Euro to Dollar Week Ahead Forecast: 1.0569 Near-term Limit

- Written by: Gary Howes

Image © The White House

The Euro is engaged in a short-term recovery against the Dollar and further gains are possible. Central bank decisions in both Europe and the U.S. form the risk highlights of the coming week.

The Euro to Dollar exchange rate (EURUSD) trades at 1.0479 following last week's 2.20% gain, its largest single weekly advance since July 2023.

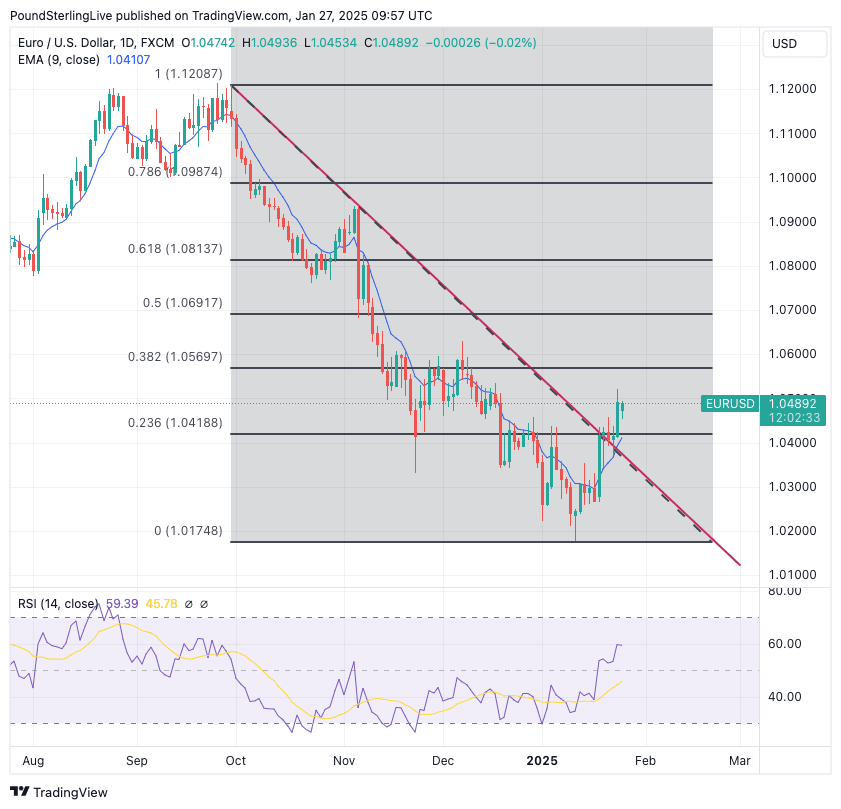

The evolving technical setup suggests the Euro has broken the descending trendline that defines the September to January selloff, which can raise confidence that an interim short-term bottom has been reached.

EURUSD has now moved above the nine-day exponential moving average (EMA) as the rebound grows, confirming upside impetus on a multi-day forecast horizon.

However, Friday's 0.75% advance means the spot has diverged too far from the nine-day EMA (currently at 1.0408), which suggests some consolidation towards this level in the next two days is likely.

The pair should be restricted between 1.0409 and 1.05 in the first part of the week, with the potential of a higher break occurring in the latter part of the week that could see it rise towards the near-term target of 1.0569.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

This level represents the 38.2% Fibonacci retracement of the September-January selloff.

Such a gain will depend on what the Federal Reserve says about the interest rate outlook at Wednesday's policy meeting and what the European Central Bank says and does on Thursday.

The two central bank event risks will be overshadowed by the ongoing efforts of Donald Trump to shape America and the global order in his image. Expect more tariff threats and ponderings from the President to provide near-term volatility.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

But more broadly, the Dollar experienced its weakest performance in more than a year last week as investors lowered expectations for the imposition of a universal tariff on U.S. imports, which was considered by markets to be the most USD-bullish policy Donald Trump could deliver.

Trump's win in November accelerated the USD rally as investors priced in such a scenario. After one week in power, traders are more certain that the blanket tariff won't be applied.

Instead, it is becoming clear that tariffs will be used as part of a geopolitical negotiating tool, allowing for negotiations and avoiding worst-case outcomes from a trade perspective.

The transactional approach to tariffs was laid bare on Sunday when Trump threatened Colombia with a 50% import tariff after a deportation flight to Colombia was refused permission to land. Colombia's government quickly abandoned its stance, and tariffs are now off the table.

Above: Trump addresses the WEF. Copyright: World Economic Forum/Pascal Bitz.

For the Eurozone, it looks like Trump will lay off the tariff threat if the European countries commit to buying more U.S. oil and gas. This is not a high hurdle to jump for a region that is virtually devoid of its own gas and oil production.

The developments lower the odds of parity between the Euro and Dollar being reached, although it must be pointed out that the exchange rate's downtrend is still intact from a multi-week perspective and we could merely be witnessing a pullback in an overbought U.S. Dollar.

A resumption in the selloff remains a high-risk outcome for H1 2025.

"We remain convinced that tariffs will be used actively by Trump and by the end of this week the financial market interpretation of tariffs could well be notably different," says the FX research desk at MUFG Bank. "We are unconvinced that this leg lower for the US dollar will be sustained and view this as just a lightening of a crowded long dollar position."

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Federal Reserve meeting on Wednesday comes in the shadow of Trump's address to Davos where he explicitly called for lower interest rates, confirming the Fed will have a more meddlesome White House to contend with.

The Fed is independent, but verbal pressures from the Executive branch could potentially see 50-50 decisions err on the side of dovishness, i.e. more cuts than would have previously been the case.

This is USD-negative.

"Between the absence of immediate tariffs in this week’s flurry of executive orders, Trump’s renewed attacks on the Fed, and some improved PMI surveys in Europe, the dollar bull narrative has taken a few hits. Stretched positioning means the greenback is vulnerable to shifts in perceptions around the policy outlook in the near term," says Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics:

The Fed will leave interest rates unchanged, saying more time is needed to reflect on the robust nature of the U.S. economy and the impact of previous rate cuts.

The market is priced for just one cut this year, meaning there is ample space for further cuts to be priced in. Any hint that this might be the case would push the Dollar lower.

File image of ECB President Christine Lagarde. Photo by Sanziana Perju / European Central Bank.

The ECB will cut interest rates by 25 basis points and will likely maintain similar guidance to previous meetings. Specifically, the ECB would indicate that it would continue to deliver further interest rate cuts if the data warranted but that there was no set path to interest rates.

Lower interest rates are needed to boost growth in the Eurozone economy, but inflationary pressures remain stubbornly above the ECB's target of 2.0%.

The ECB will welcome last week's PMI reading that unexpectedly beat expectations and suggested that the Eurozone economic data pulse had reached a nadir. This can allow the ECB to express some optimism and push back against calls to accelerate the pace of cuts, potentially boosting euro exchange rates.

This can allow the EURUSD recovery to rise above 1.05.

"The Governing Council appears committed to a gradual and cautious easing cycle," says Mariano Cena, an economist at Barclays. "This approach allows the ECB to balance the risks of prolonged inflation undershooting with ongoing concerns about weakening growth across the Euro Area."

Keep an eye on the German CPI inflation release due Friday, where the expectation is that the monthly CPI rate will have flatlined at 0% in January, down from 0.5% in December.

Anything lower than this can tip the Euro-Dollar back below 1.05 ahead of the weekend.

The decline confirms that inflation is under control in the Eurozone's biggest country, justifying lower rates at the ECB and countering any 'hawkishness' that might have been inferred from events the day before.