Dollar a Sell Against Euro, Pound and Yen Says Morgan Stanley

- Written by: Gary Howes

© lj16, Reproduced Under CC Licensing

Morgan Stanley strategists are sellers of the U.S. Dollar against the Euro, Pound and Yen and buyers of U.S. treasury bonds.

The Dollar is strengthening at the time of writing as investors digest the news that the U.S. looks set to proceed with a universal tariff on U.S. imports. However, Morgan Stanley doesn't think this will be enough to reboot the Dollar bull.

"We turn bearish the DXY and recommend selling USD versus EUR, GBP, and JPY," says Morgan Stanley in a global strategy note.

Analysts at the Wall Street bank think U.S. yields have peaked and should begin trading lower, explaining that:

"US yields have been the primary driver of most market dynamics in recent weeks – including the USD. We also think major themes motivating investors’ widespread and large USD bullish positions (including stretched expectations for the trade policy and fiscal outlook) are likely already in the price."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

U.S. bond yields rise as demand for the underlying bond falls amidst expectations for rising inflation.

Yields started rising again after U.S. economic data releases started to beat expectations from around October 2024, suggesting the disinflation process was stalling and reversing.

The dollar followed suit, with moves accelerating in the wake of Donald Trump's November election victory which was largely considered to be an inflationary macroeconomic outcome by the market.

But analysts at Morgan Stanley think investors should now consider buying bonds again as a fair amount of term premium already exists, while recent inflation data have provided more evidence of disinflation.

This implies a peak in yields, which would mechanically imply a peak in the USD.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

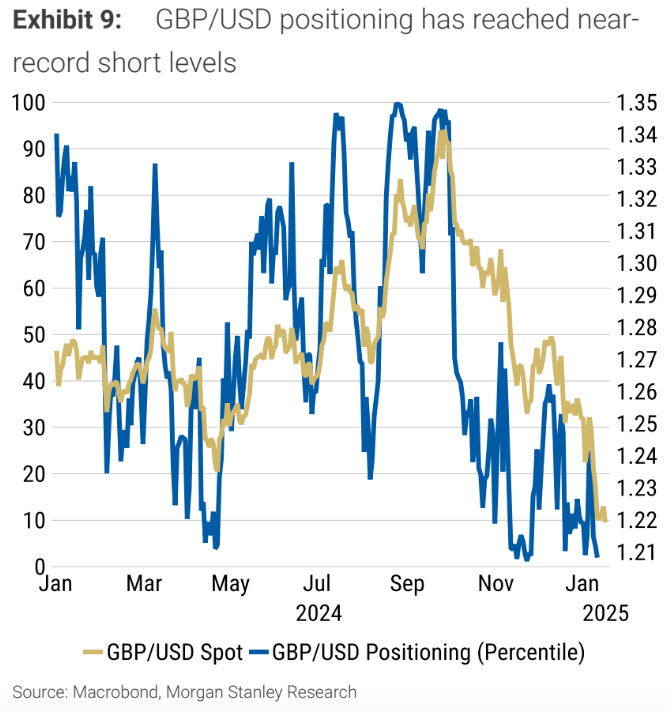

Morgan Stanley's call to sell USD comes amidst stretched short positioning in the British Pound, which can provide a signal that a rebound is possible.

"We see a potential GBP short squeeze, given positioning. Falling US rates could also provide relief to GBP. The GBP-gilt yield correlation may remain negative, boosting GBP as gilt yields decline along with USTs," says Morgan Stanley.

Strategists target a move in GBP/USD to 1.27.

Elsewhere, rate differentials imply to strategists that EUR/USD should be trading closer to 1.07, but could go as high as 1.08.

Regarding the Dollar-Yen conversion, "decline. The relationship between USD/JPY and US rates

remains strong. Falling US yields are likely to weigh on the pair," says Morgan Stanley, targetting a move to 145.