 5.2% in October and regular pay (which excludes bonuses) rose by 5.6%, a rate that is well ahead of inflation.

The Bank of England considers wages a key driver of inflation: as pay increases, spending power in the economy and demand increases. In turn, as businesses pay out more, they cover costs by raising prices.

"Earnings growth remains at a clip that is, clearly, incompatible with a sustainable return to the Bank of England's 2% inflation target over the medium-term," says Michael Brown, Senior Research Strategist at Pepperstone.

However, Brown also notes a statistical base effect is behind the jump, as this year's data is flattered by an unusually low print at the same time last year.

"The wage strength is surprising at first glance, but there is simply no longer the kind of momentum in the economy required to keep it going," says Matt Lewis at TopMoneyCompare.com.

Another measure of pay growth, the more timely PAYE income tax measurement, shows a 0.8% m/m fall in December, pushing down the 3-month y/y rate from 6.4% in November to 5.6% in December.

"That may mean this latest burst of wage growth is already fading," says Ashley Webb, UK Economist at Capital Economics.

Financial markets see the next interest rate cut at the Bank of England falling in February, with one or two more seen over the remainder of the year.

Most economists we follow think the market is underpriced and that the Bank will cut on at least four occasions if not more.

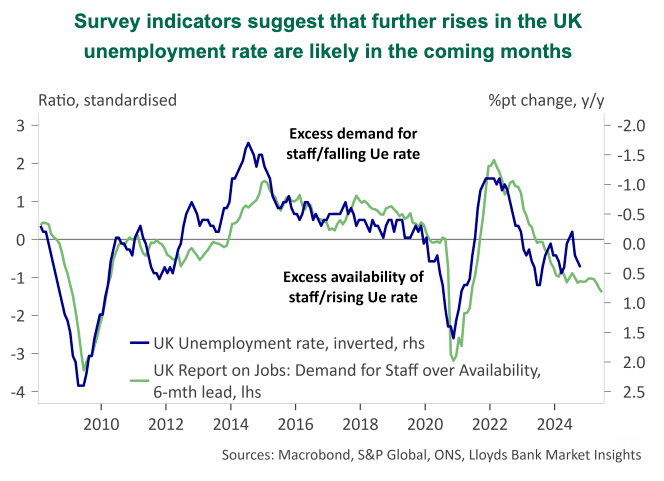

Key to this move would be a deterioration in the labour market, which would weigh on wages and ultimately cool inflation.

For the Pound, this implies a high likelihood of a dovish tilt in market pricing.

"Overall, some Monetary Policy Committee members may be worried by the resurgence in regular private sector pay growth. But we suspect most of them will look at the signs that the loosening in the labour market will mean that wage growth will soon resume a downward trend," says Webb.

Image courtesy of Lloyds Bank.