Pound Advances Against Dollar As Trump Turns Fire on the Federal Reserve

- Written by: Gary Howes

Above: Trump addresses the WEF. Copyright: World Economic Forum/Pascal Bitz.

The Dollar extended a run of losses after the new U.S. President made it clear he wants lower interest rates and all but confirmed a blanket import tariff won't be considered.

There could be some pressure on the Federal Reserve to ere on the 'dovish' side in upcoming decisions after Donald Trump told the World Economic Forum, "I'll demand that interest rates drop immediately."

"Likewise, they should be dropping all over the world. Interest rates should follow us all over," he added in a videolink address to the Davos conference.

Following the speech, Trump questioned the Fed Chair's decision-making on interest rates in comments to reporters, saying, "I think I know interest rates much better than they do, and I think I know it certainly much better than the one who’s primarily in charge of making that decision" and adding that he planned to speak to the Fed Chair "at the right time."

The comments will reignite speculation over Federal Reserve independence going forward. Certainly, Trump has indicated he won't seek any form of direct control of the U.S. central bank, but his commentary alone could push the dial on future decisions.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Trump is proving himself to be a tour de force in the opening days of his second administration, enacting radical change in many U.S. institutions.

Fed Chair Jerome Powell will be wondering if his patch of Washington DC will escape unscathed.

The comments have not materially impacted monetary policy expectations, with market pricing showing one rate cut is anticipated over the duration of 2025.

But, if Trump's comments suggest we are at peak 'hawkishness' (i.e. markets start to bet on more than one cut), then the USD upside impulse might fade.

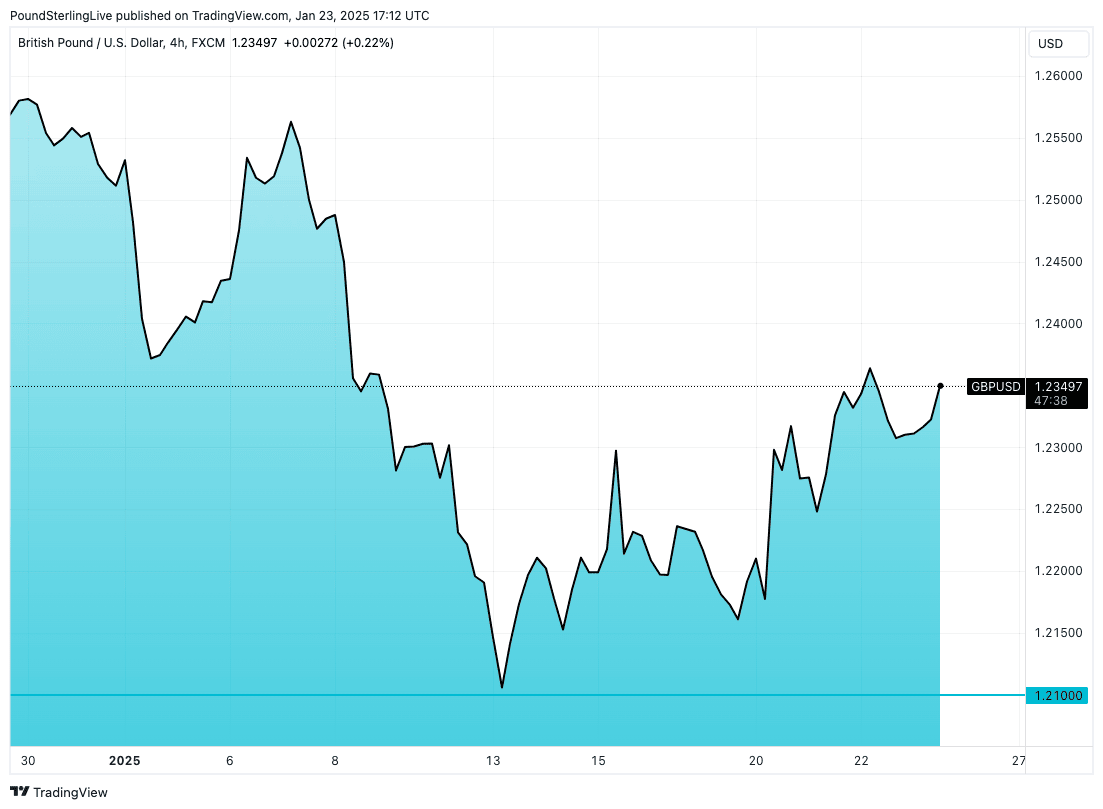

The recovery of the Pound to Dollar exchange rate hints at this, extending on Thursday to 1.2347, the highest level since January 08.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Trump also told the meeting in Davos that global oil prices must come down, which is a clear indication he wants energy prices to contribute to lower inflation.

Lower inflation readings are the critical ingredient allowing the Federal Reserve to cut interest rates more than once in 2025, regardless of what Trump says.

Lower inflation will also lessen the negative impact of the trade tariffs Trump has signalled he will pursue.

He told Davos that "different amounts of tariffs" for different countries would be appropriate, all but confirming the blanket tariff idea he toyed with during the election campaign is unlikely.

For global FX, this is a relief and would underpin a further retracement in the Dollar.