Pound Sterling Bears Outnumber the Bulls, Making it a Buy With One Wall Street Bank

- Written by: Gary Howes

Image © Adobe Images

The market is now a net seller of the British Pound amidst a shift in sentiment. But looking ahead, this could mean it is better positioned to recover, and one Wall Street investment bank is a buyer.

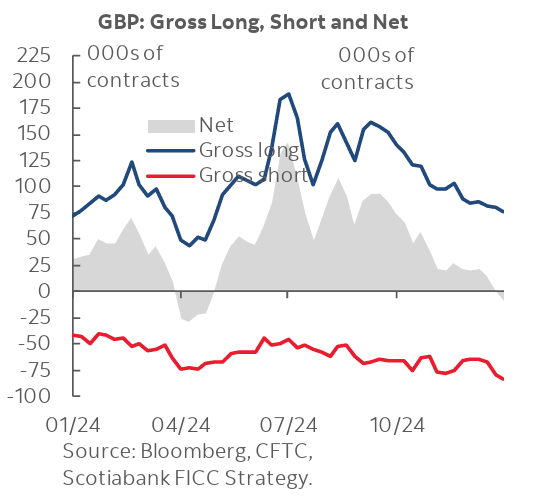

According to the latest Commitment of Traders report, investors are net 'short' on the British Pound, the first time positioning has turned negative since May 2024.

Holding a 'short' position means a speculator or real money trader has bought a contract that delivers a positive return if the currency falls. That the market now holds more selling interest than buying interest on the Pound reflects the sentiment shift that has taken place since the end of 2024.

"Broader GBP sentiment weakened after looking roughly balanced since the end of last year. Speculative traders moved to net short GBP overall for the first time since May 2024 while institutional money lifted net GBP shorts by USD800mn to just over USD5bn," says Shaun Osborne, FX Strategist at Scotiabank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market had been net 'long' for much of 2024 amidst a period of ongoing outperformance in the British Pound.

When a currency's positioning becomes crowded, it becomes vulnerable to any setback in the fundamental narrative. This would result in traders rushing to the exit door and closing out their longs, accentuating selling pressures and increasing the speed of the selloff.

It's why positioning is often seen as a contrarian indicator and speculators sometimes target currencies that appear stretched from a positioning perspective.

Image courtesy of Scotiabank.

In late 2024 and early 2025, Pound Sterling's fortunes turned due to a run of poor economic data releases and concerns about the government's rising debt.

This exposed the Pound to a washout of the crowded long positions that had built up through the course of the year (see above chart).

These latest data CoT data tell us that the overhang of stretched 'long' positioning in the Pound has been removed, which could lower the risk of further declines.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Of course, positioning in the Pound Sterling can fall deeper into negative territory, but from a tactical perspective, the more balanced positioning in GBP would primarily signal why the January selloff has ended.

Developments could even hint at relief.

"The short GBP trade continues to wane, and it does not feel like positioning is on our side anymore," says a note from the JP Morgan trading desk.

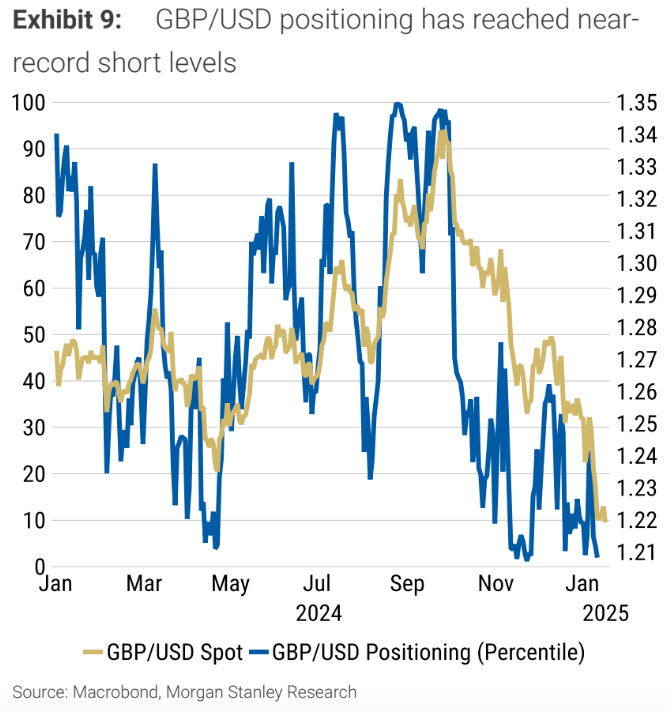

According to an analysis by Morgan Stanley, GBP short positioning is now potentially stretched: "We see a potential GBP short squeeze, given positioning. Falling US rates could also provide relief to GBP. The GBP-gilt yield correlation may remain negative, boosting GBP as gilt yields decline along with USTs."

Image courtesy of Morgan Stanley.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

If positioning becomes too one-sided, any positive news or surprise events (e.g., better-than-expected economic data, hawkish central bank comments) could trigger a short squeeze. In a short squeeze, traders rush to close their short positions by buying GBP, causing its value to rise sharply.

"We think the risk/reward is attractive to enter short USD positions. We recommend buying the EUR, JPY, and GBP against the USD," adds Morgan Stanley.

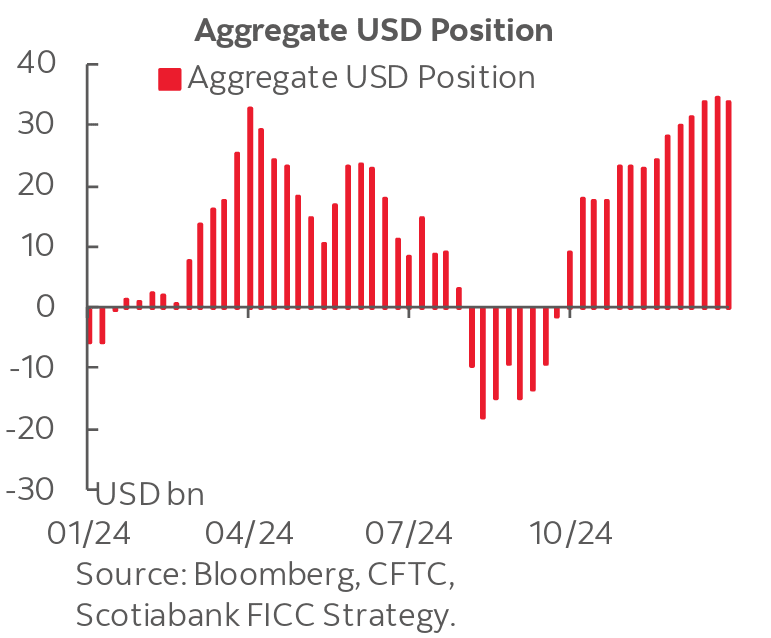

Positioning in the Dollar has meanwhile eased from recent peaks, with the latest data showing the first pullback in USD bullish positioning since the start of December, with net Non-Commercial (speculative) traders trimming just under USD1 bn off their dollar longs.

Image courtesy of Scotiabank.

"Positioning is now seen as the biggest USD headwind, which is a concern we share. Not surprisingly, long USD is also perceived as the most crowded trade," says Ralf Preusser, an analyst at Bank of America.

FX positioning helps explain why only a fifth of respondents to Bank of America's FX Sentiment Survey mentioned that being long USD was their highest conviction trade.

However, strategists at JP Morgan say this alone is not enough to call an end to the Dollar's recent dominance. "USD positioning is elevated, though that by itself is just a headwind, not a catalyst. Our analysts continue to see USD supported medium term," says the bank in a recent note.